Tax Cuts Boosted Growth, but Put Pressure on Government Revenue, Finance Minister Says

Tax and fee cuts will likely boost GDP growth by 0.8 percentage points this year, but have put significant pressure on fiscal revenue in some places, China’s Minister of Finance Liu Kun said on Wednesday.

This year, the Chinese government cut income tax and value-added tax (VAT), as well as other taxes, and reduced the premium firms pay for their staff’s pension insurance. From January to October, the state reduced tax and fee burdens by 1.97 trillion yuan ($281.5 billion), and cuts for the whole year are likely to surpass 2 trillion yuan, accounting for over 2% of the annual GDP, Liu said in a report (link in Chinese) delivered to lawmakers on behalf of the State Council, China’s cabinet.

The cuts are estimated to contribute 0.5 percentage points to fixed-asset investment growth and 1.1 percentage points to retail sales growth, he said, adding that businesses and the public widely say “tax and fee cuts this year have exceeded expectations.”

While the new VAT cut saved manufacturers and wholesalers 459.9 billion yuan between its April implementation and October, profits of manufacturers with annual revenues from main businesses above 20 million yuan fell 4.9% year-on-year in the first ten months of the year, according to data from Liu’s report and the National Bureau of Statistics (link in Chinese). The profit decline was mainly due to factors such as falling industrial product prices and slowing production and sales growth, Zhu Hong, a senior statistician of the statistics bureau, said in a statement (link in Chinese).

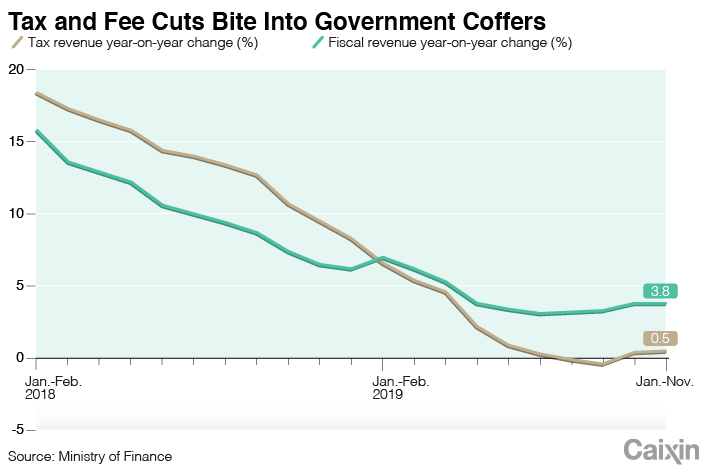

Liu also warned that tax and fee cuts have bitten into government revenue and social insurance fund revenue in some regions. Data from the Ministry of Finance show that fiscal revenue rose 3.8% year-on-year in the first 11 months of this year, down 2.7 percentage points year-on-year; and tax revenue grew only 0.5% year-on-year, down substantially from 9.5% growth over the same period last year.

|

Local governments have been scrambling to supplement the loss with other revenue sources, such as selling state-owned assets and creaming off more profits from state-owned enterprises. Finance ministry data show that nontax revenue jumped 25.4% year-on-year in the first 11 months, up from a 9.1% decline over the same period in 2018. Liu cautioned, however, that authorities should prevent local governments from collecting arbitrary fines and fees to raise funds.

Liu promised to fully implement the current tax and fee cut plan and strengthen fiscal management to offset the reduction in revenue.

The deck headline in a previous version of this story conflated industrial profits with the profits of major manufacturers.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com)

Caixin Global has officially launched Caixin CEIC Mobile, a mobile-only version of a world-class platform for macroeconomic and microeconomic data.

From now on, all users can enjoy a one-month free trial on the Caixin App through December 2019. If you’re using our App, click here. If you haven’t downloaded the App, click here.