Caixin Insight: Big Week for the Securities Regulator

REITs one step closer to reality

On Friday, the China Securities Regulatory Commission (CSRC) released trial guidelines (link in Chinese) for publicly traded infrastructure securities investment funds, which are China’s version of real estate investment trusts (REITs).

The finalized details are essentially the same as the draft for public comment discussed in this newsletter when the CSRC and National Development and Reform Commission (NDRC) announced the pilot on April 30.

So while there isn’t a lot that’s new, it’s worth taking note of the finalized guidelines as they are an important step towards actual rollout of REITs.

When the initial announcement came on April 30, we wrote “New infrastructure projects like 5G, data centers, smart power grids or even satellite networks have greater revenue generation potential than many traditional infrastructure projects, and are thus well-suited for REIT investment, but we do not yet know whether they will be included in the pilot, as their position is still emerging and somewhat ambiguous.”

While that is still officially the case, as there hasn’t been a public announcement, we are now pretty confident that new infrastructure will be eligible to serve as an underlying asset, and that the initiative may even have helped motivate the policy’s release. One of our analysts wrote in July about a talk given by Xu Xianping, an architect of China’s new infrastructure initiative, which discussed policy tools (link in Chinese) to support new infrastructure and specifically highlighted REITs.

U.S.-China cross-border audit dispute continues

The CSRC responded (link in Chinese) to calls by the U.S. Public Company Accounting Oversight Board (PCAOB) to arrange co-auditing of U.S.-listed Chinese companies on Saturday, saying that “open dialogue and cooperation is the right way to solve the problem,” and highlighting that the CSRC sent an updated proposal to the PCAOB on Aug. 4 based on the latest requirements and ideas from the U.S.

This is pretty much the same line that the CSRC has stuck to since the dispute began, but the statement said “exchange of information including that of audit work papers should be conducted through regulatory cooperation channels,” as opposed to the joint auditing arrangement proposed by the U.S., which is effectively a rejection. However, that doesn’t necessarily mean the CSRC is insincere in saying it wants to cooperate — improving regulation of Chinese companies is also in the CSRC’s interest, but to some extent its hands are tied by the legal framework it’s working in— current Chinese laws and regulations aren’t compatible with the co-auditing process proposed by the U.S.

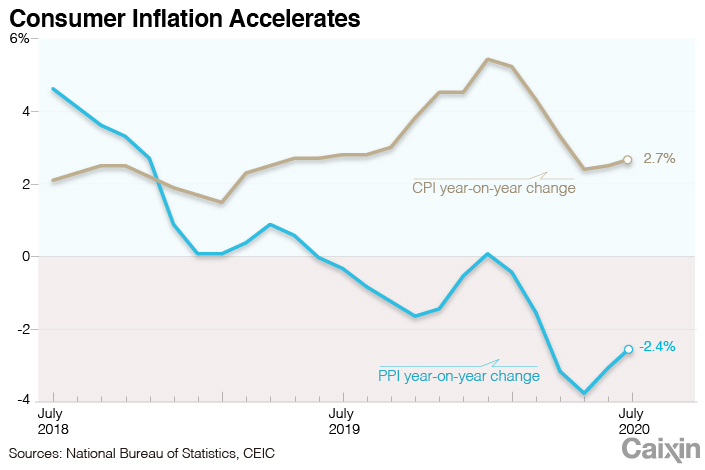

CPI increases as PPI falls

Consumer inflation edged up last month, largely due to an increase in food prices, particularly pork. The meat cost 85.7% more in July than it did a year ago, a bigger increase than June’s 81.6% growth. Vegetables also rose in price, up 7.9% year-on-year, accelerating from a 4.2% increase in June, due primarily to widespread flooding in South China.

Core CPI rose less quickly, up just 0.5% year-on-year in comparison with a 0.9% jump in June. The deceleration in core CPI growth was mainly due to low prices in the services sector amid a slow recovery from the fallout of the Covid-19 pandemic, Wu Jinduo, an analyst at brokerage China Great Wall Securities Co. Ltd., said in a commentary (link in Chinese).

|

The producer price index, on the other hand, fell 2.4% year-on-year in July, moderating from a 3% drop the previous month. The recovery in industrial production as well as market demand, and rising global commodity prices, were behind the PPI’s improvement, according to the official statement. “We expect CPI inflation to resume its downtrend soon in coming months and drop to around 1% at year-end, due mainly to the higher base from surging pork prices, while PPI inflation could rise further in coming months on a global recovery,” Nomura economists wrote in a note.

CSRC proposes dropping rating requirement for exchange-traded bonds

The days of easy money for rating agencies look to be coming to an end.

The CSRC proposed abolishing the mandatory rating requirement for corporate bonds on Friday in a draft policy revision (link in Chinese) released for public comment. The move comes as part of efforts to address the “ratings bubble,” which has drawn attention in recent days as domestic ratings agencies upgraded their assessments of local government bond issuers despite their fiscal income falling dramatically amid the Covid-19 outbreak.

The measure seeks to reduce dependence on external ratings and encourage investors to make more independent judgments, helping bring ratings back to their normal function of revealing risk and promoting more rational pricing of it.

Contact editor Joshua Dummer (joshuadummer@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas