China Business Digest: U.S. Sanctions Chinese Companies Over South China Sea; Vanguard Repositions in Asia

|

|

|

|

The U.S. Department of Commerce imposed export restrictions on 24 Chinese companies, while American fund giant Vanguard Group Inc. is shifting its Asia business focus to the Chinese mainland. JPMorgan Chase & Co. will have to pay a hefty 51% premium to take over its China fund joint venture. Hotpot giant Haidilao reported a net loss of 965 million yuan ($100.6 million) during the first six months amid the Covid-19 pandemic. Meanwhile, China said food supplies remain stable and consumers should not be “overly anxious” or resort to “panic buying.”

— By Mo Yelin (yelinmo@caixin.com) and Han Wei (weihan@caixin.com)

** TOP STORIES OF THE DAY

U.S. sanctions 24 Chinese companies amid South China Sea dispute

The U.S. Department of Commerce imposed export restrictions on 24 Chinese companies Wednesday citing China’s territorial claims in the disputed South China Sea. Companies blacklisted include several subsidiaries of state-owned construction giant China Communications Construction Co.

Vanguard repositions in Asia with China focus

Vanguard Group Inc. said it plans to end its onshore presence in Hong Kong and Japan while relocating its Asia headquarters to Shanghai. The move reflects the U.S. fund giant’s shifting priority to the Chinese mainland market in its Asia business.

JPMorgan to pay $1 billion for full ownership of China fund venture

JPMorgan Chase & Co. will have to pay 7 billion yuan ($1 billion) to take full control of its mutual fund joint venture in China. The U.S. bank is looking to purchase the remaining 49% stake in China International Fund Management Co. from its Chinese partner Shanghai International Trust Co. The asking price for the stake represents a 51% premium over the appraised value.

Shares of Alibaba rally after Ant Group Files IPO prospectus

Shares of e-commerce giant Alibaba Group Holding Ltd. closed up 4% in Hong Kong on Wednesday, as investors welcomed the first glimpse of financial information from its fintech affiliate Ant Group with the publication of the latter company’s IPO prospectus after market close Tuesday. Alibaba owns 33% of Ant Group, which is expected to raise up to $30 billion through a dual listing in Hong Kong and Shanghai.

Didi drives into Russia with taxi service

Ride-hailing giant Didi Chuxing said on Tuesday it has launched a taxi service in Russia, the latest stop on its global roadmap as it aspires to take on global leader Uber. Didi said it has launched its DiDi Express service in Kazan, the capital and largest city of the Russian Republic of Tatarstan, home to the country’s largest tech industrial park.

China says no need for panic buying of food and oil

China’s food supplies remain stable and consumers should not be “overly anxious” or resort to “panic buying,” a senior agriculture ministry official said on Wednesday, following recent uncertainty caused by the coronavirus pandemic. (Reuters)

The U.S. became China’s fifth largest oil supplier in July

China’s crude imports from the U.S. in July rose 139% year-on-year to a record 3.7 million barrels per day, data from the General Administration of Customs showed on Tuesday, making the North American country China’s fifth largest oil supplier for the first time.

Haidilao posted huge losses for first half of this year

The Chinese hot pot giant said in a report on Tuesday that the company posted net losses of 965 million yuan on revenues of 9.7 billion yuan during the first six months of this year amid the Covid-19 pandemic. That’s compared to 912 million yuan in net profits for the Hong Kong-listed company during the same period last year.

|

** OTHER STORIES MAKING THE HEADLINES

• U.S.-listed Chinese fashion e-commerce platform Mogu has released second-quarter results showing that sales linked to live video broadcasts have continued to gain steam. In the quarter through June 30, Mogu’s livestreaming-related sales skyrocketed 72.4% year-on-year to 2.3 billion yuan ($320.7 million), accounting for 72.6% of total gross merchandise value.

• The China box office took in 508 million yuan in a single day for the Qixi Festival, also known as Chinese Valentine’s Day, which fell on Tuesday. That marked a single-day record since movie theaters reopened following a prolonged closure during the Covid-19 pandemic.

• Chinese home appliance maker Galanz is offering to acquire a partial stake in U.S.-based rival Whirlpool (link in Chinese) in a deal that could cost the Chinese company over 2 billion yuan.

• Okki, a Chinese cloud-based customer relationship management specialist, announced on Wednesday that it had received an investment of hundreds of millions of yuan from Alibaba (link in Chinese) in a recent funding round.

• Chinese synthetic insulin pioneer Gan & Lee Pharmaceutical tripled its business overseas in the first six months and recorded 15% net profit growth, powered by insulin sales, which also drove its operating costs to balloon 47.15% as it began selling active pharmaceutical ingredients for diabetes treatments.

• One of Credit Suisse Group AG’s most prominent executives in Asia, Alain Lam, is joining Chinese smartphone-maker Xiaomi Corp. as chief financial officer, according to people familiar with the matter. (Bloomberg)

• Nasdaq-listed special purpose acquisition company Orisun Acquisition and China’s biggest shared workspace provider, Ucommune International Ltd., have received $53 million in backstop investment commitments from 14 investors, Orisun announced in a statement on Monday. (DealStreetAsia)

• Chinese electric-vehicle maker Xpeng could raise as much as $1.275 billion from its U.S. initial public offering after flagging that its shares would be priced at $15, two sources with direct knowledge of the matter said. (Reuters)

• China’s four largest lenders are facing a funding gap of trillions of yuan to meet global capital requirements designed to protect the public and the financial system against massive bank failures, according to S&P Global Ratings. (Bloomberg)

** ON THE CORONAVIRUS

• China’s Sinovac Biotech Ltd. said it has signed an agreement with Indonesia’s state-owned drugmaker Bio Farma, pledging to help the latter produce at least 40 million doses of its potential coronavirus vaccine in the country before March 2021.

• Dozens of Chinese nationals gathered outside their embassy in Singapore on Tuesday in frustration over new rules requiring them to get tested for Covid-19 before they can board their upcoming flights home, something Singapore doesn’t generally offer to those without symptoms. (Bloomberg)

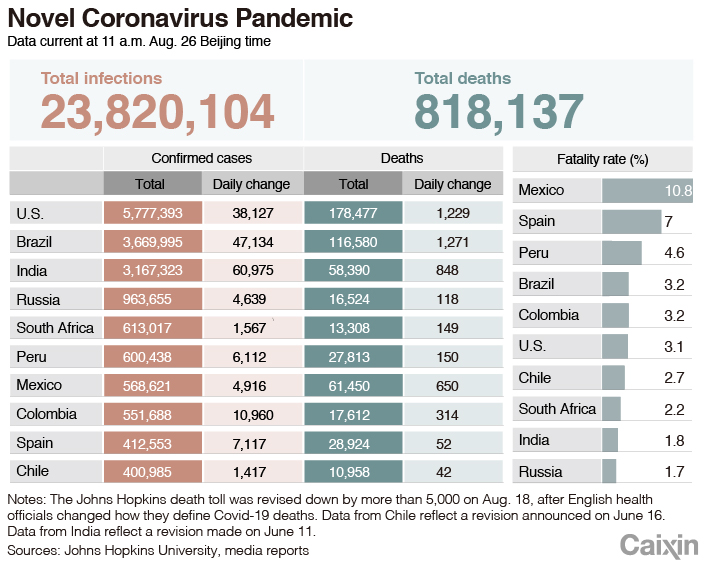

• As of Wednesday afternoon Beijing time, the number of coronavirus infections globally surpassed 23.9 million, with the death toll passing 819,000, according to data compiled by Johns Hopkins University.

• The Chinese mainland reported (link in Chinese) 15 new symptomatic Covid-19 infections on Tuesday, up from 14 a day earlier. All of the new cases were imported. The mainland also added 14 asymptomatic cases.

**LOOKING AHEAD

Aug. 26: Xiaomi and Bilibili to report their latest financial results

Aug. 28: BYD and ZTE to report their latest financial results

Sept. 1: Release of Caixin China manufacturing PMI

Sept. 3: Release of Caixin China services PMI

Contact reporter Mo Yelin (yelinmo@caixin.com) and editor Yang Ge (geyang@caixin.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

- MOST POPULAR