Xiaomi Joins Tech Rescue Effort With Share Buyback

Shares of smartphone-maker Xiaomi Corp. jumped as much as 3% on Monday, after the company announced it had begun buying back shares to support its sagging stock.

Shares of Xiaomi, the world’s fourth largest smartphone seller, jumped to as high as HK$10.48 ($1.34) in morning trade in Hong Kong, versus its previous close of HK$10.16 on Friday. The stock ultimately gave back about half of the gains to end the trading day up 1.4% at HK$10.30.

The stock has moved steadily downward since its initial public offering last July that was the year’s second largest, on concerns about its overdependence on low-end smartphones where margins are thinnest and competition is fierce. The pressure grew earlier this month when a six-month lockup period ended, prompting many of the company’s early investors dump shares to lock in gains.

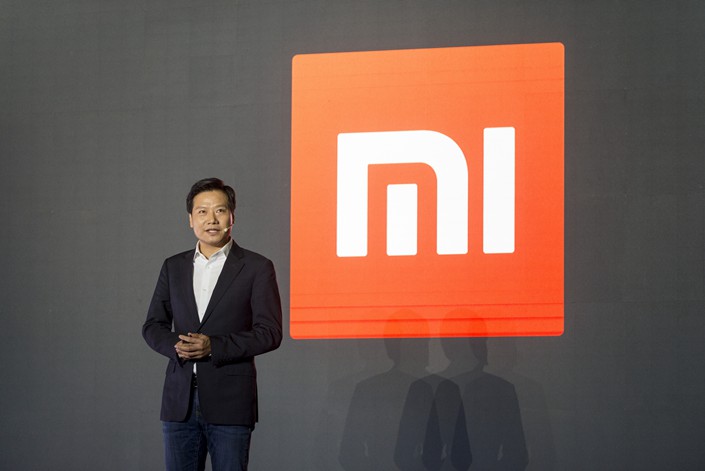

At that time Xiaomi co-founder and CEO Lei Jun pledged not to sell most of his shares for the next 365 days as a vote of confidence in the stock. The company said the latest share buyback represented another vote of confidence. Companies often launch such back-backs when their share prices sink quickly, believing the stock is oversold and may be cheaper than its true value.

Xiaomi said that on Thursday it purchased 6.14 million of its Class-B shares for an average price of HK$9.7625, according to a statement issued after market close on Friday.

“The board believes that a share repurchase in the present conditions will demonstrate the company’s confidence in its own business outlook and prospects and would, ultimately, benefit the company and create value to its shareholders,” Xiaomi said. “The board believes that the current financial resources of the company would enable it to implement the share repurchase while maintaining a solid financial position.”

At their current levels, Xiaomi’s shares now trade about 40% below their IPO price of HK$17. The stock now commands a price-to-earnings ratio of about 21, compared with a lower 13 for industry leader Apple Inc., according to Bloomberg. That means investors may still see good prospects for the company despite the recent stock declines.

Xiaomi joins a growing number of Chinese firms to launch such buybacks, as shares become depressed amid broader investor concerns about China’s slowing economy. Last September leading game operator and China’s second most valuable internet company Tencent Holdings Ltd. launched its first such buyback in four years after the stock lost about a third of its value from a January peak. And in December No. 2 e-commerce company JD.com Inc. announced a similar plan to buy back up to $1 billion worth of its stock.

Contact reporter Yang Ge (geyang@caixin.com)

- 1Cover Story: How China’s Growing Gig Economy Has Left a Generation Adrift

- 2In Depth: China’s Sweeping Banking Law Rewrite Targets Hidden Risks

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 5Over Half of China’s Provinces Cut Revenue Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas