Quick Take: State Enterprises Earn Record Profits in 2017

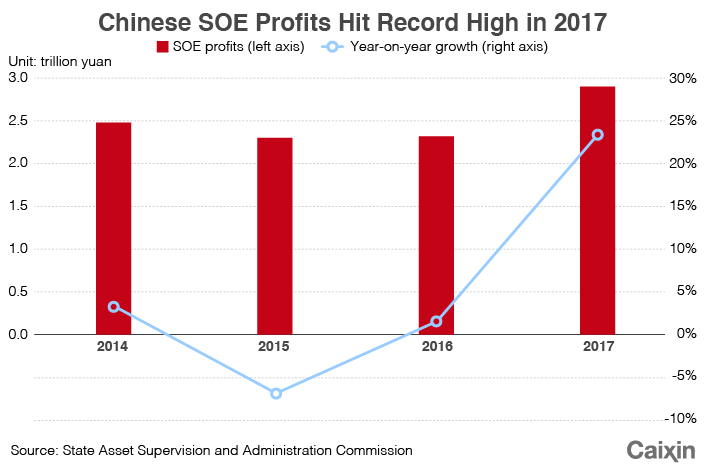

China’s state-owned enterprises (SOEs) raked in 2.9 trillion yuan ($450.3 billion) in net profits in 2017, the highest on record, official broadcaster China Central Television reported Tuesday.

The figure, roughly the size of Belgium’s economy, was an increase of 23.5% from 2016, the report said, citing the State-Asset Supervision and Administration Commission (SASAC), the country’s SOE watchdog.

SOE revenues rose 14.7% to 50 trillion yuan. The companies paid 3.7 trillion yuan in taxes, up 11.5%, according to the report.

The strong performance of the SOEs came after government-imposed policies to reduce excess capacity in industries such as coal and steel as part of its supply-side reforms. The measures squeezed the supply of the commodities and drove prices up, benefiting producers, many of which are SOEs.

|

China’s SOEs made 2.32 trillion yuan in net profits in 2016, a marginal 1.7% increase from the previous year. In 2015, the companies earned 2.3 trillion yuan in profits, down 6.7% from 2014, SASAC figures showed.

The government launched its campaign against overcapacity in the first half of 2016.

Bolstered by the campaign, China’s producer price index (PPI), which measures changes in the prices of goods bought and sold by manufacturers and mining companies, rose 6.3% last year, its first increase since 2011 and the highest figure in nine years. The PPI increase was led by price rises in energy and raw materials.

Contact reporter Fran Wang (fangwang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas