China Taps India’s Tech Gold Mine

“Do you guys know Jack Ma? How could we reach him? We would really like him to come give a talk.”

In April in Hyderabad, capital of southern India’s Telangana state, a company executive from T-Hub posed the question to a group of Chinese reporters on a field trip to the technology hub.

“People on the Indian startup scene are very much looking forward to meeting him. We want to get his advice on how to build up a technology ecosystem,” he said.

|

| About 2,500 people from across India gathered in Mumbai on May 17 to watch the country’s launch event of the new OnePlus 6 smartphone made by Shenzhen-based OnePlus. Photo: VCG |

T-Hub is an Indian startup incubator. Its office, reminiscent of an international technology giant, features a nearly 10-meter (33-foot) playground slide and a bell modeled on the one they ring at the New York Stock Exchange. T-Hub rings its bell when managers want to make major announcements to staff.

In its meeting rooms hang framed pictures of Ma, the co-founder of China’s biggest e-commerce firm, Alibaba Group Holding Ltd.; Bill Gates, co-founder of Microsoft Corp.; and Travis Kalanick, co-founder of Uber Technologies Inc.

T-Hub is just one of the many Indian startups eager to tap into technology know-how from China, as its burgeoning scene aims to replicate successful cases for the world’s second-most populous country.

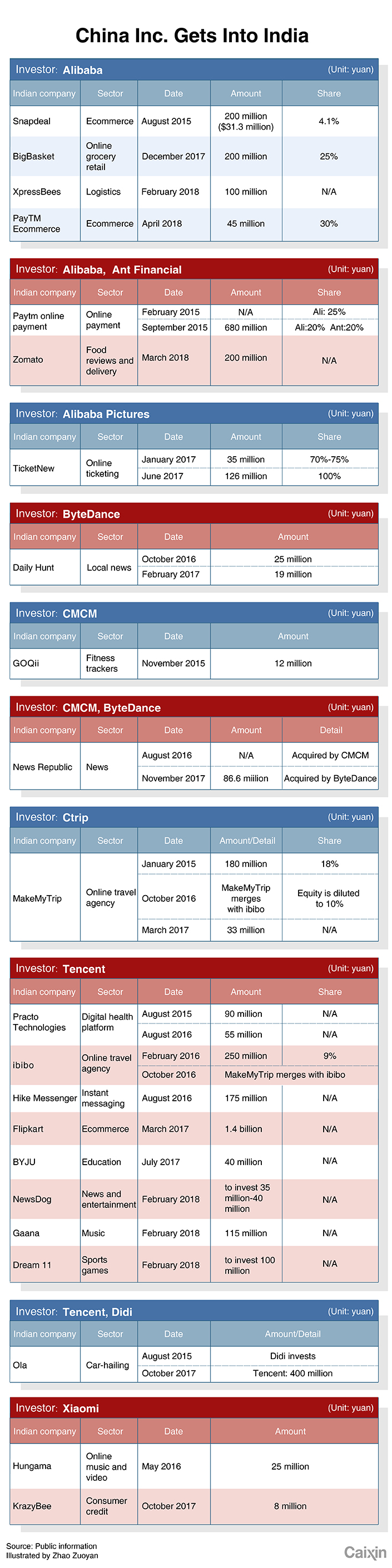

Chinese tech companies have sensed that hunger and have reciprocated by investing an estimated $4 billion in India since 2015, according to preliminary data compiled by Caixin. The wave of investments shows no sign of abating. China has sped up its presence in India, gobbling up stakes in startups and breaking ground for facilities to produce smartphones.

Among the companies are technology giants Alibaba and Tencent Holdings Ltd., handset-makers Xiaomi Corp. and Vivo Corp., as well as up-and-comers such as Jinri Toutiao, a news aggregator, and Cheetah Mobile Inc., a mobile apps creator.

“India currently doesn’t impose much restriction on foreign investment, not to mention the fact that the average age of its 1.3 billion population is only 27 years old,” said Chen Shaohui, Meituan-Dianping’s vice president of strategy. “The young population is a boon to grow our internet business.”

The on-demand services platform in February partook in a $100 million funding round for Swiggy, an online food-delivery startup based in Bangalore, southern Karnataka state. Similar to the Chinese food delivery apps, Swiggy lets customers discover popular restaurants and track their food orders in real time. It boasts being able to deliver food in about 35 minutes.

A notable investor is Ant Financial Services Group, the Alibaba affiliate that operates mobile payment app Alipay. It currently holds about a 40% stake in Indian mobile payment provider Paytm E-Commerce Pvt. Ltd.

An Ant Financial spokesperson told Caixin that sharing its know-how with Paytm has helped boost the latter’s daily transaction growth 11 times. The Indian company now boasts 7 million merchant partners.

“India is Alipay’s first leg of globalization. It offers us economies of scale in terms of population and economic growth,” said Chen Yan, who helms Ant Financial’s operations in India. “Mobile subscription fees have rapidly dropped and India’s market size for mobile phones is 200 million units a year. This is a great opportunity to expand our mobile payment services.”

Meanwhile, Tencent’s portfolio of investments includes music-streaming app Gaana, ride-sharing company Ola, e-commerce platform Flipkart, and messaging app Hike.

As many as 14 Chinese handset manufacturers have also set up production facilities in India to churn out “made-in-India” phones. That move came after regulators in August 2016 imposed an additional 35% to 40% tax on foreign-assembled phones, on top of the country’s 10% import duty. This compares with a 12% tax for made-in-India phones.

Vivo Communication Technology Co. started making its phones locally in late 2015, well before the higher tax took effect. Oppo Electronics Corp., on the other hand, announced a 22 billion rupee ($325 million) factory late last year, which is slated to begin mass production in 2019.

Not to be outdone is Xiaomi Inc., the largest phone brand in India, which unseated formidable rival Samsung Electronics Co. Ltd. in the last quarter of 2017. Together, the brands command more than half of India’s smartphone market.

Xiaomi began building phone factories in India in 2015, and it recently announced it would add three more plants there, bringing its total to six.

The Beijing-based smartphone-maker boasts that “over 95%” of Xiaomi smartphones sold in India are “made in India.”

While tons of Chinese cash has flooded into India’s promising tech scene, observers cautioned that investors have to lay out their strategies and business plans carefully.

Chen said Meituan prefers injecting funds over launching its own business in India, at least for now, because the former model allows it to deepen its understanding of how Indian enterprises work while helping it gradually build a network of business contacts — possibly paving the way for something bigger in future.

“It’s better to be safe than sorry,” said a private equity fund manager. “Most investments in India haven’t made money. It has risks including corruption, a lack of exit opportunities, expensive valuations and the need for the government to play a greater role in supporting businesses.”

|

Contact reporter Jason Tan (jasontan@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas