China Business Digest: Li Ka-shing Plans to Sell $7.3 Billion of Mainland Properties; China Fines Five Financial Companies $47 Million for Misconduct

|

|

|

|

|

|

Hong Kong tycoon Li Ka-shing continues to pull out of the Chinese mainland market as he’s in talks to sell two properties in Beijing and Shanghai worth 50 billion yuan ($7.31 billion). SoftBank is said to be weighing a bid for ByteDance’s TikTok business in India while at home there are signs the Japanese company could be moving into online payments.

— By Lu Yutong (yutonglu@caixin.com)

** TOP STORIES OF THE DAY

Exclusive: Li Ka-shing plans to sell more mainland assets

Hong Kong tycoon Li Ka-shing is planning to dispose of two properties in Beijing and Shanghai worth 50 billion yuan ($7.31 billion), a sign the billionaire is further pulling business out of the Chinese mainland. CK Asset Holdings Ltd., Li’s flagship enterprise, plans to sell a mixed residential and commercial project in northeast Beijing, Caixin learned from multiple sources. Mainland property giant Sunac China Holdings Ltd. in interested in taking over the project, a person close to the deal told Caixin.

China banks plan $28.5 Billion of bond sales to replenish capital

Chinese banks are planning near-record bond sales this month to replenish capital levels weakened by a surge in cheap loans to struggling businesses and sliding earnings. Industrial & Commercial Bank of China Ltd. (ICBC), the world’s largest lender, and three domestic competitors plan to sell a combined 195 billion yuan ($28.5 billion) of perpetual or tier-2 capital bonds in September, Bloomberg reported, citing people working on the plans.

Chinese authorities warn renters and landlords of risks on leasing platforms

Housing authorities in several Chinese cities told renters and landlords be wary of “abnormal rental prices” offered by long-term rental companies after a number of apartment rental operators absconded with tenants’ money.

China fines five financial companies $47 million for misconduct

China fined (link in Chinese) five financial institutions a total of 320 million yuan ($47 million), as the country’s banking watchdog steps up a crackdown on financial misconduct to tame systemic risks. China Minsheng Bank was fined 107.8 million yuan for banking illegal property projects, and China Zheshang Bank was fined 101.2 million yuan for selling off-balance sheet wealth management products, according to a statement posted Friday by the China Banking and Insurance Regulatory Commission (CBIRC). Hua Xia Bank, China Guangfa Bank and China Huarong Asset Management Co. were also among the institutions issued fines.

Yum China guides Hong Kong listing price at $53 a shareYum China Holdings Inc., which operates KFC and Pizza Hut restaurants in the country, is telling prospective investors it plans to price its second listing in Hong Kong at HK$412 ($53.10) per share, putting it on course to raise HK$17.3 billion.

SoftBank reportedly considers bid for TikTok’s India operations

Japanese tech investment giant SoftBank Group Corp., which owns a stake in ByteDance Ltd., is trying to assemble a group of bidders for the company’s TikTok assets in India and has been looking for local partners, Bloomberg reported.

Smartphone maker Oppo’s second-half orders spike on Huawei setbacks

Chinese smartphone maker Oppo Co. Ltd. sealed 110 million new orders for the second half of the year, taking its year to date smartphone sales to an all-time high of 170 million, people at the company told Caixin. The spike came as its hometown rival Huawei Technologies Co. Ltd. found itself unable to acquire key components for its high-end products due to U.S. sanctions.

Online payment license suggests ByteDance is moving into fintech

A company controlled by ByteDance CEO Zhang Yiming has clinched a buyout that gives it access to a coveted license to provide online payment services on the Chinese mainland. It could let the Beijing-based tech firm develop third-party payment platforms like those of Tencent Holdings Ltd.’s WeChat Pay and Ant Group Co. Ltd.’s Alipay.

U.K.’s Premier League ends China soccer coverage agreements

The English Premier League terminated a 650 million pound ($861.6 million) agreement for the broadcast rights of English soccer matches in China amid growing political tension between the two countries.

Wechat users want to see the evidence behind Trump’s ban

The U.S. WeChat Users Alliance, which sued President Donald Trump last month over his ban on the Chinese messaging app, on Thursday asked a judge to order the government to turn over evidence supporting the ban so that they can use it in their bid for a preliminary injunction. The U.S. is opposing the request.

A hearing on the users’ request for a preliminary injunction is scheduled for Sept. 17, three days before Trump’s order take effect.

|

** OTHER STORIES MAKING HEADLINES

Finance & Economy

• China’s banking regulator on Thursday gave a Japanese company approval to set up the first fully foreign-owned money broker on the Chinese mainland, as the country continues to open up its financial markets.

• The Housing Leasing Association of Hefei, capital of East China’s Anhui province, warned (link in Chinese) local landlords and tenants on Thursday to be careful about leasing houses above or below market prices, after several rental agencies cashed in on higher leasing prices.

Business & Tech

• Chinese Tesla challenger Nio Inc. said that its August sales grew to a record high of 3,965, up 104% year-on-year. The news came a day after its peer Li Auto reported record deliveries of 2,711 for the same month.

• The State Council approved two nuclear power projects with a total investment of 70 billion yuan ($10.2 billion), as part of efforts to cut greenhouse pollution levels and bolster the economy through infrastructure investment.

• China opened its first overseas public school in Dubai on Tuesday. The Chinese School Dubai, which has financial support from the Chinese government, will cover 12-year basic education from primary to high school and operate on a nonprofit basis.

• Huawei chief Ren Zhengfei said the challenges facing his company will help forge “heroes,” as he sought to signal the firm is down but not out.

** ON THE CORONAVIRUS

• On Friday, the Chinese mainland reported (link in Chinese) 25 new coronavirus cases for Thursday, up from 11 the previous day. All of the new infections were imported, with 13 of them detected in the southern province of Guangdong and five in Shanghai.

Read more

Caixin’s coverage of the new coronavirus

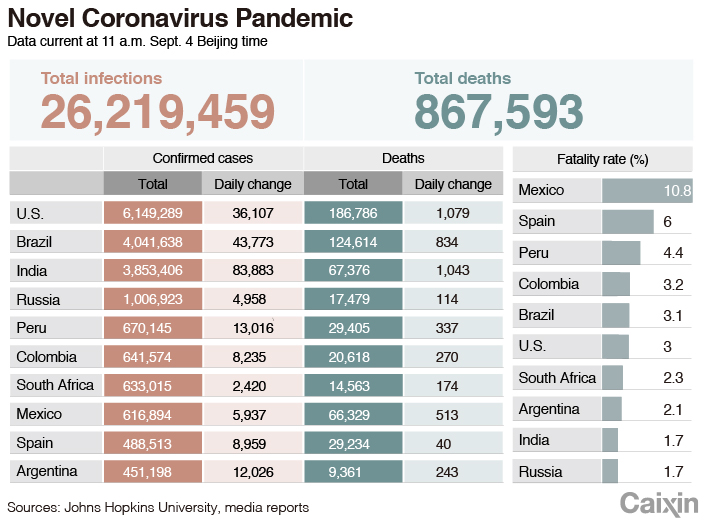

• As of Friday afternoon Beijing time, the number of global coronavirus cases has surpassed 26.3 million, with more than 868,000 deaths, according to data from Johns Hopkins University.

** AND FINALLY

Supermarkets in Urumqi, the capital of Northwest Xinjiang Uygur autonomous region, are gradually returning to business after a 45-day lockdown.

|

Shop staff at an Urumqi supermarket check customers’ temperatures on Wednesday as they come in. |

Contact reporter Lu Yutong (yutonglu@caixin.com) and editors Flynn Murphy (flynnmurphy@caixin.com) and Gavin Cross (gavincross.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

- MOST POPULAR