Luxury Brands Slash Price Tags in China

* Louis Vuitton was first luxury-goods maker to lower prices, on June 29, followed by Hermes and Gucci in early July

* Moves follow a decision in late May by the State Council to cut tariffs on consumer goods to stabilize imports amid the ongoing China-U.S. trade war

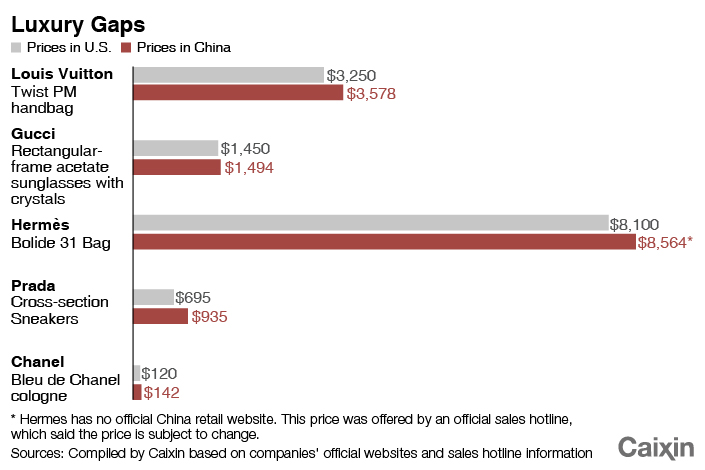

(Beijing) — Luxury brands, including Louis Vuitton and Gucci, have cut retail prices in China, following Beijing’s recent move to trim consumer-good tariffs. But the impact of the cuts will be limited as there remains a big gap in the prices of their products sold at home and abroad, analysts said.

Louis Vuitton was the first known luxury purveyor to lower prices, starting June 29, according to a company statement sent to Caixin, adding that such efforts will continue.

Hermes’ and Gucci’s price cuts on certain products in China went into effect in early July, according to company statements to Caixin. None of the brands, which rarely offer discounts, have disclosed by how much they slashed prices.

The moves follow a decision in late May by the State Council, the country’s cabinet, to cut tariffs on consumer goods to stabilize imports amid the ongoing China-U.S. trade war. As of July 1, the average duty on shoes and apparel fell to 7.1% from 15.9%, and the tariffs on leather bags dropped to less than 10% from as much as 20%, according to the official announcement.

“There will be some positive impact, but it won’t be very significant given that a big price gap remains after the reduction,” said Luan Lan, an associate partner at McKinsey & Co. in Shanghai who follows the luxury market.

|

Tariffs on imports account for only 0.5% to 7% of the products’ retail prices, according to Shanghai Customs, which cited a survey by the Ministry of Finance. In comparison, the VAT can be as high as 17% and the consumption tax on perfume, for example, is 30%.

Chinese luxury-buyers have grown more sensitive to prices in recent years, Luan said. Five years ago, 60% of luxury consumers would tolerate a 20% price gap. But now only 20% buyers are willing to do so.

Global luxury brands have constantly promised to shrink the price gap and take steps such as opening online stores on e-commerce sites to better cater to the Chinese luxury market, which McKinsey estimated will become the world’s largest by 2025, with a share of 45%.

“There is high chance more luxury brands will try to bridge the price gap to stimulate domestic consumption and improve overall brand experience,” Luan said.

Contact reporter Coco Feng (renkefeng@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas