China’s Services Sector Hasn’t Shrunk This Much in 14 Years, Caixin PMI Shows

China’s services sector contracted at the steepest pace in more than 14 years in February, as the gauges for total new businesses and employment plummeted to record lows amid the coronavirus outbreak, a Caixin-sponsored survey showed Wednesday.

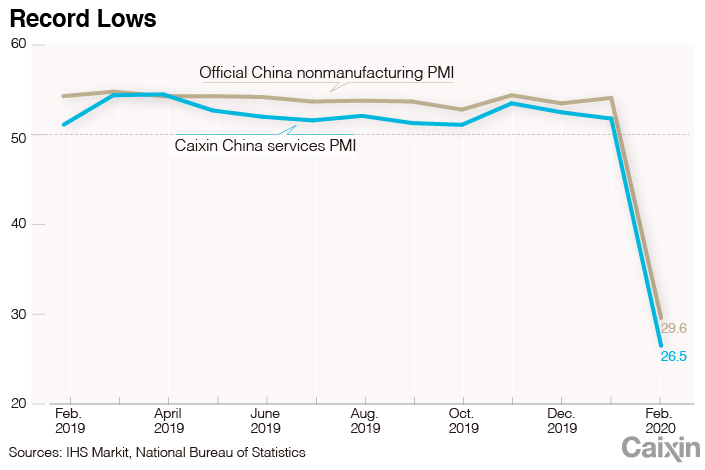

The Caixin China General Services Business Activity Index, which gives an independent snapshot of operating conditions in the services sector, fell to 26.5 in February from 51.8 in the previous month. The February reading was the lowest since the survey began in November 2005. A number above 50 indicates an expansion in activity, while a figure below that points to a contraction.

The reading follows a sharp decline in the Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which fell to a record low of 40.3 in February. The Caixin China Composite Output Index, which covers both manufacturing and service companies, tumbled to an all-time low of 27.5 in February from 51.9 the previous month.

|

The services PMI survey of roughly 400 companies in the sector was carried out from Feb. 12 to Feb. 21. The majority of surveyed companies identified the coronavirus outbreak as the key driver of reduced services activity.

Government efforts to contain the epidemic include restricting transportation and the movement of people in many cities across the country, disrupting business operations.

Read more

Caixin’s coverage of the new coronavirus

Demand for services softened both at home and abroad. The gauges for total new business and new export business both plunged into contractionary territory in February, falling to their lowest levels on record, the survey showed. Some firms attributed flagging overseas demand to client cancellations and travel restrictions.

The measure for employment across the services sector also fell into negative territory and dropped to its lowest-ever reading in February. Travel restrictions amid the outbreak resulted in many services firms being unable to fill roles, according to the survey.

The gauge for backlogs of work at service enterprises surged to a record high in February due to the decline in availability of workers and company closures, the survey said.

The gauge for service companies’ business expectations, which indicates how optimistic or pessimistic they are about the business outlook for the coming 12 months, also dropped to a record low last month despite remaining in positive territory.

“The coronavirus epidemic has obviously impacted China’s economy,” said Zhong Zhengsheng, director of macroeconomic analysis at CEBM Group, a subsidiary of Caixin Insight Group Ltd. “It is necessary to pay attention to the divergence of business sentiment between the manufacturing and the service sectors. While recent supportive policies for manufacturing, small businesses and industries heavily affected by the epidemic have had a more obvious effect on the manufacturing sector, it is more difficult for service companies to make up their cash flow losses.”

Recently, Chinese authorities have lowered interest rates and cut fees and taxes for businesses on the frontlines of the fight against the coronavirus to help them survive the epidemic. Some economists forecast that the manufacturing sector may recover more quickly and easily than the services sector, as it’s easier for manufacturing to match output to demand. The services sector, however, will have limited capacity to offset lost business in the short term.

China’s official nonmanufacturing PMI, which covers the services and construction sectors, fell to 29.6 (link in Chinese) in February, marking the weakest level since the survey began in 2005, according to data released Saturday by the National Bureau of Statistics. The Caixin services PMI survey does not include the construction sector.

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editor Gavin Cross (gavincross@caixin.com)

Read more about Caixin’s economic indexes.

Caixin Global has launched Caixin CEIC Mobile, the mobile-only version of its world-class macroeconomic data platform.

If you’re using the Caixin app, please click here. If you haven’t downloaded the app, please click here.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas