CX Daily: The PBOC's Top 2019 Priorities

Central bank outlines policy priorities, warns on risks

The PBOC has outlined its priorities for the coming year, pledging to improve guidance on credit policies while promoting innovation and reform in financial markets, and strengthening the bond market’s role in supporting the economy.

According to the lengthy to-do list, published on the central bank’s website late Tuesday, the role of the bond market in replenishing banks’ capital will be strengthened, and the authorities will push forward a market-oriented mechanism to deal with bond defaults, promote further opening-up of the bond market and support innovation in the market system and products.

The central bank reaffirmed commitments to push forward supply-side structural reform in the financial sector, echoing President Xi Jinping’s call on the work Friday. The list was accompanied by a warning that the economy faces growing downward pressure and that it “remains an arduous task to prevent and defuse financial risks.”

FINANCE & ECONOMICS

|

U.S. and China negotiators hold trade talks. Photo: Bloomberg |

Demands /

U.S. says more China purchases alone not enough for deal

The U.S. is pushing for a trade deal that includes “new rules” for China's economic model, as well as provisions that ensure Beijing keeps its promises, in remarks that seem to contrast with President Donald Trump’s earlier optimism.

The issues on the table between the U.S. and China “are too serious to be resolved with promises of additional purchases,” U.S. Trade Representative Robert Lighthizer said Wednesday in testimony before the House Ways and Means committee. Plans are underway to invite Chinese president Xi Jinping for a summit to finalize a potential agreement.

Growing interest /

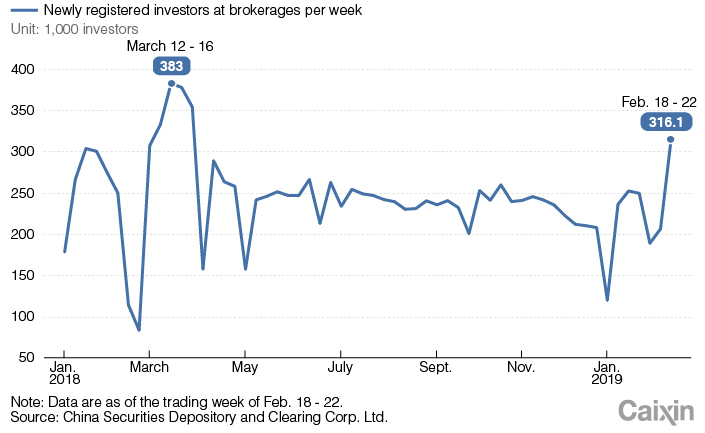

New investor sign-ups surge

|

China’s brokerages have seen a surge in new customers looking to invest in the country’s rebounding stock markets. Between Feb. 18 and Feb. 22, the number of newly registered investors jumped 53% from the previous trading week to more than 310,000, the highest weekly figure in 10 months.

Leadership /

Regulatory officials warn of high-tech board challenges

Yi Huiman, the China Securities Regulatory Commission's new chairman, spoke at length about China's new high-tech board and the difficulties it faces at his much-anticipated press debut Wednesday, including the lack of experience of brokerages and banks in pricing and underwriting IPOs.

But he avoided commenting on the hottest topic of the day – the recent bull run in mainland stock markets. The benchmark Shanghai Composite Index, one of the world’s worst performers last year, has in contrast been the best performer so far this year, jumping almost 20%. The Chinese public often says that heads of the agency are “sitting on top of a volcano” because of the sensitivity of the job and the unpredictability of China’s stock markets.

Payback /

Qinghai SOE makes interest payment for offshore U.S. dollar bond

Qinghai Provincial Investment Group has put into a Bank of New York Mellon account the $10.88 million interest payment it owes for $300 million of offshore U.S. dollar-denominated bonds, the state-owned company told us.

The company said overseas investors will soon receive the payment, which had been delayed in the first default of its kind in more than 20 years. The company in the interior Qinghai province previously had also made late payment on a domestic note due Monday.

Insurance /

Chinese insurers made accountable for sales partners’ abuses

China’s insurance regulator ordered insurance companies to strengthen supervision of their intermediary partners such as agents and brokers in an effort to impose order on a chaotic and largely unregulated sector of the industry.

The China Banking and Insurance Regulatory Commission in a notice Tuesday made clear that insurers will be held accountable for any wrongdoing by insurance intermediaries with which they have signed agency and collaboration agreements. Unbalanced regional development and vicious competition have led to a scattered and unregulated insurance intermediary sector that is rife with violations and shady practices, according to market participants.

Quick hits /

• Will Kim’s trip to Vietnam nudge North Korea toward reform?

• Investment growth seen weakening after a strong start to 2019

• China's economy sees first signs of pickup, earliest gauges show (Bloomberg)

• China's sovereign bond rally falters as barrage of threats loom (Bloomberg)

• Chinese miner eyes Congo potential in bid for Australian copper producer (FT)

• State-owned giants in campaign to pay off bills to private companies

• Citic Bank gets new chief

• Opinion: China’s stock investors need to calm down

BUSINESS & TECH

|

Intel banners at the Mobile World Congress this week in Barcelona. Photo: VCG |

5G /

Intel chip tie-up becomes latest victim of U.S.-China tensions

Just a year after hailing the tie-up’s formation, Intel has officially killed its chip deal with Unisoc in the high-speed modem space. Unisoc is part of the larger Unigroup, which is connected to China’s prestigious Tsinghua University and has been one of the nation’s most aggressive acquirers and developers of new technology.

Intel recently decided to end the partnership, Robert Topol, general manager of Intel's 5G Strategy and Program Office, told Nikkei Asian Review at a major telecom show in Spain this week. Intel insisted it hadn’t scrapped the partnership because of political pressure from Washington, though unnamed sources told Nikkei that recent tensions between Beijing and Washington were a factor.

M&A /

Anta Sports receives green light for foreign acquisition

Anta Sports Products Ltd. is set to close a $5.2 billion takeover offer for Finland’s Amer Sports OYJ earlier than expected, as China’s largest sportswear company reports record annual net profits.

Regulatory hurdles were expected to hold up the deal, which an Anta-led consortium offered in September, until as late as May. But they have now been cleared, and a vote of shareholders is expected March 7, an Anta spokesperson told us.

Selloffs /

Debt-mired China Mingsheng Investment sheds property shares

Cash-strapped private investment conglomerate China Minsheng Investment Group (CMIG) has sold off yet another asset, this time half of the 18.04% stake its subsidiary Shanghai Jiawen holds in property developer Yango City Group to building materials company Fujian Jiecheng Trading.

CMIG, which has assets in areas ranging from solar power to real estate and finance, is struggling to pay off an estimated 233 billion yuan ($35 billion) of total debt amid an economic slowdown.

Bioethics /

China proposes high-level scrutiny on gene editing

China’s National Health Commission has released draft regulations proposing more scrutiny of scientific experimentation such as gene editing as well as penalties for rule breakers.

According to the draft regulations, clinical research and biomedical technologies would be classified according to their risk level, with high-risk practices such as gene editing to be supervised by China’s national cabinet, the State Council.

IPO /

China Rail lays groundwork for Beijing-Shanghai IPO

China’s national rail operator has hired an official institutional adviser for the planned public listing of its lucrative Beijing-Shanghai high-speed rail line, aiming to complete supporting work for the IPO by year end.

China Rail Corp. and the China Securities Regulatory Commission posted separate announcements Tuesday related to what could become one of the biggest new domestic listings this year or next. The groundbreaking move would be one of the rail operator’s largest yet to pay down hundreds of billions of dollars in debt built up over the past decade by building the world’s largest high-speed rail network.

Quick hits /

• The Canadian minister who could decide whether Huawei’s Meng Wanzhou goes free

• China approves first biosimilar of foreign drug, breaking Roche monopoly

• China's Horizon Robotics now valued at $3 billion

• Chinese match-making site admits to costly set-up with fake mate

• Evergrande sets up new EV firm following botched Faraday Future investment

• Tencent adds teachers to gaming controls for minors

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas