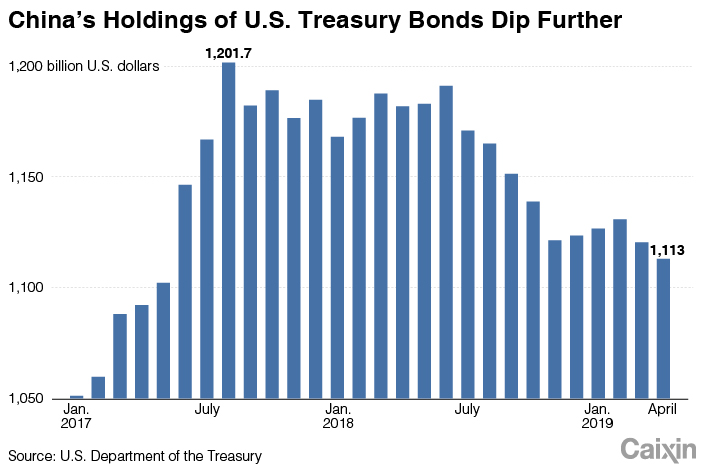

Chart of the Day: China’s U.S. Treasury Holdings Drop to Lowest in Nearly Two Years

China’s holdings of U.S. government debt fell for the second straight month in April, dropping to the lowest level in nearly two years, data released by the U.S. Treasury Department on Monday show.

The hoard slid by $7.5 billion to $1.113 trillion and followed a $10.4 billion decline in March to $1.1205 trillion. China’s holdings are now the lowest since May 2017 when they stood at $1.102 trillion.

|

China is the biggest foreign holder of U.S. government bonds, known as Treasurys, and global markets have become increasingly sensitive to the monthly changes since trade tensions between the world’s two largest economies flared up last year and deteriorated sharply in early May. The concern is that any large-scale selling of U.S. government bonds by China would send prices tumbling, although it could reduce the value of China’s remaining holdings. That could result in yield on the debt rising, making it more expensive for the government to borrow.

But many economists doubt that China would dump U.S. government debt.

“Despite an increasingly hawkish stance, Beijing will most likely remain pragmatic,” economists with Nomura International said in a note on June 4. They said significant selling of government debt “is unlikely, as falling U.S. Treasury prices would also be a loss for China. However, a less aggressive option for China might be to reduce its purchases of additional U.S. Treasuries.”

Julian Evans-Pritchard, a Singapore-based economist with research firm Capital Economics, said any major selling would also put pressure on the Chinese currency, the yuan, also known as the renminbi.

“The size of the PBOC (People’s Bank of China)’s foreign exchange reserves are determined by its exchange rate policy and it can’t run down those reserves without putting upward pressure on the value of the renminbi,” Evans-Pritchard said in a note in May. “Any damage that China inflicts on the U.S. from shrinking its foreign exchange reserves would come at the expense of China’s export competitiveness.”

China funds its purchases of U.S. Treasurys with its foreign exchange reserves, which peaked at almost $4 trillion in June 2014, but fell to just under $3 trillion in January 2017 and have since hovered between $3 trillion and just under $3.2 trillion.

Contact reporter Liu Jiefei (jiefeiliu@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas