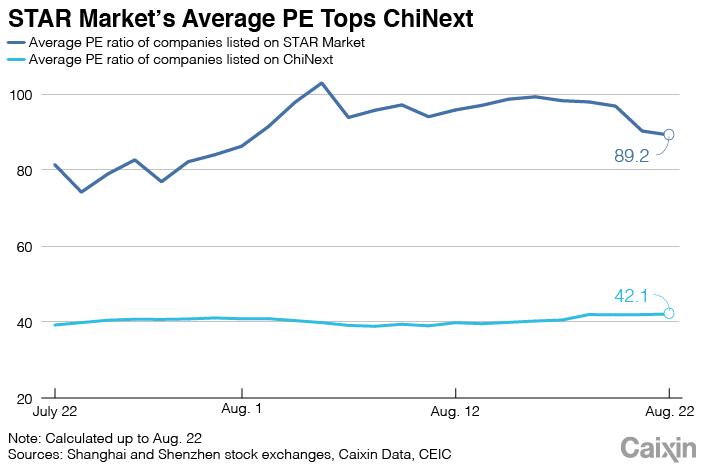

Charts of the Day: One Month On, Shanghai Tech Board’s Average PE Ratio is Still Sky High

Shanghai’s new tech board, dubbed the STAR Market, has been up and running for a month since it started trading on July 22, and investors generally remain enthusiastic.

|

On Thursday, the board’s average price-to-earnings (PE) ratio was nearly 90, much higher than the ratio of 42 on Shenzhen’s ChiNext board, which mostly hosts tech companies, according to data from the Shanghai and Shenzhen stock exchanges. Tech companies usually have higher PE ratios, as investors usually bet on them based on expected future growth rather than past performance.

|

In its first month of trading, the STAR Market’s turnover totaled nearly 600 billion yuan ($84.6 billion), accounting for about 15.7% of the Shanghai stock market’s total turnover, data from the Shanghai bourse show.

The new tech board’s average turnover rate seems to have stabilized, falling to between 10% and 15%, a significant drop from 78% on the board’s first trading day. Nearly 40% of investors qualified to invest on the board did so in the first month of trading, data show (link in Chinese).

On Tuesday, the STAR Market’s outstanding margin financing balance totaled 3.3 billion yuan, while the securities lending balance totaled 2.7 billion yuan, data show (link in Chinese).

Shanghai’s high-tech board is the first on the Chinese mainland to trial a registration-based IPO system, and has abolished an unofficial cap on the PE ratio imposed on listing candidates — the upper limit has been set at 23 since early 2014 and is informally enforced through “window guidance” to companies seeking a listing on other boards and their sponsors. The aim of the change is to let investors and the market decide on the price of shares, as in some other countries, rather than the regulators.

Read more

In Depth: China’s New Tech Board Takes Off for Long-Term Mission

China Securities Regulatory Commission Chairman Yi Huiman said in June that the registration-based IPO mechanism might result in more-frequent delistings and higher IPO prices. Yet investors still showed great interest in the board even before it started trading, with some IPOs oversubscribed more than 300 times.

Contact reporter Timmy Shen (hongmingshen@caixin.com, Twitter: @timmyhmshen)

- 1Cover Story: How China’s Growing Gig Economy Has Left a Generation Adrift

- 2In Depth: China’s Sweeping Banking Law Rewrite Targets Hidden Risks

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Luckin-Backer Centurium Capital to Buy Blue Bottle Coffee From Nestlé

- 5In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas