In Depth: Earthquakes Are the Latest Setback to China’s Fracking Ambitions

After a series of earthquakes shook Rong county in western China on Feb. 24 and Feb. 25, the Sichuan Earthquake Administration moved quickly to say there was no connection with fracking activity in the region.

The earthquakes killed two people and injured 12, with around 13,000 people reported to have been affected more broadly. Many locals ignored the province’s earthquake monitoring body and continued to blame the two state-owned giants drilling in Sichuan, China Petroleum & Chemical Corp. (Sinopec) and China National Petroleum Corp. (CNPC).

Videos went viral on social media of protesters marching holding banners with such slogans as “Resist shale gas mining.” Facing a growing public outcry, the local government suspended fracking operations — the use of high-pressure liquid to blast through rock to extract oil or gas — for both companies. Various insiders at Sinopec and CNPC say they don’t know when operations will resume, if at all.

While fracking may not have been responsible for the earthquake, the suspension is another major setback for China’s fracking ambitions. The country sits atop an estimated 1.115 trillion cubic meters (39 trillion cubic feet) of shale gas, the largest reserves in the world. Many have long dreamed that the country might follow the U.S. and its shale gas transformation and harness its own reserves.

|

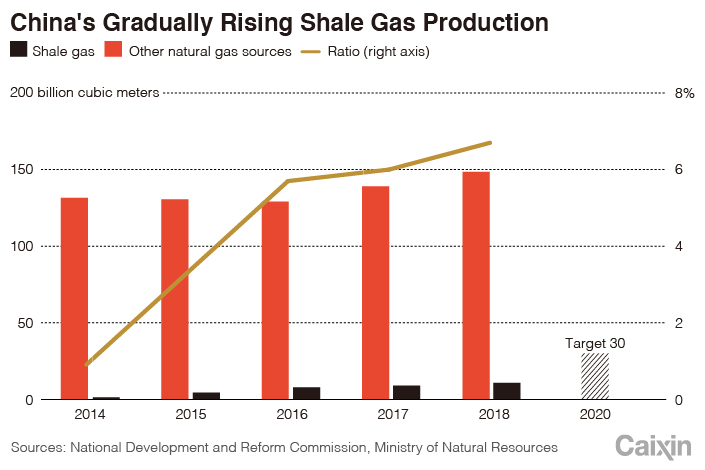

Such a shale boom would come at a crucial time. China became the world’s biggest natural-gas importing country last year, relying on imports for 45.3% of its total supply. And demand continues to balloon. Consumption reached 280.3 billion cubic meters in 2018, an 18.1% increase from 2017, following a 15.3% increase the year before. Yet unlike U.S. shale reserves, China’s tend to be located much deeper underground and in less accessible, mountainous regions. Finding the mechanisms to encourage the upfront investment needed to ensure its extraction has proved difficult.

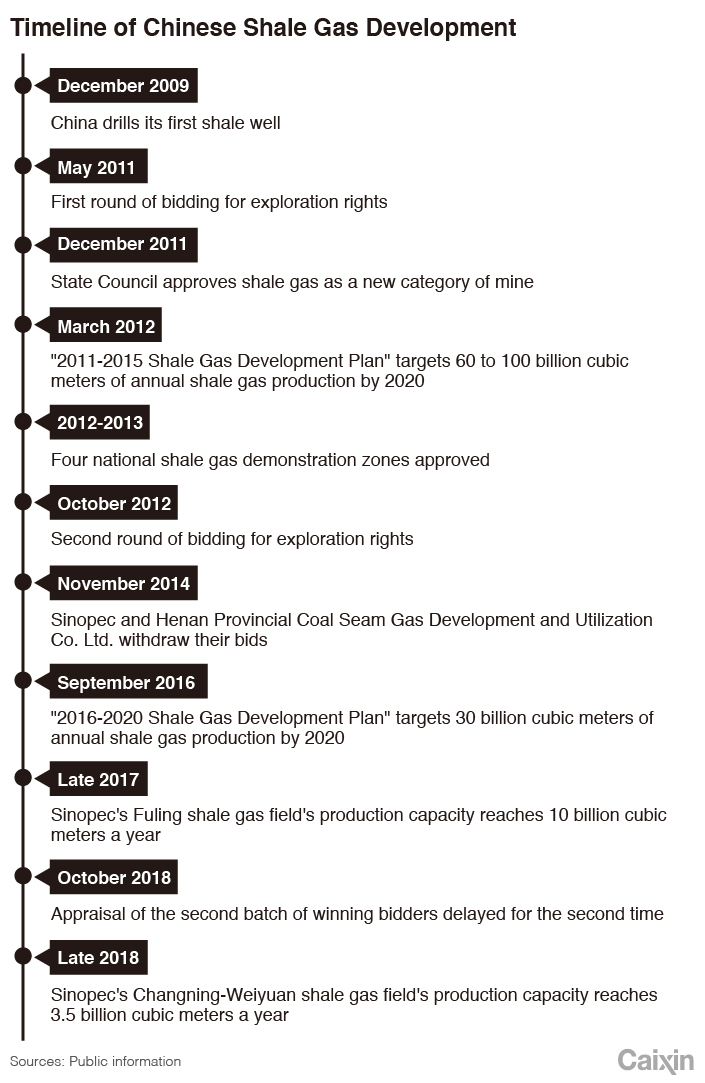

As government departments began to mull the possibility of a shale-gas revolution in the late 2000s, it was seen as a potential way of breaking up the monopoly of state giants on exploration and extraction. The industry had a “honeymoon period” in 2009 when the government allowed foreign oil companies and foreign capital to enter joint exploration agreements with Chinese companies and to bid for deep oil and gas rights through auctions on designated blocks.

While this seemed promising in theory, once foreign companies began to explore in the blocks they had won, they often found extracting shale gas from their blocks would be far costlier than they realized. Interested rapidly waned, a planned second round of bidding in 2012 was postponed, and after that year no new foreign companies entered to explore China’s shale reserves.

Yet that year the National Energy Administration and the former Ministry of Land and Resources were confident enough to target 60 billion to 100 billion cubic meters of shale gas output by 2020 in its “2011-2015 Shale Gas Development Plan.” By 2015, annual production amounted to less than 4.5 billion cubic meters. The 2016-2020 plan saw ambitions scaled back to 30 billion cubic meters by 2020.

The withdrawal of foreign companies placed the brunt of the burden on Sinopec and CNPC, particularly after China’s gas shortages in the winter of 2017, when large-scale gas outages occurred in the north of the country, exacerbated by the speed with which the government moved to increase its usage of gas for heating instead of heavily polluting coal power. Yet much of the blame was also given to the unreliability of the existing means for importing gas into the country.

|

In April the next year, state planner the National Development and Reform Commission issued a document calling for domestic gas production and storage to be ramped up. In July 2018, President Xi Jinping also said in a speech that “[gas] exploration and development must be enhanced to ensure energy security,” while in September, the State Council, China’s cabinet, issued documents calling for the “rapid increase of reserves and production.”

The latter order led to CNPC setting out plans for the vast and rapid development of shale gas extraction. In 2018, it opened over 300 new wells in the Sichuan Basin, an increase of 50% on its previous number. It aimed to open another 700 more by 2020.

Both companies took the lead in the government’s ambitions to produce 30 billion tons of shale gas by 2020. CNPC ramped up infrastructure investment and opened over 300 wells last year, with the goal of opening 800 by 2020. Sinopec also ramped up production.

Sinopec’s Fuling Shale Gas Field entered commercial development in 2014 and built an annual capacity of 10 billion cubic meters in 2017. The Fuling shale gas field contributed 6 billion cubic meters of shale gas production to Sinopec in 2017 and 2018. In Chongqing, Sinopec plans to build a capacity of 15 billion cubic meters by 2020, with an annual output of 10 billion cubic meters. In the Sichuan Basin, Sinopec also has the “Weiyuan-Rongxian,” “Jingyan-Qiangwei,” “Rongchang-Yongchuan” and other shale gas blocks.

Yet given the speed with which both companies were moving to develop their shale production to meet the 2020 target, the suspensions in the aftermath of the earthquake are major setback. So far there is no research proving a direct link between shale gas mining and earthquakes. From research in the U.S., there is some suggestion that shale mining could cause small earthquakes, but there’s no clear sign it could cause large earthquakes such as those seen in Rong county.

Contact reporter David Kirton (davidkirton@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas