Caixin Insight: New Data, Little New Policy

The direction of policy remains fundamentally unchanged from the last few weeks. Everybody is now waiting for the National People’s Congress, set to convene May 22 after being delayed for months due to the coronavirus. If you’ve been reading our weekly reports, you already know that the main points of anticipation are:

- GDP growth target

- Will it be lowered, turned qualitative rather than quantitative, turned into another metric, or be abandoned?

- Fiscal deficit increase

- How much will it rise, and how much will it go off-balance sheet into special bonds and LGFVs?

- Stimulus package details

- Despite being under discussion for months, China’s stimulus package remains half under wraps, with few concrete details made public; many are hoping for clarity from the Two Sessions

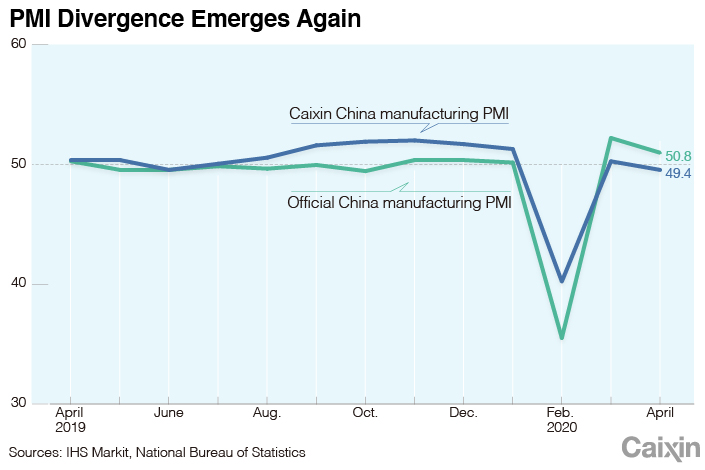

Caixin Manufacturing PMI

- Manufacturing activity fell back into contractionary territory in April with a reading of 49.4, down 0.7 points from March.

- The trend was in line with the National Bureau of Statistics PMI, but the two indexes have diverged somewhat, with the NBS manufacturing PMI standing at 50.8, down 1.2 points from March but still expansionary.

|

- Readings for the two manufacturing PMIs’ subindexes were much the same, with both new export order indexes falling sharply, dragging the new orders index down. Both employment subindexes fell, although the NBS subindex remained expansionary whereas Caixin’s measure remained contractionary.

- While resumption of domestic production continued apace in April, the sharp fall in export orders severely constrained China’s economic recovery, noted Zhong Zhengsheng, director of macroeconomic analysis at CEBM Group, a subsidiary of Caixin Insight Group.

- “Amid the second shockwave from the pandemic, the problems of low business confidence, shrinking employment and large inventories of industrial raw materials became more serious. A package of macroeconomic policies, as suggested in the April 17 Politburo meeting, must be implemented urgently. It is particularly necessary to aid weak links including small and midsize enterprises and personal incomes,” Zhong said.

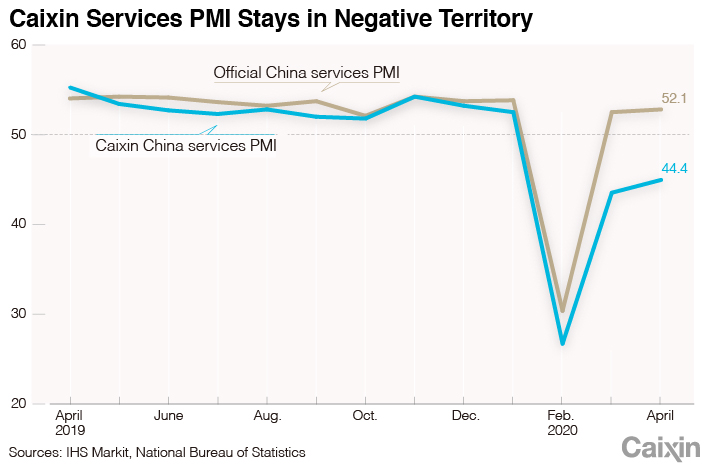

Caixin Services PMI

- Services activity continued its three-month contraction in April, rising slightly to 44.4 in April from 43 in March, remaining firmly in contractionary territory.

- Total new orders received by service providers contracted for the third month in a row, though the rate of decline continued easing from the fastest rate on record in February. New export business also contracted for the third consecutive month in April, with the rate of contraction accelerating from March as external demand plummeted.

- However, the gauge for service companies’ business expectations, which indicates how optimistic or pessimistic they are about the business outlook for the coming 12 months, rose further to a three-month high after the reading hit a record low in February. Companies hope to see a recovery in business conditions once the pandemic situation improves, the survey said.

|

Exports Good, Imports Bad

A decline in China’s imports accelerated in April as the coronavirus pandemic wreaked havoc on global supply chains, while exports defied expectations by returning to growth after declining for several months.

Merchandise imports plunged 14.2% year-on-year (link in Chinese) to $154.9 billion in April, much steeper than a 0.9% decline the previous month, according to data released Thursday by the General Administration of Customs. The reading was worse than the median forecast for a 10% drop in a Caixin survey of economists (link in Chinese).

Exports grew 3.5% year-on-year to $200.3 billion last month, reversing a 6.6% drop in March and far better than the median forecast for a 13.7% decline in the Caixin survey. The surprise export rebound might be a result of exporters catching up on backlog orders, and therefore would not last long.

Bank of China Swallowing the Bitter Fruit of Its Oil Futures Product

Bank of China Ltd. (BoC) started a settlement process on May 5 with tens of thousands of customers who suffered heavy losses on the bank’s speculative oil futures product after last month’s collapse in crude prices amid a pandemic-driven global slump in demand.

The settlement provides that small investors with less than 10 million yuan investments will get 20% of their initial investments back, while larger investors will get nothing. Still, that is way better than what it was, where all investors were set to lose their entire investments and also owe the bank money.

BoC has agreed to shoulder most of the $1 billion losses only after regulators stepped in. This type of futures product is indeed riskier than most products offered by banks, but these products also provide retail investors with limited capital access to the futures market. One should not abandon the entire investment product category just because of this one incident, some banking regulators argued.

REIT Pilot

On April 30, China launched a pilot program to allow the issuance of REITs backed by profit-making infrastructure projects that will be traded publicly like stocks.

Since 2005, there have been periodic calls for establishing REITs in China, but their development has been held back by challenges somewhat unique to China’s real estate market, including lack of liquidity in potential underlying assets, as noted by Yi Gang at the 2018 Boao Forum.

Quasi-REITs have been sold since 2014, but they are all technically asset-backed securities products, traded privately and taxed differently from true REITs.

Key Features

- The pilot will bring China its first publicly traded REITs potentially available to individual investors.

- The trial will focus on projects in major economic areas including the Beijing-Tianjin-Hebei region, the Yangtze River Delta, the Xiongan New Area economic zone, the Greater Bay Area (Hong Kong-Zhuhai-Macao region) and Hainan province.

- Only completed infrastructure programs can be underlying assets of publicly traded REITs; housing and other real estate projects are not eligible.

- The pilot is designed around a “public fund + ABS” arrangement, making them equity-based rather than debt-based. Each infrastructure project corresponds to an ABS issued to hold 100% of the project’s equity, with a publicly offered fund that holds 100% of the ABS with at least 80% of its capital.

- The REITs are required to disburse at least 90% of their disposable earnings each year, making them high dividend products.

- The current definition of eligible underlying infrastructure includes warehousing and logistics, transit facilities like toll roads, airports and ports, and municipal infrastructure including water, electricity and heat, as well as industrial parks, but excluding residential and commercial real estate.

The initiative may be meant to pave the way for greater private investment in new infrastructure development. The importance of private funding for new infrastructure has been repeatedly emphasized by officials and those at state-linked research centers, including Liu Shijin, deputy director of the CPPCC economic committee, and Zhu Baoliang, chief economist of the State Information Center. New infrastructure projects like 5G, data centers, smart power grids or even satellite networks have greater revenue generation potential than many traditional infrastructure projects, and are thus well-suited for REIT investment, but we do not yet know whether they will be included in the pilot, as their position is still emerging and somewhat ambiguous.

Weathervane

Signals from top political meetings have remained fundamentally consistent, touching on the same topics in the same tone that we’ve been seeing over the last few weeks.

Li Keqiang chaired a meeting of the State Council executive committee on May 6, to hear a report on, you guessed it, implementation of policies to support resumption of work and help enterprises save jobs.

The meeting reiterated the “six stabilities” and “six guarantees,” and highlighted three key (but not new) policies, including

- allowing small and micro enterprises to delay income tax payments, and for VAT exemptions to be extended for public transit, delivery services and other daily life necessities

- on top of the 1.29 trillion yuan of special bonds issued at the beginning of the year, another 1 trillion yuan to be issued by the end of May

- strengthening financial support measures to stabilize company operations and support employment

The Politburo Standing Committee met on April 29 and on May 6, focusing largely on virus prevention and control work. The April meeting declared that “decisive results” had been achieved in the battle to defend Hubei and lauded “major strategic achievements” in the national epidemic prevention effort, but did not go so far as to declare victory. This same line continued in the May meeting, where Xi stressed that the situation remains uncertain, and while it is no longer an “emergency” scenario, that “does not mean that the control measures can be relaxed” as the overseas epidemic has not been curbed and there are still some concentrated outbreaks in certain regions of China.

The April meeting also placed special emphasis on the battle against poverty, one of Xi’s signature issues (alongside financial risks and pollution) that links closely with the “six stabilities” and “six guarantees” we discussed in our April 22 brief. It also called for accelerated construction of both new and traditional infrastructure, and highlighted rural issues including increasing farmers’ income and expanding agricultural marketing channels, hinting at the high priority placed on the ongoing rural revitalization campaign.