In Depth: Why Tencent Wants a Lift in Corporate Cloud Customers

*Chinese tech giant plans to leverage its huge user base in the consumer market to catch up in the corporate-focused sector

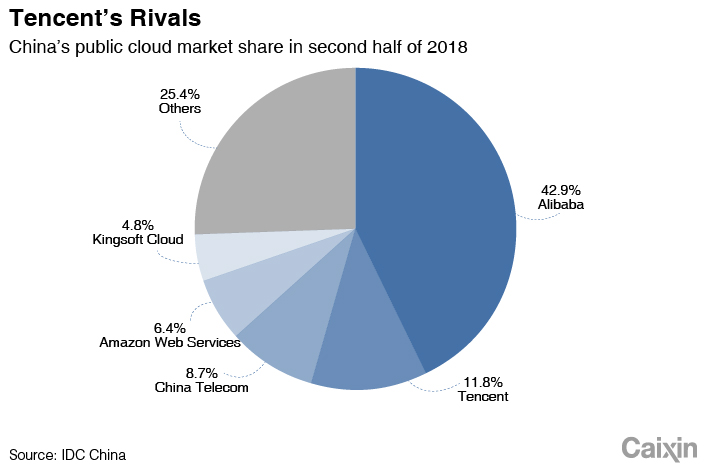

*But company has moved slowly in the cloud market where it owns just a 11.8% share compared with Alibaba’s 42.7%

(Beijing) — At the end of September, with its first across-the-board overhaul in six years, Chinese internet giant Tencent Holdings Ltd. announced a plan to revamp its business structure. It included consolidating several content businesses and creating a new division devoted to cloud computing and data services for corporate customers.

Tencent had been talking about an overhaul since late 2017, when Chairman and CEO Pony Ma said the Shenzhen-based internet company should focus more on business clients. One senior executive told Caixin that Tencent had set its mind on pursuing a major strategy shift from consumer-focused internet to corporate-focused internet, or what was called the “industrial internet.”

“These changes now will be the starting point for the next 20 years of Tencent’s operations,” said Ma, who called the overhaul a “major strategic upgrade.”

The restructure, which will eventually affect the company’s 50,000 employees and at least 30 vice president-level executives, came as Tencent faced growing challenges to maintain its momentum after years of uninterrupted growth. The 19-year-old company posted its first quarterly profit drop in 13 years in the second quarter of 2018 as its core gaming business grappled with increasing government scrutiny.

Tencent said last year it would use the restructure to “further explore the integration of social, content and technology that is more suitable for future trends and promote the upgrade from consumer internet to industrial internet.”

There have been rapid and significant changes in the industrial internet sector and the infrastructure it requires. Cloud computing, artificial intelligence (AI) and their equivalents are not only new technologies, but also new business models. As a latecomer in this competitive sector, questions are being asked about whether Tencent can catch up in the corporate-focused activity of cloud computing. And what aspects of the company need to be changed — from personnel to workflows — for it to achieve its strategic shift?

The company seems to be determined to further build its muscle at a personnel level. Tencent President Martin Lau told a meeting of executives in November that around 10% of management would need to step down in the following 12 months, sources told Caixin.

Lau said the company faced challenges that included consuming internal competition, slackness in innovation, and an overall slowing economy. “Mid-level executives will soon meet this target of 10%,” Lau declared.

The edict doused any prevailing thoughts of lifetime employment that were once common among its top executives.

Under the restructure plan, Tencent merged its social networking, mobile internet and online media divisions into one business group. It created another new group focusing on cloud computing and smart technology, namely the Cloud and Smart Industries Group (CSIG).

The new group was put under the spotlight during a Tencent company showcase six months after the overhaul. On May 21 and 22, president Martin Lau, CSIG chief Dowson Tong, and leaders of the company’s six business groups held a summit in Yunnan to explain the strategy for its roadmap to the so-called industrial internet. The Chinese tech giant said it planned to leverage its huge user base in the consumer market to catch up in the corporate-focused sector.

The “lever” of Tencent Cloud

Tencent’s strengths are in areas like gaming and video while it’s less established in sectors that are now moving online, such as public administration, culture and tourism — but its advantages are distribution and traffic.

For Tencent Cloud’s president Qiu Yuepeng, those will be important in the fight for more corporate clients. The cooperation has always been extensive, Qiu emphasized, in making use of various products and tools developed by Tencent and trying hard to leverage the company’s advantages in the consumer-focused internet.

Government services, for example, have been on a track to “go cyber,” but pushing the public to use them is where local governments lack experience — and where the company hopes to fill the gap.

It is a similar situation in many other sectors, including insurance and banking, which deal with large customer bases. “Those who could offer traffic to these businesses would be good news, and it’s where internet companies can step in to help,” the CEO of another cloud service provider who shares a common client with Tencent told Caixin.

For Qiu, Tencent’s long-running consumer focus will be an advantage in the industrial internet era. Many senior executives at Tencent Cloud, including Qiu, come from the company’s QQ team, Tencent’s most successful instant messenger service in earlier days.

But Qiu is also aware of the differences between the two markets. Corporate clients tend to make decisions in a more professional and rational manner. To win in this market, one “has to sow deep.” Tencent’s cloud business arm has sales teams in all of China’s provinces and works with more than 6,000 corporate clients.

Most of its current clients are linked to consumer-focused sectors such as gaming, video, and e-commerce. Gaming companies, for example, work with Tencent Cloud which connects them to Tencent’s other platforms and products to help marketing and distribution of online games. “Of course, some corporates do not want to go on Tencent Cloud. But they are afraid to lose that traffic,” said the CEO mentioned above.

Another senior executive from a major cloud service provider agreed that Tencent’s strategy to leverage its consumer business to its cloud operations seemed right. But he told Caixin the internet company’s restructuring was not thorough enough. In his view, WeChat is Tencent’s most powerful and resourceful product, with highly valuable corporate resources under its control.

“Almost all corporate clients in China are now already on WeChat,” he said. But WeChat is too independent in its own ecosystem, he said, and has been extra careful with other products, so the effects of collaboration with the most popular mobile product in the country are yet to be tested.”

|

|

Graphic: Gao Baiyu/Caixin |

Besides Alibaba, Tencent Cloud’s rivals in China include China Telecom, Amazon, and other ambitious Chinese tech giants, including Huawei and Baidu. Tencent Cloud’s total revenue in 2018 was 9.1 billion yuan but AliCloud more than doubled that with 21.36 billion yuan. The global champion, Amazon’s cloud computing arm AWS, established six years before AliCloud, took in revenue of $25.66 billion last year.

This story has been updated to use the half-year figures for Alibaba’s share of China’s cloud computing market, in order to be consistent with the accompanying chart. The updated version also corrected the attribution to the quote about some corporations’ ambivalence toward Tencent Cloud. It was not Qiu who said it, but the CEO of another cloud computing company.

Contact reporter Isabelle Li (liyi@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas