In Depth: China’s E-Commerce War 2.0

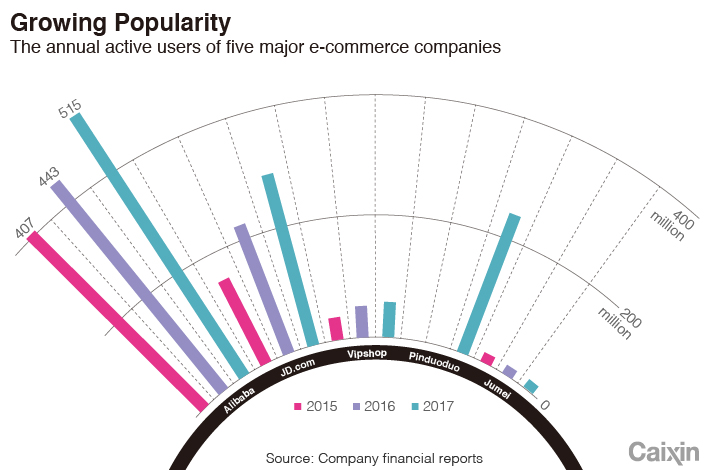

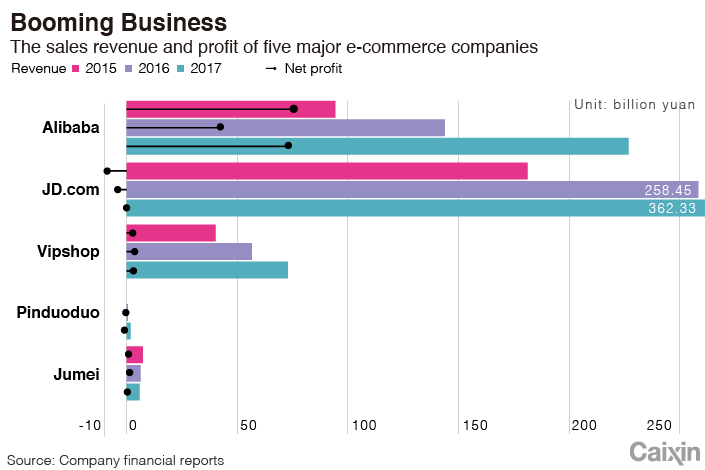

Chinese e-commerce companies are riding a new wave of initial public offerings to tap fresh capital from global investors, led by spectacular recent debuts by industry stars such as Meituan Dianping and Pinduoduo Inc.

The recent rush of listings reminds some of the craze fanned by Alibaba Group’s blockbuster debut in New York in 2014.

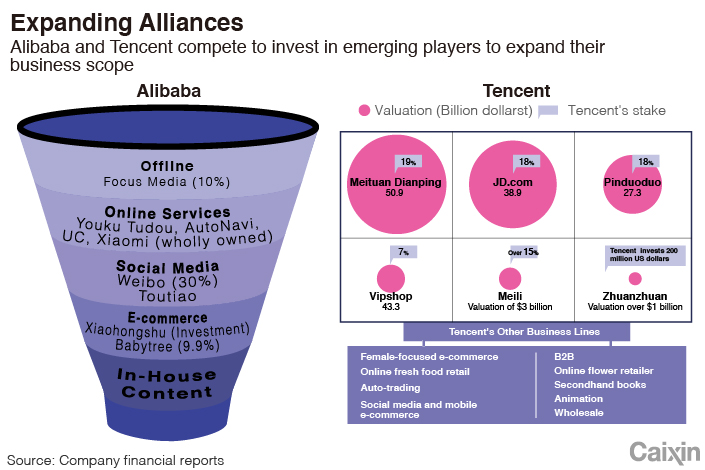

Both the industry and the market have since changed substantially. Years of aggressive expansion and investments helped Alibaba and Tencent Holdings to build a near duopoly in China’s e-commerce industry as the pair each holds stakes in a large number of emerging market players. Tencent is an investor in Pinduoduo, Meituan Dianping and the No. 2 e-commerce site JD.com, while Alibaba backs Suning.com, Ele.me among others.

China’s e-commerce sector has also matured from the rapid-growth phase to a more stable business stage. Investors’ enthusiasm is cooling especially with signs that China’s economy and domestic consumption are losing momentum.

The escalating trade war with the U.S. also complicates the business outlook, although slowing trade may not always be a bad news for e-commerce companies. The 2008 global financial crisis, which dented foreign demand, forced Chinese exporters to turn to the domestic market and created a rare opportunity for the rise of Alibaba’s online shopping site Taobao.

|

However, Jack Ma, founder of Alibaba who is retiring as chairman, warned business partners and industry players that the trade war is “going to be a mess” and would last “maybe 20 years.”

In its quarterly policy report issued in August, the central bank for the first time warned the e-commerce sector of risks from a saturated market, rising costs and a squeeze on margins.

In the face of rising uncertainties, Chinese e-commerce companies persist in the battle for survival. Alibaba and Tencent are locked in competition to expand their reach and recruit partners to build their own ecosystems with business segments spreading online and offline. Meanwhile, emerging players are competing to take advantage of social media for broader access to customers.

The next round of competition among e-commerce companies is beginning, focusing on their capacity to find new market niches, accelerate monetization and further improve supply chain and logistics efficiency.

Changing market

The landscape of China’s consumer market is changing. Official data showed that the country’s total retail sales rose 9.4% in the first half, the lowest growth since 2004. In July, growth of consumer goods sales further slowed to 8.8%, or 6.5% if price factors are excluded, the slowest pace of expansion yet recorded.

The sluggish growth in consumer spending sparked debates on whether China is showing signs of “consumption downgrade,” a euphemism generally meaning an increase in the proportion of spending going to essentials such as food, or a shift from high-quality products to lower-quality ones.

|

The rise of Pinduoduo, the group-buying site known for bargain deals, is often cited as an indicator that Chinese consumers are shifting to lower-cost products. In three years, relying on distributing group-buying plans via Tencent’s popular social media service WeChat, Pinduoduo has grown into China’s third-largest e-commerce company in terms of sales, following Alibaba and JD.com.

In July, Pinduoduo, which has more than 300 million registered users and handles 20 million orders each day, debuted in New York to raise as much as $1.63 billion in one of the biggest flotations by a Chinese enterprise this year.

Officials sought to rule out concern about consumption downgrade. Mao Shengyong, a spokesman for the National Statistics Bureau, said China’s consumption is still upgrading as people’s spending on services such as education and healthcare continues expanding.

Retailers are increasingly migrating online, supporting the growth of e-commerce. In the first half of 2018, China’s online retail sales grew by 30.1% to 4.08 trillion yuan ($595.8 billion), much faster than the overall growth of retail sales. E-commerce accounted for 17.4% of total retail sales, up from 10.6% in 2014, central bank data showed.

The rapid growth of Pinduoduo stems partly from its success in developing the market for rural and low-income consumers, who have only just been connected to the internet and have been largely neglected or underserved by established e-commerce enterprises, analysts said.

|

“We found a ‘new continent’ that still has great growth potential,” Colin Huang, founder and chairman of Pinduoduo, said when celebrating the company’s New York listing.

The mobile internet population in China is expected to grow from 970.6 million last year to 1.1 billion by 2020, with the increase taking place largely in smaller cities and rural areas, according to Analysys, an internet data provider.

All about traffic

The partnership between Pinduoduo and Tencent shows how access to customers and valuable users is crucial to e-commerce companies.

Pinduoduo has become an important segment of Tencent’s e-commerce alliance that could challenge Alibaba’s famous Taobao and Tmall marketplace. In return, Tencent’s WeChat platform, with access to more than 1 billion users worldwide, is the crucial part enabling Pinduoduo’s model of meshing online shopping with social media that has allowed it to expand quickly.

Tencent’s WeChat as well as instant messenger QQ also offer key access to users for JD.com, contributing one-third of the e-commerce company’s growth in new users, according to Zhang Jing, a JD.com social media department executive.

Established enterprises and emerging players both crave more traffic to boost sales. JD.com’s marketing chief Yan Jingjing said the company will seek more partnerships with mobile application operators for access to new users.

While Tencent controls key access to users, Alibaba has stepped up acquisitions on a wide range of assets online and offline to reach more users. In July, Alibaba invested 15 billion yuan for a 7.99% stake in China’s largest outdoor advertising company Focus Media as its latest effort to tap offline customers. Focus Media operates an extensive liquid crystal display (LCD) network in offices and apartment buildings in 300 cities to advertise for clients including Tencent and JD.com.

Media reported that Alibaba and Tencent have both held talks with global marketing giant WPP for potential acquisition of WPP’s China business.

Getting more traffic and using big data technology to match users with services and goods is now the key strategy for most e-commerce platforms, analysts said.

A JD.com executive said the company has attached increasing importance to its department of search services and product recommendation, putting the unit under director supervision of CEO Richard Liu.

Earlier this month, Alibaba said it would integrate the membership systems of various subsidiaries including Tmall’s online grocery store, video site Youku, food delivery unit Ele.me and online music portal Xiami. A company source said the consolidation is part of Alibaba’s campaign since 2014 to integrate user data and internal resources.

Evolving logistics

With its own self-operated warehouse network and courier team, JD.com has long been proud of its highly efficient delivery system. In a recent meeting with analysts, CEO Liu said there is still no “real rival” nationwide to JD.com’s logistics service.

But rivals are catching up. Alibaba since 2013 has started to build its own logistics network under the arm of Cainiao Network Technology Co., which recently began intensive investment in domestic competitors including Dianwoda and ZTO Express.

Meanwhile, logistics for the e-commerce sector is changing as the boundary between online and offline retail becomes increasingly blurry. In the past, the logistics systems of e-commerce and physical stores were strictly separated, but as e-commerce giants expand into brick-and-mortar sales, the inventory management and delivery services of online and offline business are gradually integrating to further increase efficiency.

“The whole logistics chain will be restructured,” said Wang Wenbin, chief technology officer of Cainiao.

Now, major e-commerce platforms can deliver goods to shoppers in big cities within one day. The next question is how they can expand rapid service into the vast rural areas where delivery costs are much higher, analysts said.

On the other hand, e-commerce companies are also seeking to move upstream of the supply chain to tap new growth sources, by directly working with manufacturers to develop self-branded products in a bid to expand profit margins and enhance efficiency of the supply chain.

Unlike the U.S. and Europe where retailers’ house brands account for as much as half of the total retail market, brands owned by Chinese retailers account for only about 5% of the market, according to Hu Hao, a researcher at JD.com’s big data department.

“Against the backdrop of overcapacity and shifting consumption behavior in China, it is a good opportunity to develop new brands with high cost performance to meet consumers’ demands,” Hu said.

“Shifting from consumer-focused internet to manufacturer-focused” is the next key strategy of JD.com, said company research head Cui Zhiyu.

Contact reporter Han Wei (weihan@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 5In Depth: China’s Sweeping Banking Law Rewrite Targets Hidden Risks

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas