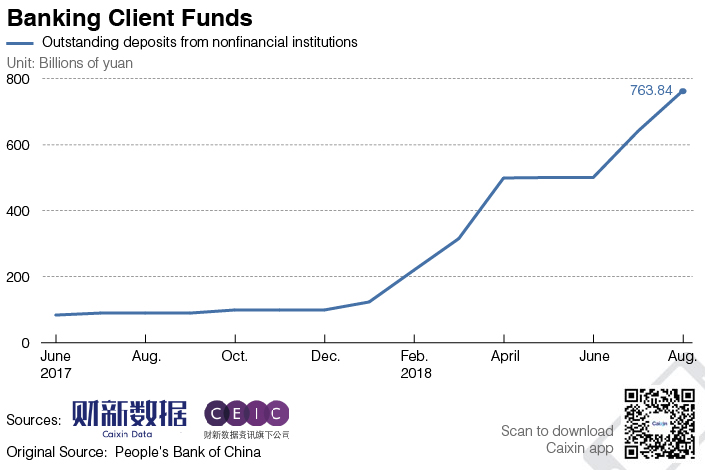

Chart of the Day: Online Payment Firms Are Banking More Client Funds

Online payment firms’ deposits of client funds hit a new high in August as the central bank has ramped up regulation of the burgeoning mobile payment industry.

|

Nonfinancial institutions’ outstanding deposits — the client funds that third-party payment firms must deposit with a centralized custodian — rose 19.1% in August from the previous month to 763.84 billion yuan ($111.42 billion), according to the latest data (link in Chinese) from the People’s Bank of China (PBOC).

The PBOC announced in June that nonbank payment firms need to gradually raise the ratio of client reserve funds under centralized deposit. They have until Jan. 14 to deposit 100% of their client fund reserves.

The move comes as part of the central bank’s broader efforts to clamp down on financial risk as more and more money flows into China’s two mobile payment giants, Alipay, an affiliate of Alibaba Group Holding Ltd., and Tencent Holdings Ltd.’s Tenpay.

China’s mobile payment platforms handled 202.9 trillion yuan in 2017, according to the Ministry of Industry and Information Technology.

Contact reporter Charlotte Yang (yutingyang@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas