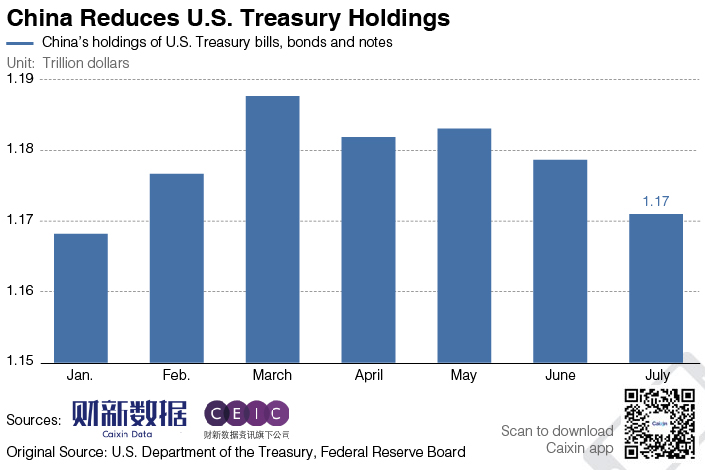

Chart of the Day: China’s U.S. Treasury Holdings Sink to Six-Month Low

China’s U.S. Treasury holdings dipped to a six-month low in July as the trade conflict between the world’s two largest economies showed no signs of cooling off.

|

China decreased its holdings of U.S. Treasury bills, bonds and notes by around 0.65% to $1.17 trillion at the end of July, down $7.7 billion from a month earlier, according to data published Tuesday by the U.S. Treasury Department.

China is the largest foreign holder of U.S. treasuries, accounting for about 18.7% of the total foreign holdings in July.

The second largest holder, Japan, increased its U.S. Treasury assets by $4.9 billion from a month earlier to around $1.04 trillion at the end of July, according to official U.S. data.

Trade frictions between China and the U.S. continue to escalate. Earlier this week, Beijing vowed to strike back with tariffs on an additional $60 billion of U.S. imports, after Washington slapped new levies on about $200 billion worth of Chinese goods.

Correction: A previous version of this story incorrectly stated that China is the largest foreign holder of U.S. debt, when it is actually the largest foreign holder of U.S. treasuries held by foreigners.

Contact reporter Charlotte Yang (yutingyang@caixin.com)

- 1Luckin-Backer Centurium Capital to Buy Blue Bottle Coffee From Nestlé

- 2Two Sessions: With 4.5%-5% Growth Target, China Aims to Create Space for Reform

- 3China Business Uncovered Podcast: Brazil’s ‘Very Chinese Moment’

- 4Cover Story: How China’s Growing Gig Economy Has Left a Generation Adrift

- 5First Tanker Crosses Strait of Hormuz Since Iran’s Closure Threat

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas