PBOC Deputy: Financial Opening-Up Is a Path China Must Follow

China’s economy continued to post stable growth in 2018 and made progress on structural adjustments, despite headwinds of weak external demand and unfavorable domestic conditions. In response to downward pressure, the People’s Bank of China (PBOC) enhanced policy measures to support the real economy, mitigated and resolved financial risks and continued to deepen reform and opening-up.

So far this year, market expectations have improved significantly because of two factors. First, the countercyclical policies have gradually helped the economy. Second, the U.S.-China trade negotiations have made progress. It is widely expected that China and the United States will finally reach an agreement. One of the issues discussed during the negotiations is the opening-up of the financial sector, which was already a priority in China's financial reform agenda. The task helps bridge differences and foster consensus in the China-U.S. trade negotiations.

Progress made

China has been making steady efforts to deepen financial reform. Last year, a number of important measures were adopted to further the supply-side structural financial reforms and to enable the financial sector to better serve the real economy. These measures have effectively promoted the healthy development of the financial sector and the overall economy.

President Xi Jinping announced a plan last April to further open up the Chinese economy with measures to be adopted “sooner rather than later.” Since then, important progress has been made in opening up the financial industry.

First, the banking, securities and insurance industries have further liberalized market access, and by 2021 the equity ownership cap for foreign investors will be removed. The scope of business has been expanded for foreign banks, foreign securities companies and insurance brokers.

Second, foreign institutions have been granted national treatment in the credit investigation sector, credit rating sector, bankcard clearing and settlement, and nonbank payment sectors.

Third, the two-way opening-up of the capital market has made progress. The bond market was further opened, supported by improvement in the relevant accounting rules, taxation arrangements and trading systems. The connectivity of domestic and foreign stock markets has been deepened. Overseas participants can now trade yuan-denominated crude oil futures onshore. And overseas participants have access to the commodity futures market.

Looking back at reforms of the past decades, financial sector opening has served the needs of China’s development. Opening-up has promoted the development of China’s financial sector and the competitiveness of financial institutions.

Further opening-up

Financial sector opening-up has always been a choice that China has made out of its own needs. At the initial stage of reform and opening-up, China brought in foreign capital and issued debt abroad, which provided essential financial support for economic growth and spurred a series of financial reforms. After the outbreak of the Asian financial crisis, we recognized that it was imperative to reform commercial banks with efforts to introduce external strategic investors and push them to go public, creating new incentives and updating the constraint mechanism, transforming them into market-oriented players. In the meantime, China adopted international standards and rules, implemented Basel rules, improved corporate governance principles, and updated accounting rules in line with international standards.

As China enters a new era of development, further financial sector opening-up is a path we must follow to deepen financial reform and integrate into the global economy.

From a domestic perspective, the economy is transitioning from high-speed growth to high-quality development. The contribution of the service sector to GDP growth is becoming more important relative to that of manufacturing. During this process, the financial sector must find a new model to support the transition and adapt to the emerging economic structure.

From the international perspective, as China further integrates into the global economy, Chinese enterprises have expanded their overseas operations and demanded more financial services. To serve their need, Chinese financial institutions have to go global and compete on the world stage. Therefore, we must adopt regulatory rules that treat domestic and foreign financial institutions equally and have fair, open, transparent market rules in line with international standards to support the Chinese financial institutions to adapt to the international environment and enhance capacity globally. Financial sector opening-up will also allow foreign financial institutions and investors to participate in China’s financial market and benefit from our economic growth.

Financial sector reform is an important component in China’s overall plan of reform and opening-up for the new era. As a next step, we will continue to do so and aim to achieve a high degree of openness.

First, we will open up across the board and make sure the measures are properly implemented. Restrictions will be further eased on foreign investors’ holdings, business presence, shareholder qualification and business scope. The relevant laws and regulations will be amended to remove obstacles for the adoption of reform measures. Processing of applications by foreign investors will be accelerated. Research will also be made on further easing market access restrictions.

Second, China will push forward rule-based and systematic opening-up by gradually adopting the approach of pre-establishment national treatment and the negative list. The current practice of case-by-case approval will be changed. We will sort out existing laws and regulations, make necessary amendments and formulate a single set of access and regulatory standards to make sure that all institutions, domestic and foreign, have equal access to the sectors that are not on the negative list.

Third, we will improve the business environment and increase transparency in policymaking. We will enhance coordination and communication in policymaking and promote convergence to international standards. Administrative procedures will be streamlined, and administrative approval procedures will be improved for better transparency and efficiency.

Fourth, greater opening-up will go hand-in-hand with better financial regulation. Supporting measures will be adopted to effectively mitigate and dissolve financial risks and to establish a regulatory framework and financial infrastructure that match the progress of opening-up in the financial sector. Macro prudential management and financial regulation will have better coordination. The gap and shortfall in regulatory rules and framework will be addressed to prevent systemic financial risks. Cross-border regulatory cooperation will be intensified to prevent regulatory arbitrage and to plug regulatory loopholes.

China’s opening-up will continue, and more measures will be adopted. We will further open up the financial sector in an active and orderly manner and welcome overseas financial institutions and investors in this win-win process.

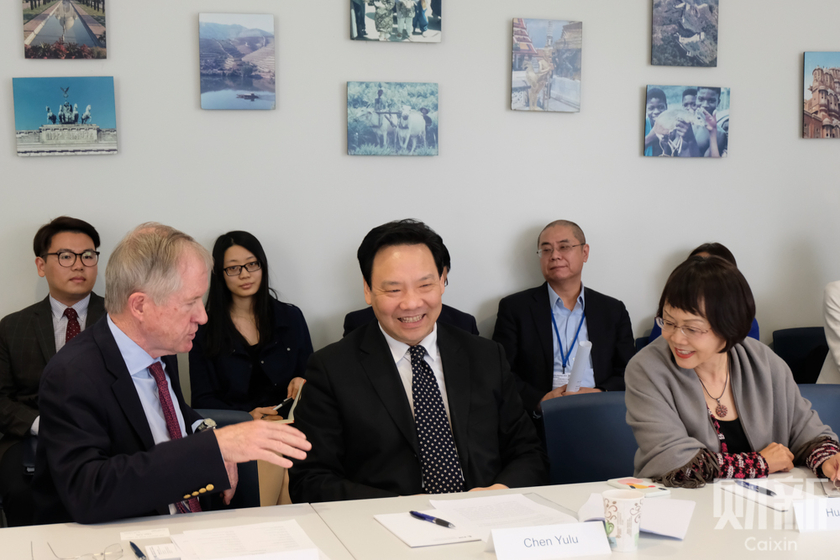

Chen Yulu is a deputy governor of the People’s Bank of China, the central bank. This article excerpts a keynote speech delivered by Chen on Wednesday at the Caixin Roundtable in Washington.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas