In Depth: CATL Loses Electric-Car Battery Crown as Foreign Firms Muscle In

Contemporary Amperex Technology Co. Ltd. (CATL) has seen its spark fade this year, losing its position as the world’s No. 1 electric-car battery producer after foreign rivals started to take a share of the country’s massive market.

CATL’s luck has turned amid changes to China’s industrial policies, which helped the company’s rapid rise to the top in the first place.

Founded in 2011, CATL grew into an electric-car battery giant largely by piggybacking on government policies, including a de facto ban on foreign firms selling their batteries in China. It has also been one of the major beneficiaries of Beijing’s decade-old subsidy program which helped create China’s entire electric-car industry.

As both have either been cancelled or are set to be phased out, the Fujian province-based company is now facing competition from overseas on top of its domestic competitors, such as BYD Co. Ltd.

As Beijing moved to phase out subsidies, the whole industry has taken a hit. In May, total sales of new-energy vehicles in China amounted to 70,200 units, representing a year-on-year drop of 25.8%, according to China Passenger Car Association. Sales of new-energy cars will drop 14% this year to fewer than 1 million units, according to BloombergNEF.

|

No safety net

CATL’s real challenge came in June last year, when a government list of recommended battery suppliers was abolished, clearing the way for foreign companies to enter the Chinese market.

The list, which included only domestic firms, was widely criticized as protectionist when it was introduced in 2015.

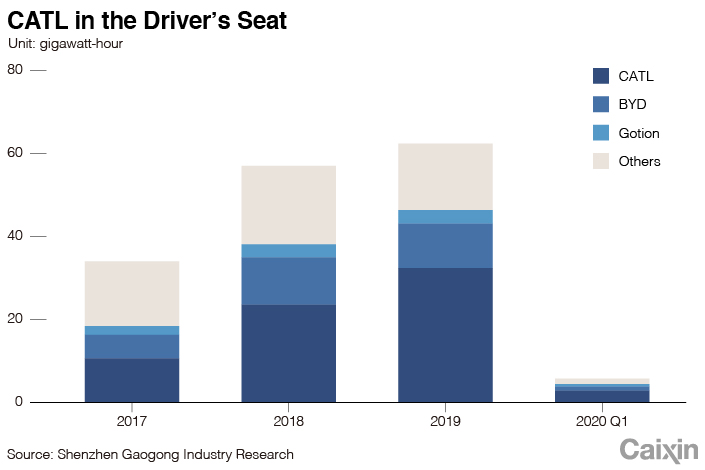

Without foreign competition, CATL quickly developed into the dominant battery supplier in China, where most of the world’s electric cars have been sold since 2015. By 2017, CATL took the world No.1 battery-maker spot for the first time, unseating long-established rivals, including LG Chem Ltd. and Samsung SDI Co. Ltd.

A few days after it said the recommended list would be scrapped, the Chinese government started to significantly slash the subsidies it had offered to the sector since at least 2010, with an eye on eventually getting rid of them completely.

Though CATL, which was listed in Shenzhen since June 2018, has never revealed the contribution subsidies have made to its bottom line, analysts believe the incentives play a major role in its relatively high profit margin compared to its non-Chinese rivals.

CATL’s margin has been generally over 10% in recent years, compared to around 5% for firms such as South Korea’s LG Chem and Samsung SDI, and Japan’s Panasonic, according to a research note from Caitong Securities.

Tesla effect

Foreign companies have anticipated these policy shifts and have invested in the Chinese market in preparation.

One of them – LG Chem– saw a major breakthrough early this year when it was selected by electric-car maker Tesla Inc. to supply batteries for vehicles at the U.S. company’s new Shanghai factory, which began production in January.

Tesla’s share of China’s electric car market has climbed rapidly. In May, it delivered more than 10,000 units in China, becoming the largest electric car seller in the country, the second time a foreign firm has achieved that spot.

The brisk sales of Tesla cars in China helped LG Chem and Panasonic to quickly climb the ladder. In June, both companies were included in the list of top 10 largest electric car battery suppliers in China for the first time. Globally, LG Chem and Panasonic surpassed CATL to become the first and second largest sellers of such batteries, according to data from industry groups

In the first four months, LG Chem’s battery sales jumped 91% from a year ago for a global market share of 25.5%, according to data from SNE Research. Panasonic came in second with 22.9%, followed by CATL with 21%.

CATL had also been selected as Tesla’s battery partner. In February, the Chinese company disclosed that it had won a two-year contract to supply batteries to Tesla. However, Caixin learned from sources familiar with the matter that LG Chem had secured a far bigger contract from Tesla than CATL.

In the February announcement, CATL said the contract, which runs from July 1 until June 2022, is a so-called production pricing agreement that is still non-binding, and it is still unclear how many batteries Tesla will buy.

|

New competition dynamic

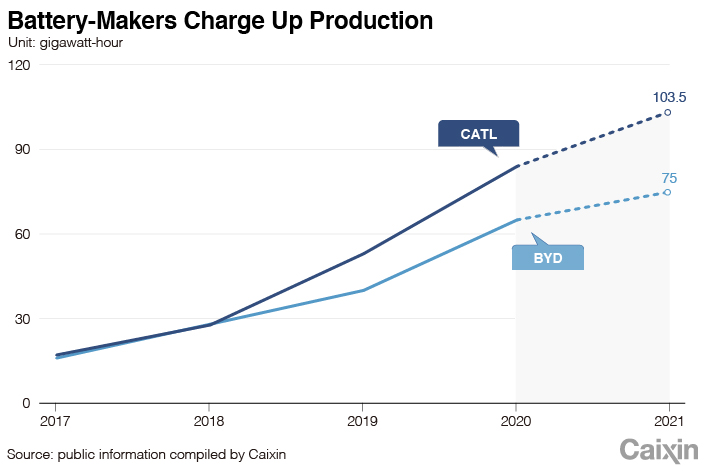

Foreign rivals are not the only competitors CATL is facing. At home, a slew of domestic players have all geared up to eat into CATL’s market share. One of the largest hometown rivals is BYD Co. Ltd., which itself is one of the country’s leading electric-car makers.

BYD previously produced batteries mainly for its own use, but has in recent years attempted to broaden its sources of revenue through greater battery sales to other automakers. Such efforts accelerated in March, when it announced it would spin off its battery business with the goal of listing it in future.

Two other smaller rivals – Gotion High-tech Co. Ltd. and Farasis Energy Gan Zhou Co. Ltd. – have recently ramped up their push. In May, Gotion hit the headlines when German automaker Volkswagen announced that it would take a 26.5% stake in a deal worth 1.1 billion euro ($1.24 billion).

And earlier this month, Farasis Energy said it had reached a deal with German luxury carmaker Daimler AG, which would pay 510 million yuan ($72 million) for a 3% stake.

One advantage CATL still has up its sleeve is its long-term supply contracts with many global automakers. For example, in 2018, CATL reached a deal with BMW Brilliance Automotive Ltd. — the joint venture between BMW Group and its local partner Brilliance China Automotive Holdings Ltd.

As part of the deal, BMW Brilliance agreed to procure from CATL batteries worth more than 800 million yuan. In 2019, the two sides signed another contract, agreeing to increase the value of that order to more than 56 billion yuan in a time frame of 11 years.

Still, sources said such long-term contracts don’t mean that CATL’s partnership with automakers will be secure. CATL will have to guarantee that it can control manufacturing costs, said a manager in charge of an engineering team at a foreign automaker which operates a local venture with CATL.

This story has been updated to correct when the government began slashing subsidies for the electric vehicle industry.

Contact reporter Mo Yelin (yelinmo@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

- PODCAST

- MOST POPULAR