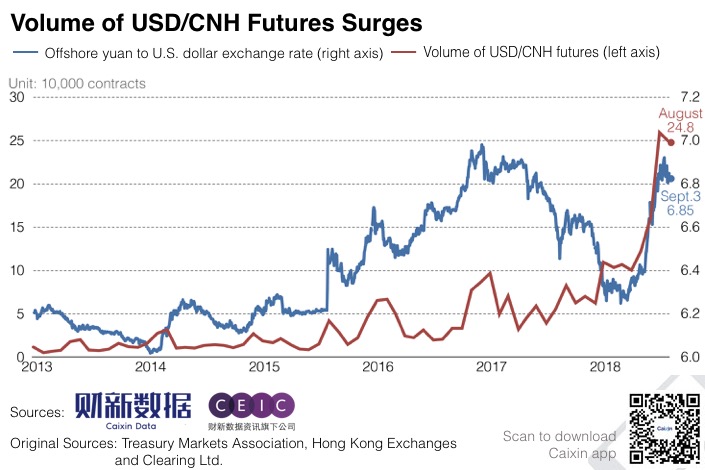

Chart of the Day: Investors Flock to Offshore Yuan Futures Amid Trade Concerns

The number of U.S. dollar/offshore yuan (USD/CNH) futures traded in Hong Kong more than quadrupled year-on-year to 248,024 contracts in August, reaching the second-highest level in history, according to local stock exchange operator Hong Kong Exchanges and Clearing Ltd. (HKEX).

|

The rising figures come at a time when market participants are looking for hedging instruments as the yuan faces depreciation pressure amid slowing domestic growth and ongoing trade tensions between China and the U.S.

HKEX launched USD/CNH futures in September 2012 in a bid to help investors manage their exposure to the offshore yuan.

Contact reporter Lin Jinbing (jinbinglin@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 4Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas