Cover Story: The Losing Game for Chinese Retail Investors

China’s biggest equity boom in years sent the market to a record $10 trillion in value with daily turnover surpassing 1.5 trillion yuan ($214 billion) for days until last week’s plunge. But the majority of investors who fueled the buying spree may not have benefited from it.

Billions of dollars poured into Chinese stocks as foreign and retail investors rushed to catch up with the bull cycle, but a rising force propelling the surge came from domestic high-frequency traders, Caixin learned.

“More traders are engaging in T+0 trading amid the brisk market, and many institutions joined in algorithmic trading that greatly amplified the transaction volume,” a stock trader at a private equity fund said. T+0 trading refers to buying and selling a stock on the same day. Such trading contributed 10% to 20% of overall trading volume, the trader said.

Such trading is allowed in most major markets but not exactly in China. China’s A-share market allows investors to settle stock transactions on the same day, meaning they can use the funds from stock sales to make new purchases the same day. But investors can exit a position only the day after the purchase.

Traders are able to skirt those restrictions now because the recent rise of margin financing allows them to borrow stocks from others and conduct same-day trading, selling and buying the same stock multiple times in one day to gain from price changes instead of buying and holding. Such a trading strategy is well suited to markets with high turnover volume and liquidity like China’s, the private equity trader said.

|

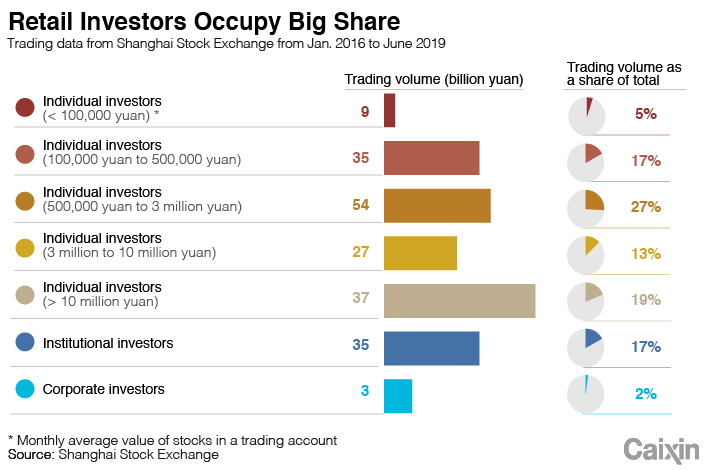

Behind the bustle of China’s stock market are hundreds of millions of amateur investors who have few options for building their savings aside from real estate and stocks. Official data showed that as of June, China had 167 million retail investors, 12% of the total population. They held a combined 1.3 trillion yuan of stocks, or 28.6% of the total market value. However, nearly 80% of them make less than 5,000 yuan ($700) a month, and only 4% of them have more than 500,000 yuan in their stock accounts.

Meanwhile, professional institutional investors held only 17% of the market total, with the remainder owned by corporate shareholders that seldom trade their holdings.

That is in contrast with major markets like the United States where institutional investors account for the lion’s share of the market as individual investors mainly participate through mutual funds and equity-index products.

The large number of small-time investors added volatility and speculative sentiment to the Chinese stock market. This creates profit opportunities for high-frequency traders, which consist mainly of institutional investors with access to stock borrowing and technologies to support algorithmic trading, analysts said. Retail investors, at the same time, are the perfect targets for attack by professional investors, they said.

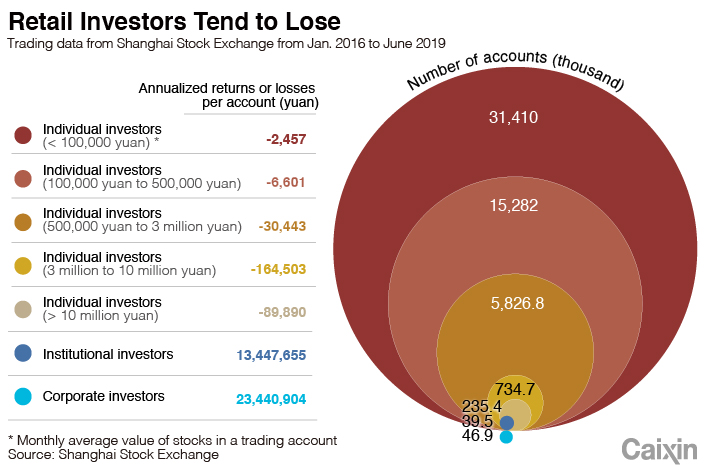

Despite their dominant numbers, retail investors have a poor track record of profiting from China stocks. A study by the Shanghai Stock Exchange found that between January 2016 and June 2019, retail investors booked losses of 1.6% to 20.5% on their stock investments while institutional investors gained 11.22%. Smaller individual investors with less than 100,000 yuan of stock holdings lost an average of 2,457 yuan per year.

Chinese regulators for years have encouraged retail investors to step back from direct trading in the stock market and turn to professional institutions for investments in hopes of altering the structure of the market. But the efforts have so far resulted in few changes.

|

‘More they trade, more they lose’

“Small-time investors hold 21% of China’s stock market value but contributed to over 80% of transactions,” according to a report led by the Shanghai bourse. “With speculative and gambling motion, many of them tend to trade frequently. But the more they trade, the more they lose.”

Young and middle-aged men make up the majority of Chinese retail traders. Their trading decisions mainly follow market trends and often show poor results in stock picking and transaction timing. On most occasions, the stocks they purchased start declining the next day, the report found.

The findings reinforce the common view in China, where retail investors are known as “jiucai,” or chives, because they keep growing only to be harvested by institutions.

“Chinese retail investors are weak in wealth management and can’t achieve the goal of wealth expansion by making stock investment decisions by themselves,” said Zhang Xiaoyan, one of the authors of the report. More education to enhance investors’ understanding of markets and risks as well as introducing institutional investors to help them make investment decisions are the main solutions, Zhang said.

But for a long time, retail investors will continue playing a major role in China’s stock market because of the huge amount of capital they hold, according to a World Economic Forum report issued this month. Their short-term focused investment behaviors will continue adding to market volatility, it found.

Resurgent high-frequency trading

The China market’s high turnover fueled by retail trading makes it a perfect hunting ground for high-frequency traders, a private equity trader said.

In 2019, the average daily turnover on the Shanghai and Shenzhen markets was 514 billion yuan, more than eight times the Hong Kong market’s HK$69.2 billion (62.7 billion yuan). Earlier this month, the Shanghai and Shenzhen markets booked more than 1.5 trillion yuan of daily turnover for nine consecutive trading days, equivalent to the total of the New York Stock Exchange and the Nasdaq stock market. The surge in transaction volume was accompanied by an increase in same-day transactions and high-frequency trading.

High-frequency, algorithmic trading emerged in China since 2012 but became a target of regulatory crackdown after the 2015 stock market meltdown as regulators blamed it for aggravating market volatility. Several algorithmic traders were investigated by regulators, including a local subsidiary of leading market maker Citadel Securities.

But the clampdown didn’t scrap the trading practice as some brokerages borrowed clients’ accounts for frequent, daily transactions.

Last year, regulators moved to ease the restriction on high-frequency trading and margin trading, boosting the revival of the business. The launch of the tech-savvy STAR Market in Shanghai provided a better venue for high-frequency trading.

As long as China’s stock market structure remains unchanged, high-frequency, same-day trading will remain popular, an algorithmic trader said.

In addition to the lack of institutional investors, analysts said the China market’s sole reliance on the call auction mechanism to determine stock prices and inadequate risk hedging tools also undermine stability of the market.

China’s market mechanism encourages margin trading but restrains short selling, causing a market imbalance, said Wu Xiaoling, a former deputy central governor. Meanwhile, stock index futures failed to play enough of a role in risk management, leaving investors with few hedging options for market fluctuation, Wu said.

That means the “market could surge easily but always be followed by a sharp fall,” Wu said.

Luo Meihan contributed to this report.

Contact reporter Han Wei (weihan@caixin.com) and editor Bob Simison (bobsimison@caixin.com)

Caixin Global has launched Caixin CEIC Mobile, the mobile-only version of its world-class macroeconomic data platform.

If you’re using the Caixin app, please click here. If you haven’t downloaded the app, please click here.

Correction: The story is updated to correct that one of the companies investigated by Chinese regulators for high-frequency trading following the 2015 market crash was a subsidiary of Citadel Securities, not Citadel LLC.

- PODCAST

- MOST POPULAR