Meituan Dianping’s Stock Delivers in Trading Debut

Shares of China’s largest on-demand services platform Meituan Dianping surged more than 5% on their trading debut in Hong Kong on Thursday.

After opening 5.65% higher, the stock gave back some of its earlier gains to close at HK$72.65 ($9.26), up 5.29% from its initial public offering (IPO) price of HK$69.

The company priced its IPO near the top range of an indicative HK$60 to HK$72, raising $4.2 billion in this year’s biggest internet IPO on the Hong Kong bourse.

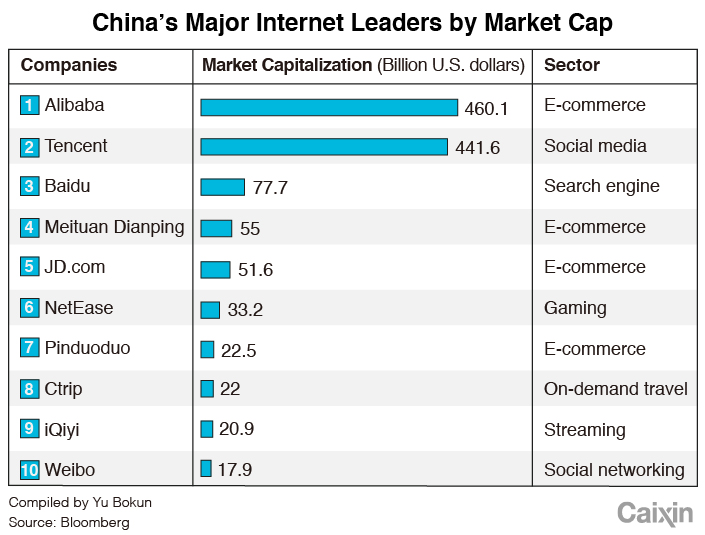

Meituan is currently valued at over $50 billion, making it China’s fourth-largest internet company, behind only the “big three” of Alibaba Group Holding Ltd., Tencent Holdings Ltd. and Baidu Inc., and ahead of e-commerce giant JD.com Inc.

Meituan was founded by serial entrepreneur Wang Xing in March 2010, in what some said was a Chinese copycat of U.S. group-buying site Groupon Inc.

From that beginning, Meituan has positioned itself as an online-to-offline (O2O) services specialist, which typically brings together everyday services like restaurant reservations and takeout delivery with high-tech internet touches. His company has gone on to dip its toe into almost every aspect of a Chinese life — including takeout delivery, ride-hailing, movie-ticket sales, travel bookings and bike sharing.

|

Meituan cemented its leadership in the space after its $15 billion merger in 2015 with top rival Dianping, which operated an app similar to U.S. online restaurant review site Yelp Inc.

Meituan now operates the world’s largest on-demand delivery network by number of deliveries, according to iResearch. In 2017, it completed about 2.9 billion deliveries with an average time of 30 minutes. The platform posted a whopping gross transaction volume of nearly 360 billion yuan ($52.5 billion) last year, processing 5.8 billion transactions, iResearch said.

Its prospects have drawn in big-name backers including social media giant Tencent, Singaporean state investors GIC Pte. and Temasek Holdings Ltd., venture capital funds like DST Global and Sequoia Capital, and the Canada Pension Plan Investment Board.

Meituan lost 18.9 billion yuan in 2017, more than triple its loss of 5.8 billion yuan in 2016. In the first four months of 2018, the company had an adjusted net loss of 2 billion yuan, reflecting the $2.7 billion acquisition of bike-sharing startup Beijing Mobike Technology Co. Ltd. in April, as well as increased sales expenses and rising debt.

Meituan plans to use proceeds from the IPO to fortify itself against stiff competition from its main competitor, food-delivery platform Ele.me, which is backed by Alibaba.

Its recently acquired Mobike also faces fierce competition from rival Ofo. Both are battling for the country’s fledging market for shared bikes.

Contact reporter Jason Tan (jasontan@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas