Chart of the Day: China’s Growing Mortgage Debt Drags on the Economy

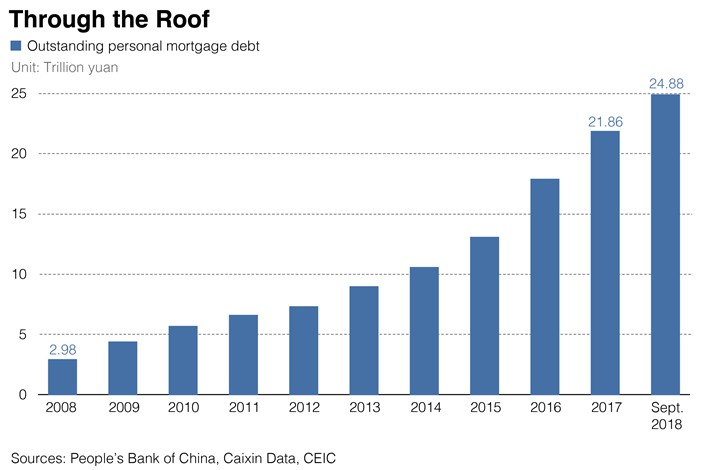

Outstanding personal home mortgages in China have expanded sevenfold from 3 trillion yuan ($430 billion) in 2008 to 21.9 trillion yuan in 2017, according to data from the People’s Bank of China (PBOC), the central bank.

|

Graphic: Gao Baiyu/Caixin |

By the end of September, the value of outstanding home mortgages had further surged to 24.9 trillion yuan, up 18% year-on-year, according to the PBOC. Rising real estate prices, property speculation and the value that Chinese people traditionally place on home ownership have helped drive a trend that has turned many people into what are called “mortgage slaves.”

Home mortgage debt makes up a significant portion of total household debt in China. As of the third quarter, it accounted for 53% of the 46.2 trillion yuan in outstanding household debt, according to the central bank.

The rising cost of housing has been a drag on consumer spending, leading many Chinese to turn to short-term consumer loans, the central bank said in its 2018 financial stability report, which was published last week. In 2017, outstanding short-term consumer credit surged 37.9% to 6.8 trillion yuan.

Many middle-class residents, especially in Beijing and Shanghai, have also mentioned on social media that the cost of housing has caused them to change their spending habits, a phenomenon known as a “consumption downgrade.”

Contact reporter Charlotte Yang (yutingyang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas