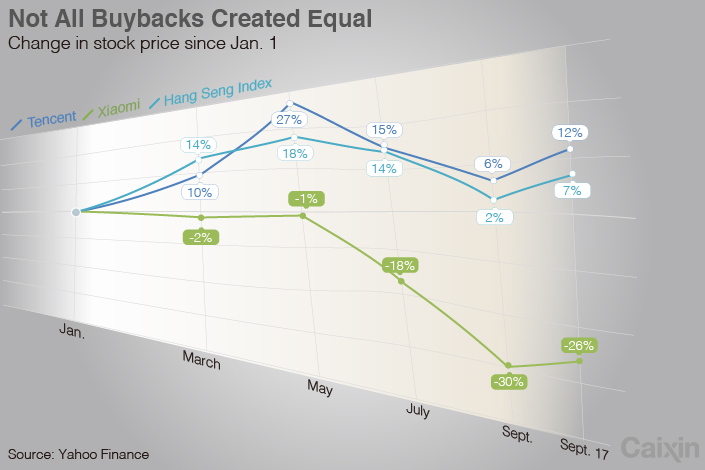

Chart of the Day: Buybacks Don’t Guarantee Stock Price Boost

Two of China’s leading high-tech firms are continuing share repurchase programs launched over the last year, according to announcements from gaming giant Tencent Holdings Ltd. and smartphone-maker Xiaomi Corp. Companies typically launch such plans when their stock comes under pressure, hoping investors will follow their lead and buy the shares.

Tencent was under pressure for much of last year after the government stopped approving new online game titles that are its largest revenue source. That prompted it to launch its first buyback in four years last September. Xiaomi launched its own buyback at the start of this year after coming under pressure from dropping sales in its home China market.

|

New disclosures from both companies revealed they are still in the market buying shares. One of those on Monday from Tencent revealed it has bought back its own stock over the last 15 trading days through Tuesday. A similar Xiaomi disclosure said the company’s board met on Sept. 2 and “formally resolved to utilize” its buyback plan, which authorizes the repurchase of up to HK$12 billion ($1.5 billion) worth of Xiaomi stock.

China’s regulator resumed approving new game titles at the end of last year, and Tencent’s shares have stabilized since then and the stock is now about 10% higher from where it was when the buyback began. But Xiaomi stock hasn’t fared as well. Third-party data showed the company’s China smartphone shipments plunged 20% in this year’s second quarter, and its stock now trades about 10% below where it stood when it first launched its plan.

Contact reporter Yang Ge (geyang@caixin.com; twitter: @youngchinabiz)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas