Cover Story: Why the Lights Are Going Out in China

As China’s economy picks up steam following the pandemic, there’s been an unexpected consequence: power shortages that forced several cities to restrict electricity use by factories, offices and even streetlights.

As night fell Dec. 14 in Yiwu, the city in eastern China’s Zhejiang province that’s known as the world’s largest small-commodity trading hub, pedestrians were plunged into darkness as streetlights didn’t turn on as usual in some areas. Streets in Yiwu remained dark the next two nights under a government decision to “reduce power consumption and pollution.”

“This is the first time in many years the streetlights were shut down for that reason,” one resident said.

Lighting of several landmark structures in Changsha, capital of southern China’s Hunan province, was also turned off this month.

“The outdoor billboard lights were shut due to government orders for power control,” said one staffer of a shopping mall in downtown Changsha.

Yiwu and Changsha are among a number of Chinese cities that imposed power rationing in December as a surge of demand from industrial production and wintertime heating worsened a supply shortage.

|

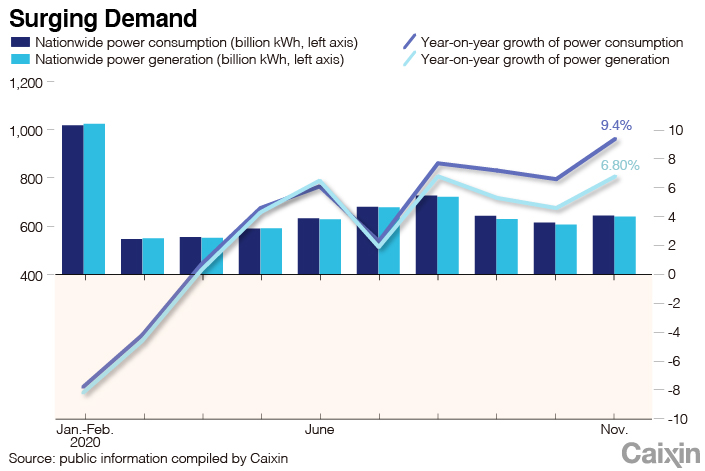

China’s total power consumption in November reached 646.7 billion kilowatt hours, up 9.4% from a year ago and hitting a two-year high. For the first 11 months, power consumption in the country rose 2.5% from the same period last year.

Growing power use reflects China’s economic rebound from the Covid-19 pandemic. In one of the first countries to emerge from pandemic-induced lockdowns, industrial production has revived rapidly as the world increasingly relies on China to supply medical gear and consumer goods. China’s industrial output surged at an accelerating pace toward year-end, with exports soaring to a record high in November.

On top of surging industrial demand, this year’s colder-than-normal winter and local governments’ efforts to meet emission reduction goals by the end of the year further added to pressure on generators.

Cities’ struggles with power outages this year reignited an ongoing debate over China’s slow-moving electricity market restructuring as analysts said the shortfall presents clear evidence of how government intervention and a distorted pricing system are sapping efficiency of the market.

Out of power

Employees at an industrial park in the Yuelu district of Changsha found no power in their offices when they started work the morning of Dec. 15. Companies in the park were later told that electricity would be limited during peak hours.

“Even my cell phone lost signal, probably due to the power cut at the nearby base station,” said one person at the industrial park.

The next day, the property manager of the industrial park posted a statement saying power rationing would be applied in the park amid a supply shortage until Dec. 18. The park was granted only 20% of its normal daily power demand.

The outage partly reflected a surge in heating demand after recent temperature drops in Hunan. A staffer at the State Grid’s Hunan unit said province-wide power consumption between Dec. 15 and 17 soared by 30% compared with the same period last year.

Industrial demand also expanded as factories kept production lines running to fill rising orders. In November, Hunan’s machinery manufacturing industry consumed 10.7% more power than a year ago, while production of other equipment used 28% more.

|

Lighting of several landmark structures in Changsha, capital of southern China’s Hunan province, was turned off in December |

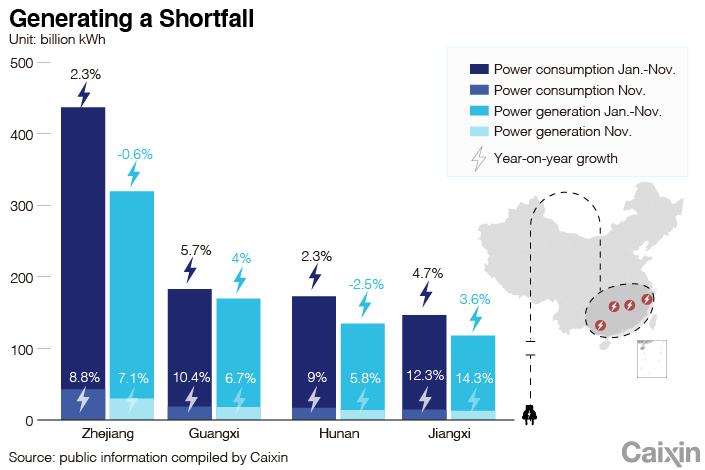

According to the State Grid, the state-owned power distributor, the peak load of the power grid in Hunan reached 33 million kilowatts this year, up 10.4% year-on-year and exceeding local generators’ maximum supply capacity by 4 million kilowatts.

The landlocked province of Hunan struggled with frequent power shortages in the early 2000s, mostly in the summertime, reflecting its lack of coal reserves and heavy reliance on imported power. The last time the province faced a severe outage was in 2011 when an aggressive emissions reduction campaign slashed power production nationwide. The situation in Hunan gradually improved in recent years following construction of a long-distance power transmission network that delivers more electricity from the western part of the country.

This year, Hunan’s wintertime power consumption surged to a record high of 31.5 million kilowatts. But the province’s local power generation capacity has remained unchanged for years at about 29 million kilowatts. Meanwhile, a shortage of water during the winter reduced hydropower production, which accounts for nearly one-third of the province’s total power supply.

|

Experts predicted that as the weather gets colder, Hunan may encounter an even worse power shortage in late January.

While Hunan’s outages stem from limitations in the local power supply structure, power cuts in Yiwu mainly reflect local authorities’ rush to meet emissions control targets.

On Dec. 12, Yiwu issued a citywide order limiting electricity use for companies, communities and public facilities. The order followed a provincial meeting urging cities in Zhejiang to meet pollution control targets by the end of this year, the last in China’s 13th five-year plan.

City governments’ aggressive move to cut power supply caused headaches for many small manufacturers in Yiwu, which have already suffered a slow business year because of the pandemic, one company owner said.

City officials’ overreaction was later corrected by the provincial government, which ordered local authorities to take more targeted measures to contain excessive power use by highly polluting industries.

“There is no shortage of power supply in Zhejiang,” said Zhao Chenxin, secretary general of the National Development and Reform Commission (NDRC).

Energy dilemma

This year’s power shortage brings the country’s long-running struggle between the coal mining and power generation industries into the spotlight again.

The outage has been compounded by recently soaring prices of coal, which fuels about half of China’s electricity generation. Domestic coal supplies have been squeezed by production halts following a series of mining accidents, a plunge in imports and a broader campaign to cut coal-fired power generation to fulfill the country’s emissions commitments.

This has pushed up prices. A local coal trading company staffer told Caixin in late December that coal prices surged 14% in the past two weeks and were 20% higher than a year ago.

|

An employee of a power plant in Hunan said generation companies are often hesitant to add coal inventory when prices are rising out of concern over costs and the risk of future price fluctuations. Provincewide inventory of coal for power generation in Hunan dropped 18.5% at the end of November from last year’s level, official data showed.

Coal price changes have long been a zero-sum game for China’s coal miners and power plants. In 2015 when coal prices plunged, the country’s coal mining industry reported a 65% drop in profits while power generators booked a record 9% increase. In 2017, coal miners experienced a 291% profit surge because of production cuts, leading to a 15.4% drop in power generators’ profits.

That partly reflected the country’s distorted power pricing regime. While coal prices float freely and are decided by market demand, power prices are still largely under government control. Generators have to keep electricity tariffs at low levels and even run at losses to ensure power supply.

The Hunan power company staffer said coal prices in the province rose above 800 yuan ($122) a ton recently, meaning the more power the plants generate, the more money they lose.

Government-controlled power pricing and pollution-control policies have discouraged localities like Hunan from adding new coal-fired power plants even amid power supply shortfalls, said Xue Jing, a power industry analyst.

Natural gas has been expected to become the main substitute for coal to help meet the company’s energy demands while keeping emissions under control. However, the cleaner source of energy has remained a minor factor in China’s overall energy consumption. In 2019, it amounted to 8.1% of energy use, far below the world average of 24%. Because of the lack of domestic reserves, power generation using imported natural gas often costs more than coal-fired power production.

Several accidents since November involving major gas pipelines have led to a shortage of natural gas in several provinces, pushing up prices. According to data from Chongqing Petroleum and Gas Exchange, China suffered a natural gas shortfall of nearly 1 billion cubic meters in November.

Finding solutions

Provinces suffering power shortages are counting on more energy imports, calling for the country to build up more long-distance power transmission capacity to transport electricity from the energy-rich regions in the West.

The central government has accelerated approval of ultra-high voltage (UHV) transmission projects in hopes of meeting demand, with the latest one linking Nanchang in Jiangxi province with Changsha. The project, costing more than 10 billion yuan, is part of a national UHV transmission system.

But some experts warned that UHV transmission projects alone will not solve China’s energy dilemma in the long run and would cost too much. UHV transmission projects can help the country cope with a short-term surge in power use, said Feng Yongsheng, an analyst at the China Academy of Social Sciences, but it will always require hefty investment for low utilization rates. A UHV transmission line linking Hunan with Gansu in the West has maintained a transmission rate of 4 million kilowatts since it started operation in 2017, much lower than the designed capacity of 8 million kilowatts.

The fundamental solution is likely to be changing China’s power pricing regime to make it better reflect the relationship between demand and supply, allowing the energy to be used in a more efficient way, analysts said.

Despite recent outages, China’s overall power supply is adequate with short-term shortfalls emerging at certain hours in certain regions, according to the China Electricity Council, a trade group.

|

When power shortages occur, Chinese authorities often use administrative measures to cut supply to industrial users and ensure supply to households and service sectors rather than using pricing mechanisms to adjust consumption, said Hou Shouli, a power industrial policy professor at Renmin University in Beijing.

Currently, Chinese households pay flat, government-subsidized electricity rates that are much lower than those paid by industrial users. The pricing system fails to reflect the real costs of power generation, according to the Chinese Academy of Social Sciences’ Feng. The fundamental solution to China’s supply problem is to change the pricing system to let the market decide prices, Feng said.

With people’s livelihoods improving, power consumption by households and service sectors will continue growing, meaning a more sophisticated pricing system is needed to ensure efficient energy use, analysts said.

“Recent power outages in different regions are warning calls for us to think about and push forward further reforms in the power pricing system,” Feng said.

Contact reporter Han Wei (weihan@caixin.com) and editor Bob Simison (bobsimison@caixin.com).

Download our app to receive breaking news alerts and read the news on the go.

- PODCAST

- MOST POPULAR