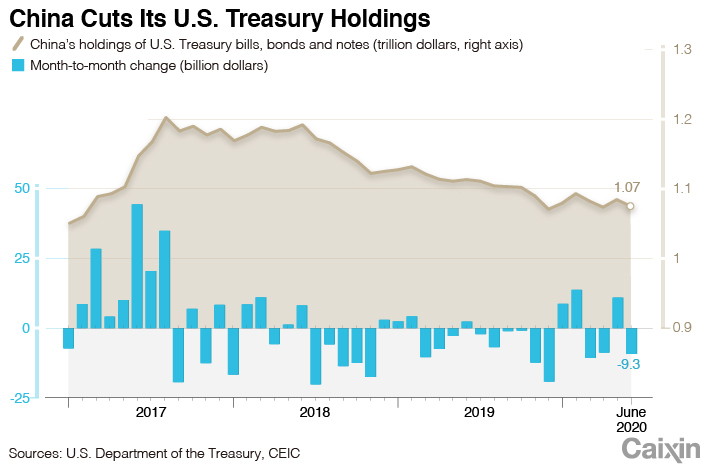

Chart of the Day: China Cuts U.S. Treasury Holdings for the Third Time This Year

China’s U.S. Treasury holdings shrank for the third time this year in June, with the largest sell-off by any country that month amid growing animosity between the two countries.

|

China cut its holdings of U.S. Treasury bills, bonds and notes by $9.3 billion to a total of $1.07 trillion, according to data released Monday by the U.S. Department of the Treasury.

Overtaken by Japan last year, China remained the second-largest foreign holder of U.S. government debt. Japan increased its holdings by $900 million to $1.26 trillion in June, holding the top spot.

At the end of June, foreign U.S. Treasury holdings amounted to $7.04 trillion, rising $60.9 billion from a month earlier to a four-month high.

As China-U.S. tensions continue to mount, the U.S. government announced on Monday that it would tighten restrictions on Chinese tech giant Huawei Technologies Co. Ltd., which would completely cut off the company’s supply of chips made with U.S. technology. It also added another 38 Huawei affiliates to an economic blacklist.

Read more

U.S. Puts Stranglehold on Chip Sales to Huawei

Contact editor Gavin Cross (gavincross@caixin.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas