Caixin Insight: State Council Rolls Out Red Carpet for Chipmakers

PMI update

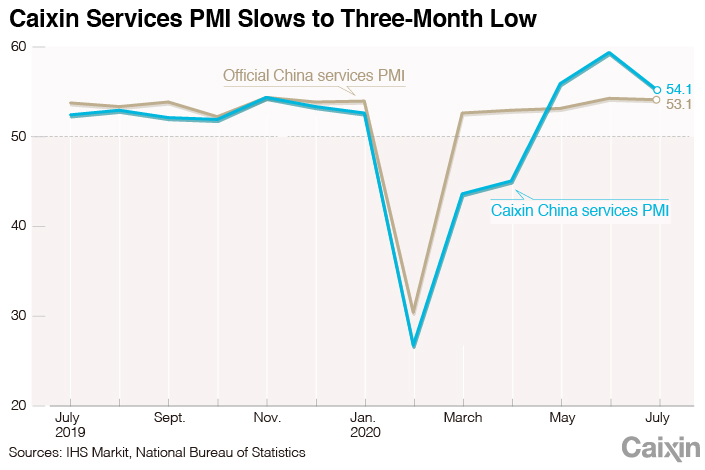

Caixin and National Bureau of Statistics (NBS) PMI data have come out, with manufacturing expanding for the third month in a row despite services performing more poorly than economists anticipated, illustrating China’s uneven recovery from Covid-19 and adding to evidence that the country’s rebound may lose steam in the second half of the year.

Here are the numbers:

- The Caixin China General Services Business Activity Index fell to 54.1 — the weakest reading in three months — from a decade-high of 58.4 in June

- NBS services PMI fell to 53.1 from 53.4 in June

- The Caixin China General Manufacturing Purchasing Managers’ Index rose to 52.8 from 51.2 in June, its highest reading since January 2011

- NBS manufacturing PMI rose to 51.1 in July from 50.9 the previous month

- The Caixin China Composite PMI, which covers both manufacturing and service companies, came in at 54.5, down from 55.7 in June

|

“Given that most economic activity has basically returned to normal, we expect the overall economy to pick up further (assuming there will not be another large-scale domestic outbreak), but the month-on-month rebound is likely to weaken significantly” in the second half of this year, Wang Tao, head of China economic research at UBS Investment Bank AG, wrote in a column (link in Chinese) published Monday.

Chipmakers join the “new nationwide system”

Domestic semiconductor stocks have soared since the State Council issued new rules Tuesday to bolster development of the integrated circuit and software industries, with 15 semiconductor stocks hitting limit up Wednesday morning.

The policy explicitly endorsed chip and software industries as part of the “the new nationwide system for tackling key core technologies” for the first time. The term has been bouncing around since at least last summer, when party journal Qiushi (link in Chinese) explained it as a “unique organizational advantage of the socialist system.” One could also argue that it’s something of a conceptual riff on Made in China 2025.

The new regulation offers chipmakers major benefits including huge tax breaks (zero corporate income tax for those making the most cutting edge chips) and a range of other preferential policies such as a streamlined review procedure for chip and software companies’ domestic listings, strengthened intellectual property rights protection, and more.

Compared with similar policies introduced in 2000 and 2011, the new incentives are more generous and apply to a much broader set of firms, expanding coverage to include IC equipment, materials, packaging and testing enterprises.

PBOC sets agenda for the half-year ahead

The central bank held its midyear meeting on Thursday, setting the agenda for the second half. The main takeaway was that broad-based money supply and social financing will grow at a significantly faster rate than last year. China Finance 40 Forum produced a short digest of more specific key priorities (link in Chinese) including:

- more flexible, moderate, and targeted monetary policy, focusing on implementation of the 1 trillion yuan relending discount policy and the two “direct” monetary policy tools introduced in June

- the two “direct” tools refer to the loan extension support facility for small and micro enterprises, and the small and micro enterprise credit support program (further explanation available here in Chinese)

- accelerating work to address shortcomings in the financial risk management system, and improve the emergency response mechanism for major financial risks

- promote steady, orderly opening up of the financial sector and actively promote yuan internationalization and capital account convertibility

- continue to deepen reform of the financial system

- deepen reform and marketization of rural financial institutions

- further support issuance of capital bonds by small and midsize banks

- actively promote research and development of DCEP and its closed pilot

TikTok sale

The Chinese music video app TikTok is under fire as Trump threatens to shut down its U.S. operations unless a domestic company buys it. Tech giant Microsoft is reported to be in acquisition talks with ByteDance, the parent company of TikTok.

Zhang Yiming, founder and CEO of ByteDance, sent two letters to employees this week to address the potential sale. In the first letter, Zhang said the team had been actively cooperating with the CFIUS investigation and said the company is committed to protecting user data. In the second letter, Zhang blamed an atmosphere of “anti-China sentiment” for the intense scrutiny of his company, and said the Trump administration’s real goal is “a comprehensive ban, or maybe more.”

But despite the duress that ByteDance has been facing, the company is unlikely to evolve to be a battlefield for the two global superpowers. Analysts point out that the social media app does not play a strategically important role in the way that Huawei does as a “national champion.”

Zhou Xuedong tells all

Zhou Xuedong, head of the takeover team for the famously troubled Inner Mongolia-based Baoshang Bank linked to fallen tycoon Xiao Jianhua, wrote a pretty spicy article (link in Chinese) recently calling out the corporate governance failures of small and midsize banks along with the corruption that they enabled.

Zhou said the most outstanding characteristic of the bank’s governance was how different the reality and spirit was from the appearance. “On the surface, the contractor bank had a relatively perfect corporate governance structure,” he said, but it existed in name only, and in reality the bank was controlled entirely by major shareholders and insiders who had captured local regulators, miring the whole operation in corruption and corporate malfeasance.

For those who’ve been reading about all the banking scandals unfolding over the last few years, it’s a super interesting read that provides a lot of detail on how exactly it all happens in practice.

Zhou also provides a handful of suggestions on how to rectify the issues, which were a bit less interesting, and mostly what you’d expect:

- strengthen party leadership and the role of the party secretary

- rationalize and diversify the equity structure

- strengthen external supervision and information disclosure

- cultivate better corporate culture and establish better incentive mechanisms

This story has been updated to correct the fact that Xiao Jianhua’s article was not originally published by Caixin, but just reposted.

Download our app to receive breaking news alerts and read the news on the go.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas