Xiaomi Tries to Go Up-Market Ahead of Smartphone ‘War’

* Smartphone-maker is eyeing the high-end market as part of its multi-brand strategy

* CEO Lei Jun said Xiaomi will pivot to produce phones under its own brand that emphasize innovation and user experience

(Beijing) — Xiaomi Corp. is raising prices and going up-market.

The smartphone-maker launched its latest model, the Mi 9, in Beijing on Wednesday, with a starting price of 2,999 yuan ($441) — making it the most expensive Xiaomi “flagship” phone to date.

It comes as the company heads into a year when China’s smartphone market will be “the most intense warzone,” co-founder and CEO Lei Jun told reporters after a launch event in Beijing on Wednesday.

The Mi 9 could well be the company’s last flagship phone with a starting price less than 3,000 yuan, Lei said at the launch.

The company is eyeing the high-end market as part of its multi-brand strategy.

Lei said Xiaomi would now pivot to produce phones that emphasize innovation and user experience, while its spinoff Redmi brand would emphasize “value for money.” The Redmi brand typically prices its phones under 1,000 yuan.

Xiaomi had long touted its products as offering value for money with a low price strategy as one of its selling points. But the decision to spin off Redmi could help Xiaomi shake off its image as a low-end smartphone brand, IDC analyst Wang Xi told Caixin in January.

The smartphone-maker has other brands that target different market segments. Xiaomi licensed selfie app operator Meitu’s branded smartphones and its popular photo-editing apps last year. It also launched Black Shark, a smartphone brand for gamers, and Poco, which targets the higher end of the market.

The launch comes after Xiaomi sales in China plunged amid a downward slide in the industry. The China market, which declined 10.5% year-on-year in 2018, has tallied five consecutive quarterly contractions.

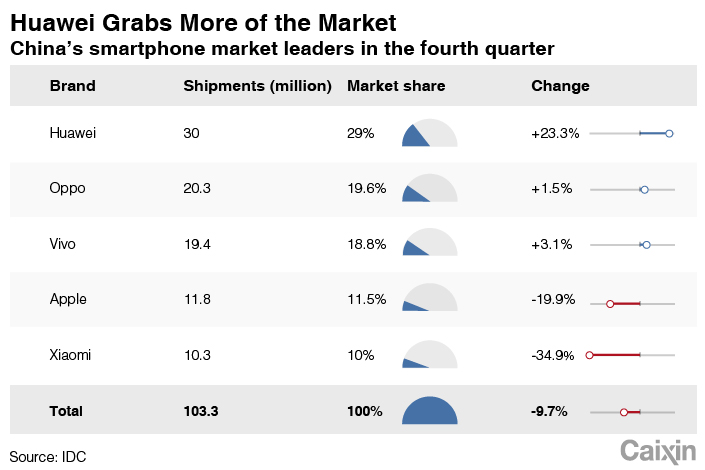

For the fourth quarter, the China market contracted 9.7% year-on-year as 103.3 million units shipped, while Xiaomi’s China shipments dropped 34.9% to 10.3 million.

|

But Xiaomi’s largest domestic rival Huawei saw its sales for the same period surge 23.3% to 30 million units, giving it 29% of the market.

Huawei in October launched its Mate 20, with a price starting at 3,999 yuan in China.

Contact reporter Tang Ziyi (ziyitang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas