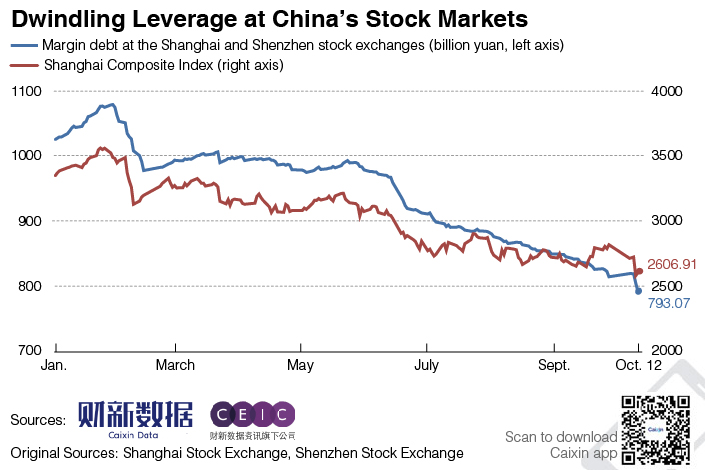

Charts of the Day: China’s Margin Debt Hits 47-Month Low

The daily margin debt on the Chinese mainland’s stock exchanges — the value of shares bought with borrowed money — fell to its lowest point since November 2014 on Friday, showing waning investor confidence in the country’s beleaguered stock markets.

|

The balance of margin debt fell to 793.1 billion yuan ($114.6 billion) on Oct. 12, dropping 12.6 billion yuan from the day before, according to data from the Shanghai and Shenzhen stock exhanges.

Chinese stock markets tumbled into bear territory this year amid escalating trade tensions with the U.S. and concerns over the country’s sluggish economic growth. Shanghai and Shenzhen have been two of the world’s worst-performing markets in 2018, and are now down 27% and 34%, respectively, from peaks in late January.

Contact reporter Charlotte Yang (yutingyang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas