Crackdown Casts Chill on Overseas Investment

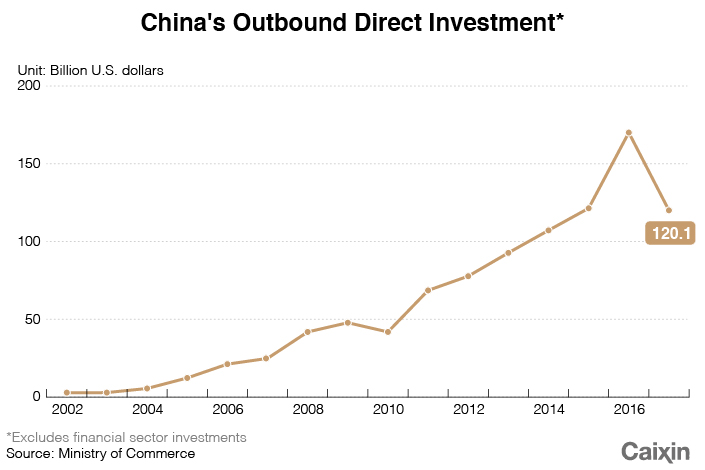

China’s outbound direct investment (ODI) marked its first-ever decline in 2017, as Beijing reined in overseas acquisitions and growing regulatory hurdles emerged in the important U.S. market, according to data released this week.

The nation’s ODI plunged by 29.4% last year to about $120 billion, according to the Ministry of Commerce, (link in Chinese) marking the first decline for the figure since the government started publishing data in 2003. The figure does not include investments in the financial sector. The ministry cited government policies aimed at dampening “irrational investments” as a factor behind the decline.

The leasing and business services sector accounted for the biggest portion of ODI last year at 29.1%, followed by wholesale and retail at 20.8%, according to the year-end data. Manufacturing and communications accounted for 15.9%, while software and information technology accounted for 8.6%.

|

Beijing began implementing measures to curb outbound investment in late 2016 in a bid to stop a wave of downward pressure on the nation’s currency, the yuan, at that time. Even after that pressure eased, the government maintained its policies on concerns that some projects were debt-fueled, taking specific aim at investments in areas it considered frivolous, such as entertainment, sports and real estate.

The commerce ministry noted that no new outbound investments were recorded from the real estate, sports and entertainment sectors during the year, even though a number of major deals in those areas were announced. One of the biggest of those saw real estate giant Wanda Group announce plans to buy U.S. production house Dick Clark Productions for nearly $1 billion, only to later scrap that purchase, reportedly due to failure to get financing.

Separately, a new report showed that Chinese investment in the important U.S. market plunged by a similar margin last year, chilled by both restrictions from Beijing and also growing regulatory hurdles from the year-old administration of U.S. President Donald Trump.

Chinese investment in the U.S. fell 35% last year to $29 billion in consummated deals, according to Rhodium Group. It added that the value of newly announced deals last year plunged by an even sharper 90%.

“Much of the decline was attributable to Beijing’s regulatory crackdown on outbound capital flows, but growing regulatory hurdles in the US — mostly more complications getting clearance from the Committee on Foreign Investment in the United States (CFIUS) — was the second punch to Chinese investors,” Rhodium said, making reference to the U.S. agency that clears all major cross-border deals for national security concerns.

Last year saw a growing number of such deals blocked, including the purchase of U.S. chipmaker Lattice Semiconductor by a Chinese buyer. Most recently, privately owned Ant Financial, the financial affiliate of e-commerce giant Alibaba, scrapped its $1.2 billion plan to buy U.S. money transfer specialist MoneyGram International Inc. earlier this month, citing inability to get clearance from CFIUS.

“CFIUS seems to have broadened its approach for reviewing Chinese deals, taking into consideration a broader array of criteria when assessing security risks, for example state-sponsored M&A activity to obtain certain technologies or concerns about data protection,” Rhodium said.

Contact reporter Yang Ge (geyang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas