China Business Digest: Beijing Investigates Luckin Coffee; Alibaba Demotes E-Commerce Chief Plagued by Rumors of Affair

|

|

China Business Digest aims to provide readers with a quick daily rundown of the top China business and finance stories, plus whatever is driving markets for the day. Please let us know if you have any feedback.

The coronavirus pandemic continues to take a toll on China’s industrial profits, which tumbled by more than a third in March. Meanwhile, Chinese authorities are investigating Luckin Coffee after the company admitted to financial fraud. Alibaba said it has demoted its e-commerce chief Jiang Fan after looking into allegations of improper behavior.

— By Tang Ziyi (ziyitang@caixin.com)

** ON THE CORONAVIRUS

Wuhan says its hospitals are clear of all Covid-19 cases

The Central China city of Wuhan, where the coronavirus was first reported, had no remaining cases in its hospitals (link in Chinese) on Sunday, government data showed. The milestone comes less than three weeks after Wuhan lifted its unprecedented 76-day lockdown to control the virus. All the other cities in Hubei, where Wuhan is located, also reported zero remaining cases in hospitals.

On Sunday, the Chinese mainland reported three new cases of the virus (link in Chinese), including two imported cases, according to the country’s top health commission.

China loosens restrictions on medical supplies exports

Chinese authorities said (link in Chinese) domestic firms would no longer need regulatory approval before exporting certain medical supplies, including coronavirus test kits, face masks, protective suits and ventilators. The new rule, which took effect Sunday, allows such products to be exported as long as they are recognized by or have registered in importing countries.

Previously, Beijing had banned the export of medical supplies that do not meet its own standards, as the poor quality of some good exported from China sparked controversies in several virus-stricken countries.

China exported 55 billion yuan ($7.8 billion) worth of products used for epidemic prevention from March 1 and April 25, official data show (link in Chinese).

Other virus news

• Members of the standing committee of the National People’s Congress (NPC), China’s top legislature, met Sunday to talk about when to hold this year’s annual meeting of the NPC. The meeting, which is usually held in March, was postponed due to the coronavirus outbreak.

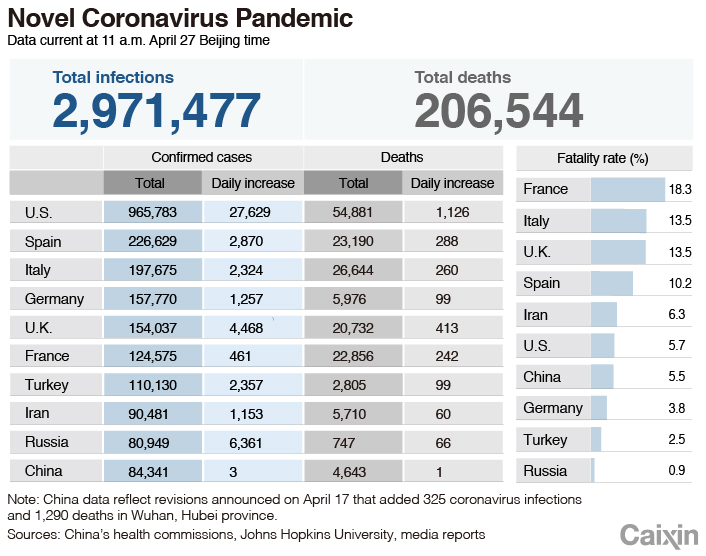

• As of Monday evening Beijing time, global cases surpassed 2.9 million, with the total death toll at more than 200,000. The U.S. had more than 965,000 cases, including over 54,000 deaths.

• Italy’s Prime Minister Giuseppe Conte announced Sunday that the government will loosen the country’s nationwide lockdown (link in Italian) starting May 4.

• U.K. Prime Minister Boris Johnson returned to work on Monday and said that it’s too soon to loosen the lockdown as it would risk a second major outbreak in the country. (Reuters)

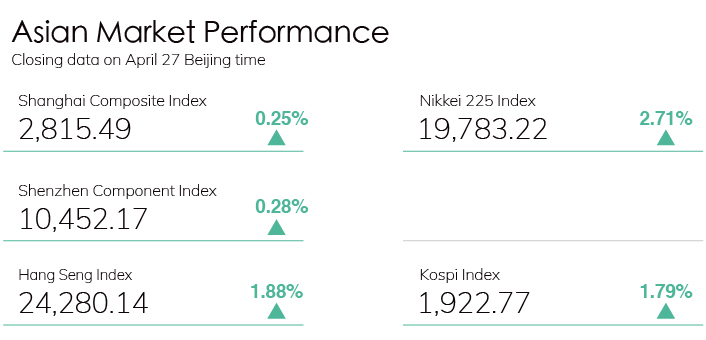

• Japan’s central bank on Monday said it would ramp up purchases of corporate and government bonds as it further eased monetary policy to support the virus-stricken economy.

Read more

Caixin’s coverage of the new coronavirus

** TOP STORIES OF THE DAY

China’s industrial profits plunge in March

Profits of China’s large and midsize industrial enterprises fell 34.9% year-on-year (link in Chinese) in March, official data showed Monday.

The figure recovered slightly from a 38.3% decline in the first two months this year. The data only cover enterprises with annual main-business revenue of 20 million yuan or more.

Chinese regulators launch probe into Luckin

China’s securities and market regulators have opened a probe into Luckin Coffee, the U.S.-listed coffee chain that admitted to an enormous financial fraud earlier this month.

Officials from the market regulator visited Luckin’s Beijing headquarters on Sunday morning and reviewed documents and questioned employees until the evening, a source at Luckin told Caixin.

Luckin issued a statement Monday afternoon saying it was cooperating with the investigation, and that its stores continued to operate normally.

Alibaba demotes e-commerce chief after rumors of affair

Alibaba on Monday demoted its e-commerce chief, Jiang Fan, after an investigation into allegations of improper behavior.

Jiang, who has overseen Alibaba’s major e-commerce platforms Tmall and Taobao since early 2019, has been demoted to vice president from senior vice president, according to an internal company document viewed by Caixin.

Investors may have lost 10 billion yuan from Bank of China’s crude investment products

About 60,000 clients of Bank of China, one of the country’s largest state-owned lenders, were trying to buy on a dip in crude prices using a paper investment product known as Yuan You Bao, sources with knowledge of the situation told Caixin.

The investors have lost a total of 4.2 billion yuan from their margin deposit accounts, the sources said. Based on the settlement price after the April 20 collapse in oil prices, the investors also owed 5.8 billion yuan to the bank on top of losses from their initial investments. (Read our in-depth coverage here.)

ChiNext Launches Registration-Based IPO System

China’s Nasdaq-style ChiNext board is officially launching a widely expected trial of a registration-based initial public offering (IPO) system and allowing money-losing startups to list on the board.

The China Securities Regulatory Commission (CSRC) and the Shenzhen Stock Exchange issued supporting rules Monday related to ChiNext’s move to a registration-based IPO mechanism and started soliciting public opinions on the rules.

A registration-based IPO mechanism is more market-oriented than the approval-based system, under which the CSRC vets every application, and approvals can take months or even years. Currently registration-based IPOs are allowed only on the Shanghai Stock Exchange’s high-tech STAR Market, a competitor to Shenzhen’s ChiNext.

China’s Biggest Bank Halts Retail Products in Commodities

Industrial & Commercial Bank of China Ltd., the nation’s largest lender, suspended sales of more products that enable retail investors to speculate on swings in commodities after many were burned by the unprecedented crash in crude oil.

The lender will temporarily halt opening of new positions in products linked to crude oil, natural gas and soybeans for individuals as of 9 a.m. tomorrow, according to a statement issued Monday. ICBC said the suspension is to protect clients’ interests amid recent volatility in commodities. The measures will not affect trading of existing positions, ICBC said in its statement.

|

** OTHER STORIES MAKING THE HEADLINES

• Dangdang Inc. co-founder Li Guoqing allegedly broke into the Chinese e-commerce company’s Beijing office Sunday and pasted notices on the walls claiming he had replaced his co-founder and estranged wife Peggy Yu as the company’s CEO.

Dangdang later said the company had informed police of the incident and canceled company seals that were taken during the alleged break-in.

• Authorities have finished allocating an additional 1 trillion yuan (link in Chinese) in special-purpose bond quotas to local governments, Caixin has learned.

• The number of functioning P2P platforms in China had fallen to 139 by March 31, down 86% from the beginning of 2019, official data show.

• Citic Trust Co. Ltd. reported a net profit of 3.6 billion yuan (link in Chinese) on revenue of 7.2 billion yuan in 2019. Both figures marked the highest in the domestic trust industry.

** AND FINALLY

China has become one of the few bright spots for luxury goods sellers in recent weeks as the country slowly emerges from its Covid-19 lockdown. Many brands like Louis Vuitton and Gucci have been able to reopen their stores there. Meanwhile, the world’s top retailers continue to suffer from continued closures in their other major markets.

|

** LOOKING AHEAD

April 30: Caixin China manufacturing PMI

May 7: Caixin China services PMI

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editors Yang Ge (geyang@caixin.com) and Michael Bellart (michaelbellart@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas