Opinion: China Helped the U.S. Dodge an Inflation Bullet

Shen Jianguang is a vice president at JD.com and the chief economist of JD Technology Group.

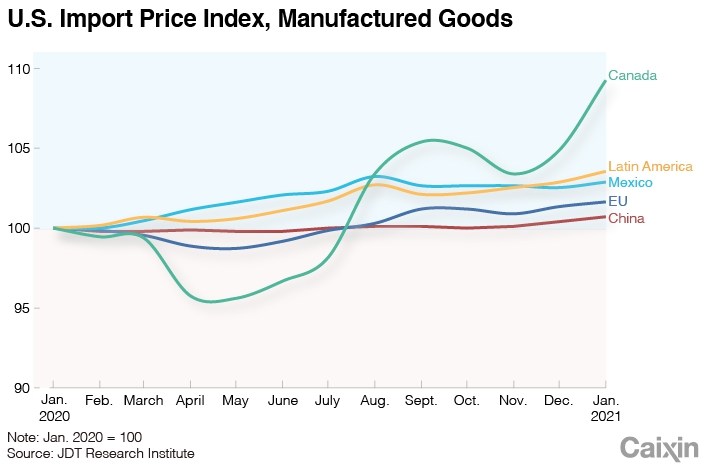

As the Covid-19 pandemic unfolded, U.S. import prices of manufactured goods from most of its trade partners rose significantly. In January, import prices from neighboring Canada went up by as much as 9.3% year-on-year. Yet import prices from China remained flat throughout despite the dollar’s depreciation against the yuan. As the United States’ top source of imports in 2020, China helped tame U.S. inflation at a time when the pandemic caused remarkable supply-demand imbalances.

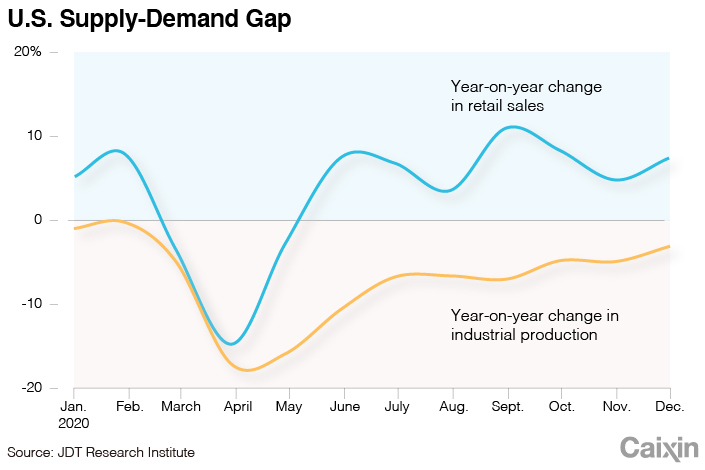

After the pandemic reached its shores in March, the United States promptly introduced unprecedented fiscal and monetary stimulus — including direct cash transfers — to support demand. Retail sales had already returned to positive growth by June. But ineffective public health responses put a dent on the recovery in production, creating a large output gap.

|

That gap was partly filled by China. The country was the earliest to emerge from Covid-19 and regain productive capacity, exporting everything from protective equipment, ventilators and computers to furniture, home appliances and other consumer goods. China’s exports to the United States were up 8.2% in 2020, growing by more than 20% year-on-year in each month from August on. In November, the increase was close to 50%.

|

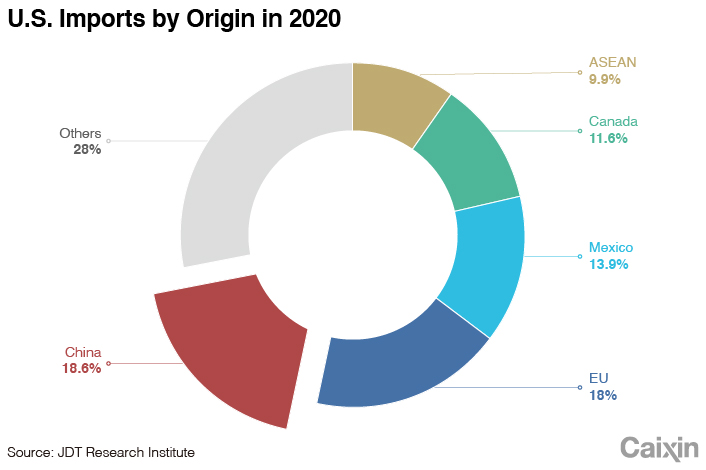

All this built on China’s already immense and resilient supply capacity, which allowed it to increase its market share in international trade. In 2020, China retook the status as America’s largest exporter, accounting for 18.6% of U.S. imports, far overtaking the European Union and leading Canada, Mexico and the member of countries of the Association of Southeast Asian Nations. This is also an example of how the United States became more dependent on the trade with China despite punitive tariffs on Chinese exports.

|

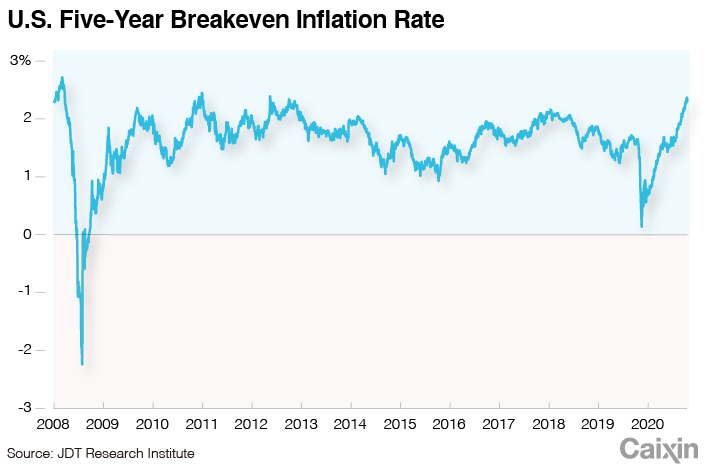

China’s stabilizer role now seems more important as reflation gains traction. With the United States ramping up vaccinations and U.S. President Joe Biden determined to push ahead with his $1.9 trillion stimulus plan, the expectation of a recovery has to some extent evolved into concerns over economic overheating and high inflation.

|

In early February, former Treasury Secretary Larry Summers worried Biden’s plan would result in “inflationary pressures of a kind we have not seen in a generation,” he said. Days later, the TIPS-implied inflation expectation, also known as the breakeven inflation rate, was inches away post-financial crisis highs. Absent the China buffer, inflationary pressures in the United States would only have been more pronounced.

The views and opinions expressed in this opinion section are those of the authors and do not necessarily reflect the editorial positions of Caixin Media.

If you would like to write an opinion for Caixin Global, please send your ideas or finished opinions to our email: opinionen@caixin.com

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

Follow the Chinese markets in real time with Caixin Global’s new stock database.

Shen Jianguang is vice president and chief economist of JD Digits, a digital and finance arm of Chinese e-commerce giant JD.com Inc.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas