China’s New Shipbuilding Giant to Challenge Global Leader After Blockbuster Merger

After two decades of charting separate courses, China’s two state-owned shipbuilding heavyweights look set to join wakes once more as part of the government’s drive to consolidate the state sector.

Subsidiaries of China State Shipbuilding Corp. Ltd. (CSSC) announced in various filings that their parent is planning a restructuring that will result in its merger with China Shipbuilding Industry Corp. (CSIC). The announcement was made on July 1 — 20 years to the day that the two companies said they would split.

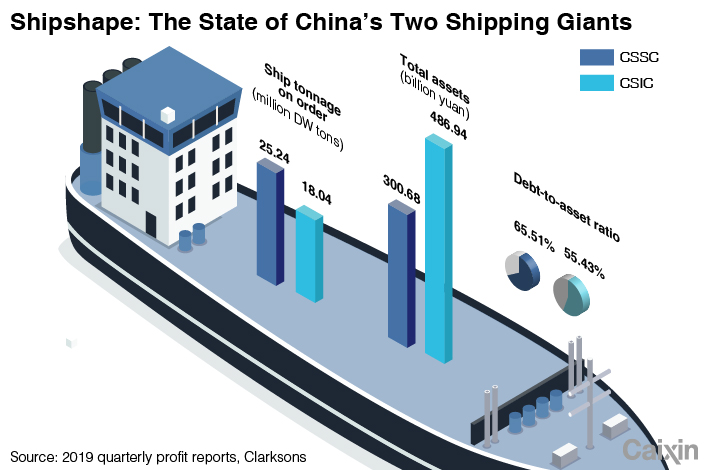

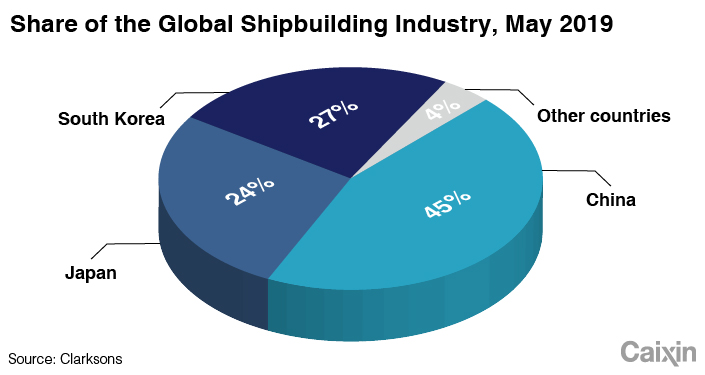

The pair’s shipbuilding empires accounted for 49% of shipbuilding or repair work orders from Chinese companies last year, and 20.85% of orders globally, according to a Caixin credit report. With CSSC assets worth 300.68 billion yuan ($43.71 billion) and CSIC holding 486.945 billion yuan of assets, the recombined company would control almost 800 billion yuan of assets.

This heft would make it a serious challenger to the current No. 1 shipbuilder, Hyundai Heavy Industries Holdings Co. Ltd., after the South Korean rival signed a deal to acquire fellow giant Daewoo Shipbuilding & Marine Engineering Co. Ltd. in March.

The global shipbuilding industry remains muddled in a major downturn, with the International Chamber of Shipping saying earlier this year that overcapacity and a fall in freight transport continues to blight shipbuilders more than a decade after the 2008 global financial crisis plunged global shipping into disarray.

|

Last year continued to be challenging for China’s shipbuilders, with total industry revenues and profits reaching 325.65 billion yuan and 4.5 billion yuan, respectively down 30.8% and 23.5% from a year earlier, according to the China Shipbuilding Industry Association. New orders also fell by 40%.

Industry experts believe that the merger will allow the two giants to focus on meeting relatively higher demand in the fuel transport segment, such as for vessels carrying liquefied-natural gas (LNG) and liquefied petroleum gas, which are also higher-value.

So far, Chinese companies have been losing out to South Korean rivals in meeting the demand, with Korean builders proving more efficient, meeting LNG ship orders in 20 months, while those from shipyards in eastern China have taken more than 30 months, according to Clarksons, a data provider. While South Korean shipbuilders received 65 orders for large LNG vessels last year, Chinese shipping companies did not receive any, according to Clarksons data.

|

Long in the works

While the two shipbuilders were split 20 years ago, there has been effort since at least 2015 to bring them together as part of a wider government effort to consolidate the state sector, build stronger state champions and to undo what many in the industry saw as needless duplication.

While there has been a lot of movement in terms of executives between the companies, a major challenge has been getting to the companies to agree on the shape reorganization would take. Another challenge has been that planned changes have needed approval from the Chinese navy, given that both conglomerates build ships for military use.

A 2016 order from the State-owned Assets Supervision and Administration Commission (SASAC), the government body in charge of China’s largest state-owned enterprises, for the companies to draw up firmer plans for the merger, put some wind in the sails of reform, with both companies moving to consolidate their subsidiaries and several debt-to-equity swaps in a move to reduce problematic debt on their books.

A military industry analyst believes that restructuring of the companies may take place in three steps, with the first being to sort employees and departments into matching areas. The second will be to implement movement between those, and the third will relate to re-sorting listed companies between the groups. “At present, the first step is the most urgent, with there being no timetable for the second and third steps,” he said.

|

China Shipbuilding Industry Corp.'s shipyard in Dalian, Liaoning province on April 26, 2018. Photo: VCG |

A more recent spur for consolidation has come from changes in the global shipbuilding industry, particularly after South Korea’s two leading shipbuilders announced their merger plans earlier in the year. The South Korean government has issued several industrial policies designed to phase out excess capacity and to provide financial and technical support to its shipbuilders as they navigate troubled waters.

The merger of CSSC and CSIC may not be the last in China’s shipping sector, with China Merchants Industry Holdings Co. Ltd., China International Marine Containers Group Co. Ltd. and AVIC International Holding Corp. all in talks on a strategic merger, multiple sources told Caixin earlier this month.

It follows substantial consolidation in other sectors where the state dominates. Shenhua Group and China Guodian Corp. merged in 2017 to create the world’s largest power utility, followed by the union of chemical giants China National Chemical Corp. Ltd. and Sinochem Group Co. Ltd. in 2018.

Contact reporter David Kirton (davidkirton@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 4Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas