Display-Makers’ Profits Slump as Panel Glut Persists

Chinese display-makers’ profits slumped last quarter due to a supply glut that’s likely to continue as more advanced plants come online over the next two years.

Top player BOE Technology Group Co. Ltd. and smaller rivals Visionox Technology Inc. and Tianma Microelectronics Co. Ltd. have all reported plummeting profits or growing losses in the third quarter.

BOE’s net profit plunged more than 80% year-on-year to 403.9 million yuan ($57.9 million) in the three months ending September, despite a 5% rise in revenue to 26 billion yuan, according to a company filing (link in Chinese) to the Shenzhen Stock Exchange on Tuesday. For the first three quarters, net income fell 48% to 3.4 billion yuan, while sales remained flat at 69.5 billion yuan.

Visionox Monday said its net loss widened by 555% to 168.2 million yuan in the third quarter, despite a surge in revenue to 455 million yuan following a merger with one of its subsidiaries. Its net loss for the nine months through September widened 150% to 152 million yuan, on revenue of 930.5 million yuan.

On Friday, Tianma reported that its third-quarter profit fell 35% year-on-year to 434.9 million yuan, while revenue shot up 11% to 7.8 billion yuan.

As demand for electronic devices including televisions, computers and smartphones grows, China has been pushing to develop its display panel industry in the hope of unseating the industry’s big boys from South Korea and Taiwan. Local governments have been footing some of the bill by forming joint ventures with panel-makers to build advanced manufacturing facilities.

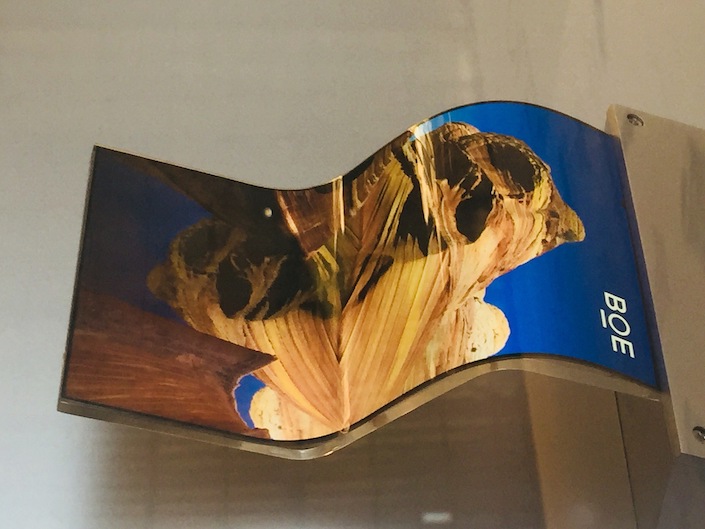

Just last week, Visionox said it had forged a pact with the government of Hefei in East China’s Anhui province for a 44 billion yuan facility to churn out active-matrix organic light-emitting-diode displays, as it bets on the mass adoption of bendable screens in smart gadgets.

China is expected to become the world’s top producer of liquid crystal display panels by 2020, seizing a production capacity market share of 40%, up from 27% in 2017, according to a JP Morgan report released this month. The bank said BOE is poised to become the No. 1 manufacturer next year with 18% of the market, beating formidable giants such as AU Optronics Corp., Innolux Corp., LG Display Co. Ltd. and Sharp Corp.

“The panel prices have been decreasing in the majority of time over the past year instead of growing,” said Boyce Fan, an analyst with WitsView Technology Corp., a panel tracker in Taipei. “Looking ahead to 4Q18 and 1Q19, the market expects a low season and the situation will not change until the end of Chinese New Year when new devices start to be produced.”

JPMorgan expects panel prices to trend down in the mid-fourth quarter this year and maintains its view that there will be a “significant oversupply” in 2019 and 2020 as new Chinese facilities enter the production fray.

Contact reporter Jason Tan (jasontan@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas