U.S. Regulators Hold Up Chinese Company’s Purchase of American Insurer

The deadline for real estate developer China Oceanwide Holdings Group Co. Ltd.’s purchase of U.S. insurer Genworth Financial Inc. has been extended again to give the two companies time to refile for approval from U.S. regulators.

The deadline, which had previously been pushed back from Aug. 31 to Nov. 30, has now been extended to April 1, the companies announced Wednesday.

The $2.7 billion deal was first announced in October 2016, but it has yet to receive approval from the Committee on Foreign Investment in the United States (CFIUS), a government body that reviews foreign takeovers of U.S. companies.

Oceanwide and Genworth plan to refile their joint application soon, the two companies said. This will be the third time they are filing a joint voluntary notice. The two companies are in “discussions with a U.S. provider about proposed mitigation approaches,” Genworth CEO Tom McIrney said in the statement.

Privately owned Oceanwide is the latest Chinese company to face U.S. regulatory roadblocks while attempting to make overseas acquisitions.

In November, Tiancheng (Germany) Pharmaceutical Holdings AG’s proposed purchase of German biological product supplier Biotest was found by CFIUS to raise “national security concerns.”

In September, U.S. President Donald Trump issued an executive order preventing Chinese-backed Canyon Bridge Capital Partners Inc. from acquiring Lattice, an Oregon-based semiconductor maker.

And in December 2016, Trump’s predecessor Barack Obama upheld a CFIUS recommendation to prevent Fujian Grand Chip Investment Fund LP from acquiring German semiconductor company Aixtron SE, due to national security fears.

There is no guarantee that CFIUS will approve Genworth and Oceanwide’s next refiling, but Oceanwide will “remain committed to the transaction and look forward to continuing to work closely with Genworth and the regulators reviewing our transaction,” Oceanwide Chairman and founder Lu Zhiqiang said in the statement.

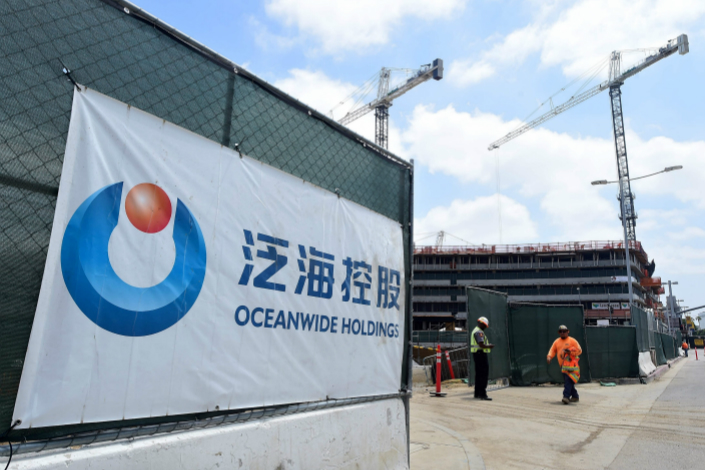

Oceanwide has established a significant presence in the U.S. real estate market, with properties in New York, San Francisco and Los Angeles, including the $1 billion Oceanwide Plaza complex in downtown Los Angeles.

In January, a conglomerate led by Oceanwide, along with IDG Capital Partners, agreed to purchase controlling stakes in U.S. technology research business International Data Group Inc.

Contact reporter Teng Jing Xuan (jingxuanteng@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas