Charts of the Day: The Bulk E-Retailer Nipping at Alibaba’s Heels

Four-year-old Pinduoduo Inc. is nipping at the heels of China’s largest e-commerce player as traditional rival JD.com Inc. loses momentum.

“Attempts to establish or prolong any monopolistic control are both wasteful and destructive,” Pinduoduo founder and CEO Colin Huang Zheng said last month in his first letter to shareholders since the company listed on the Nasdaq in July. Zheng alleged his rivals force merchants to choose a single platform to promote and sell their goods.

While the 39-year-old entrepreneur didn’t name Alibaba Group Holding Ltd., his broadside was reminiscent of an accusation leveled at Alibaba two years ago by JD.com Chairman Richard Liu.

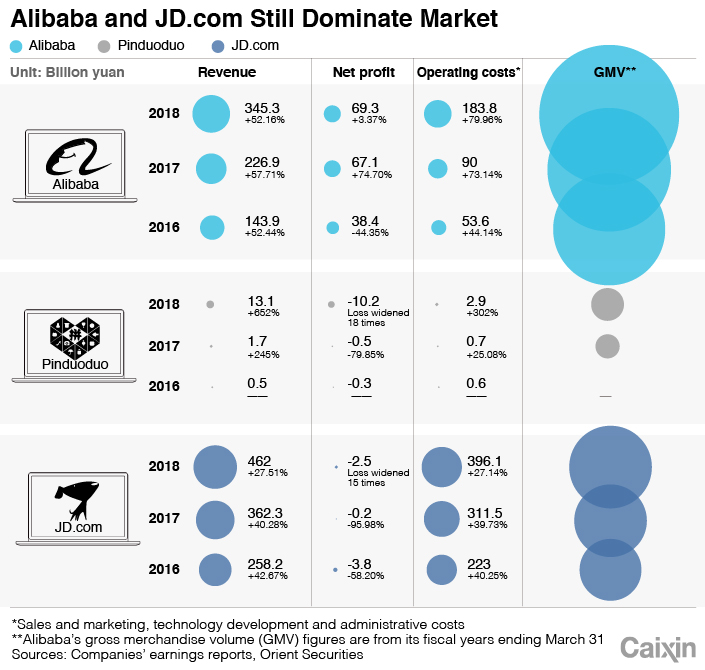

Alibaba has dominated China’s bustling e-commerce market after years of fierce rivalry with JD.com. The pair control a combined 75% of the market, with Alibaba holding 58%. But the rapid rise of four-year-old Pinduoduo Inc. to seize 5.2% is altering the competitive landscape, perhaps to the benefit of consumers.

In just four years, the Shanghai-based newcomer developed into China’s third-largest e-retailer. In 2018, Pinduoduo reported 652% growth in sales to 13 billion yuan ($1.9 billion) with 419 million annual active users, surpassing JD.com and moving closer to Alibaba’s 699 million.

An alarming signal for Alibaba is Pinduoduo’s seemingly great profit potential, which is typically measured by dividing e-retailers’ revenue by their gross merchandise volume (GMV) — the total value of stock sold through the platform. Pinduoduo’s gains from its platform orders/GMV ratio reached 2.78% in 2018, very close to Alibaba’s, according to Founder Securities.

Alibaba has shifted focus from competing with JD.com to battling Pinduoduo, sources said. JD.com’s momentum has weakened after a series of recent setbacks including a U.S. sexual assault scandal that has engulfed its founder.

|

While Alibaba and JD.com have in recent years shifted their focus to higher-end products and consumers, Pinduoduo powered its rise by targeting low-cost products and budget shoppers.

Pinduoduo introduced its “group buying” model, which encourages people to buy in bulk together with friends and relatives to access discounts. However, the company reported surging costs to gain new customers in 2018 as it became harder to lure users from outside its already large customer base. But this cost is still far lower than that for Alibaba and JD.com. Pinduoduo spent 7.7 billion yuan on gaining new users last year, a year-on-year increase of 677%.

This story has been updated to correct a chart that contained revenue, net profit and operating cost data that were all off by one decimal place.

Contact reporter Tang Ziyi (ziyitang@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas