Caixin View: Central Bank Laying Groundwork to Weaken Yuan Beyond 7-per-Dollar Barrier If Necessary

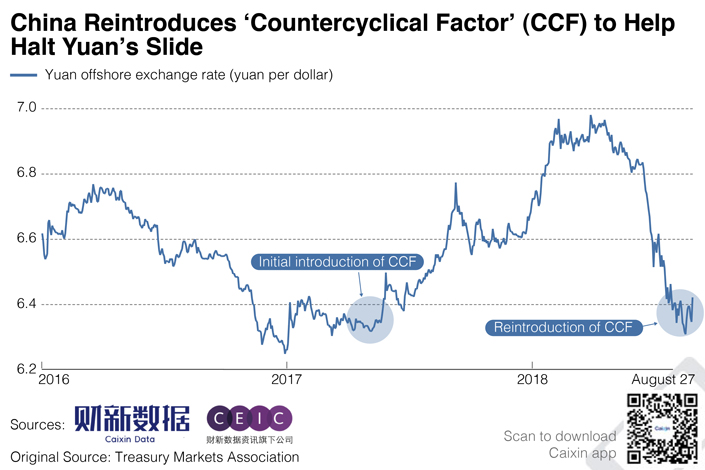

On Friday, the People’s Bank of China (PBOC) announced it had reintroduced the “countercyclical factor” (CCF) in calculating the yuan’s daily midpoint, as the central bank aims to prop up the value of the currency against the dollar and stabilize market sentiment. The original reasoning behind the CCF, which was first introduced in May 2017 and then suspended in March, is that “pro-cyclical” tendencies and “herd effects” can lead to irrational valuations of the currency that do not reflect economic fundamentals. The CCF is intended to hold back these tendencies, although the details of what goes into the calculation are somewhat of a mystery.

|

The reintroduction of the CCF instead signals that the PBOC will try to keep the yuan in a similar position to where it’s been for the last month or so — in the band around 6.7 to 6.9 yuan to the dollar. Reintroducing the CCF is an effort to strengthen market confidence that the PBOC will not, at least in the short term, allow the yuan to weaken past the important psychological barrier of 7 yuan to the dollar. This is intended to wade off fears that the slipping yuan will get out of control, leading to a torrent of capital outflows like those of 2016.

This means the reintroduction of the CCF is best seen as a continuation of two recent measures from the PBOC that also tried to keep the yuan from slipping too sharply, but didn’t attempt to strengthen it significantly:

• In early August, the PBOC effectively raised the cost for investors betting against the yuan by reinstating a reserve requirement ratio of 20% for financial institutions settling foreign exchange forward dollar sales to clients.

• Also this month, the PBOC banned banks from depositing or lending yuan offshore through interbank accounts that are available only in the Shanghai Free Trade Zone, to choke off the supply of yuan to the offshore market.

But in the longer term, two factors could push the PBOC to move beyond this range and guide the yuan over the 7-per-dollar barrier. First, the dollar index. Although as of Monday, it’s at around 95.2, below the one-year high of 96.731 that it hit on Aug. 14, the dollar could well strengthen again, bolstered by fears such as the unstable Turkish lira infecting the eurozone (see our Caixin View from Aug. 13), and Brexit-related turmoil bringing down the British pound. Second, and perhaps harder to predict, are the outcomes of subsequent rounds of U.S.-China trade talks. The last round of negotiations yielded little, and we see few signs that the two sides are close to reaching any kind of consensus. If these factors put significantly more pressure on the yuan, then managing market expectations will be crucial. We think the PBOC is especially wary of potential “overshoot” if the yuan crosses the 7-per-dollar barrier and panic ensues. So getting the market used to a level close to 7, and using tools like the CCF to demonstrate the PBOC’s control over the currency, should help prepare the ground for possible future depreciation.

Weekly Roundup

Macro & Finance

China’s top banking and insurance regulator unveiled a long-awaited plan to reorganize its departments and personnel, painting in more details of a major overhaul in the country’s financial regulatory landscape.

Sales of China’s dollar-denominated corporate bonds in July declined to the lowest level in two years amid mounting default concerns and tightening regulatory approvals for bond sales.

Regulators ordered several Chinese trust companies to stop issuing new trust products to finance real estate projects as China aims to direct more financing support to the real economy.

Surging home rents in big cities have raised questions about whether the government’s main gauge of consumer inflation accurately reflects changes in rent prices.

China is planning to encourage banks to increase their holdings of local government bonds by giving the debt risk-free status, state media reported on Tuesday, a move that could boost demand for a flood of sales set to hit the market by the end of October.

Companies

Baidu Inc.’s financial services subsidiary, which is being spun off in a $1.9 billion private equity deal, has been granted a license to sell mutual funds, an approval that will help the company close the gap with its tech-giant rivals in the fast-growing fintech sector.

Meituan-Dianping, China’s largest group discount platform and online, on-demand services provider, plans to list on the Hong Kong bourse Sept. 20, sources close to the matter told Caixin. Meituan’s IPO is widely expected to be another Hong Kong blockbuster, raising at least $4 billion and putting the company’s value at $50 billion to $55 billion.

Anbang Insurance Group Co. Ltd., whose founder was imprisoned after the government took over the company earlier this year, is preparing to sell its controlling stake in a rural bank to comply with regulations, Caixin has learned from multiple sources.

Ping An Insurance (Group) Co. of China Ltd., the country’s largest insurer by market value and second-largest life insurer by premiums, posted its best half-year performance in 10 years due to robust customer growth.

Calendar

Aug. 31: NBS releases manufacturing Purchasing Managers Index (PMI), non-manufacturing PMI, and Composite PMI Output Index for August

Sept. 3: Caixin releases the Caixin China General Manufacturing PMI for August

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas