Steel Giant Baowu’s Buying Spree Continues With $334 Million Acquisition

China’s biggest steelmaker by output is to expand further after finishing its fourth acquisition this year as part of Beijing’s campaign to consolidate the country’s steel industry.

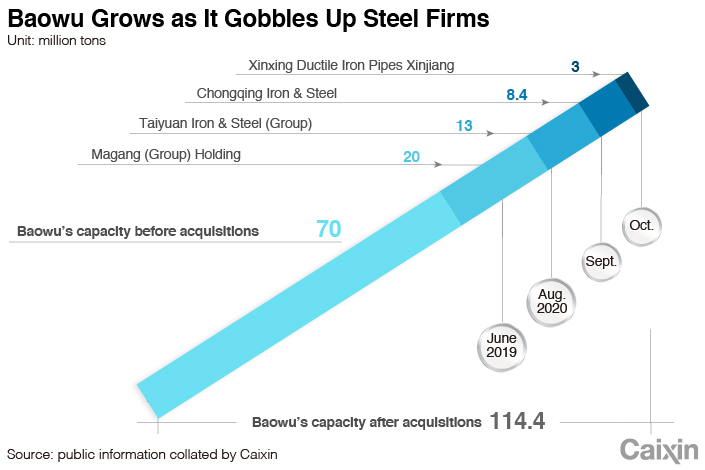

The second largest steel mill in the western region of Xinjiang, Xinxing Ductile Iron Pipes Xinjiang Co. Ltd., with a yearly capacity of 3 million tons, will be consolidated into China Baowu Steel Group Corp. Ltd. for 2.2 billion yuan ($334 million), according to a statement by a listed arm of Baowu on Friday.

The deal will grow Baowu’s annual capacity to 114.4 million tons.

The Shanghai-based behemoth overtook Luxembourg-based ArcelorMittal SA in April to be the world’s largest steelmaker by production. It also hit a five-year goal to boost its capacity to 100 million tons one year ahead of schedule.

Behind Baowu’s buying spree is Beijing’s push for a greater concentration ratio in the steel sector. An industry guidance issued by the central government in 2016 called for the top 10 companies to secure a combined 60% to 70% market share of China’s steel market by 2025.

While the top five steelmakers in Japan account for nearly four-fifths of that country’s total production, China’s top 10 made up less than two-fifths of national production last year, according to a report by Chuancai Securities.

|

“The steel industry’s hard times seem to be related to issues brought on by the Covid-19 pandemic, but the deeper reason is the low concentration ratio,” said Shen Hong, president of China Iron and Steel Association (CISA).

“With many companies scattered across the country, it is difficult to achieve a coordinated reaction to market crisis,” Shen added.

The profits of major steel companies declined more than a third in the first half of the year, with average sales margins shrinking by nearly two percentage points to 3.29%, CISA data indicates.

Consolidation is one of the options adopted by steel giants to meet government targets. Baowu, the product of a merger between two state-owned enterprises (SOEs) four years ago, has embarked on a string of acquisitions this year that absorbed four SOEs and added a combined 24.4 million tons of capacity.

The aggressive expansion, however, has weighed on Baowu’s finances. Its debt has risen by 7.6% from the start of 2020 to 480 billion yuan as of September, with almost one quarter of it to mature within one year. It had just 63 billion yuan in cash and cash equivalents, Baowu’s third quarter report said.

Contact reporter Lu Yutong (yutonglu@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.