In Depth: China Telecom Comes Home With Mainland Listing

After nearly two decades in the wilds of Hong Kong, Chinese wireless carrier China Telecom Corp. Ltd. is finally coming home.

The name that is arguably China’s oldest phone company revealed March 9 that it had applied for a new listing on the Shanghai Stock Exchange, a move that would make its stock easily available to Chinese mainland investors who have used its services for years. It said it would sell up to 12.1 million A-shares, or about 13% of its total, which could raise up to $4 billion.

Such a float would make China Telecom the first among the nation’s three major carriers to have both Hong Kong-traded H-shares and mainland-traded A-shares. The other two carriers, industry leader China Mobile Ltd. and China Unicom (Hong Kong) Ltd., are both incorporated in Hong Kong, which forbids them from concurrently listing in China. China Telecom stands out from the group because it formally incorporated on the Chinese mainland, and thus is allowed to list there as well.

The company was reportedly interested in an A-share listing as early as 2008, and revealed in 2018 it was considering such a move.

A number of factors could be driving the carrier’s homecoming. A low valuation is one, as the company hopes investors in its home market might better appreciate its stock — especially as it gets set to attempt a key transformation. The mainland stock regulator may be more receptive to such an offering now due to broader demand for new listings with the launch of a new Nasdaq-style high-tech board in Shanghai in 2019.

Another driving factor is the need for cash, as China Telecom tries to transform from a slow-growth phone service provider by moving into more value-added, higher-growth areas. One final factor could also be geopolitical, following the company’s recent blacklisting by former U.S. President Donald Trump, which has led to the delisting of its American Depositary Shares (ADSs) in New York.

“In the context of 5G, China Telecom needs to enhance its digitization and cloud-network integration capabilities and increase its business” by selling value-added telecom-related services to other enterprises, a China Telecom employee told Caixin, speaking on condition his name not be used. “And all this requires money.”

|

China’s former phone monopoly

China Telecom began life as a traditional fixed-line phone company, inheriting the modest and aging traditional fixed-line network the nation had built up in the 20th century. It entered the wireless business in 2008, but has been a perpetual laggard in that area due to its relatively late arrival compared with its two main rivals.

It made its Hong Kong IPO in 2002, and simultaneously listed ADRs in New York to make its shares more accessible to U.S.-based investors. Those offerings made China Telecom the final of the nation’s three carriers to list, following the IPO by China Mobile in 1997 and by China Unicom three years later. In all three cases, the companies’ concurrent ADR floats in New York were relatively small, amounting to 2.2% or less of their total shares.

A regulatory source told Caixin that China Telecom had tested the waters many times before about a potential A-share listing in the past. But regulators were always worried about such a move over concerns the company’s large size might draw investment dollars away from other big state-owned enterprises. That has changed recently, however, with the rollout of a new Nasdaq-style high-tech board in Shanghai nearly two years ago and a flood of new listings that followed.

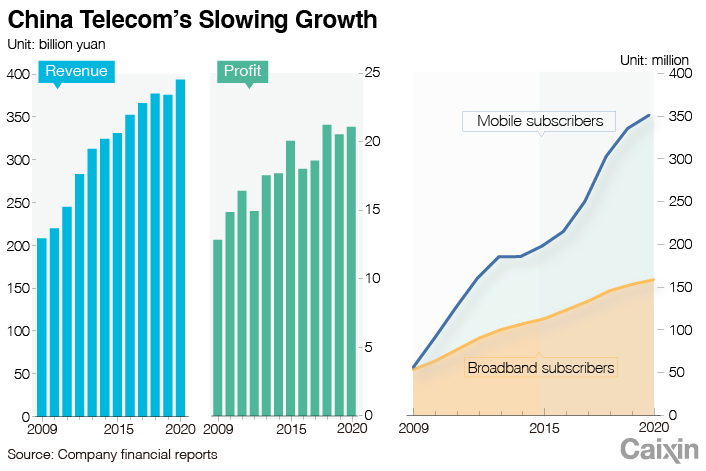

Despite being listed nearly 20 years, China Telecom’s stock now trades just 80% higher than its IPO price — far less than the broader market’s more than doubling over that time. The shares have lost about half their value over the last two years as interest in the company waned over its low-growth prospects.

A person close to the carrier pointed out that it has been reluctant to raise more money by issuing new shares in Hong Kong over the years due to its relatively low valuation, and has instead turned to debt issues when it needs new money.

Despite its hopes for a higher valuation in China, analysts pointed out that wireless carriers are a relatively undervalued group in general compared with other tech sectors like semiconductors and internet companies due to their limited growth potential. All three of China’s carriers grew strongly in the first decade of the 21st century as the big majority of the more than 1 billion Chinese who had never owned a phone signed up for service. But their growth slowed sharply over the last decade as the market neared saturation.

|

Banished from Wall Street

Its movement forward with the A-share listing plan comes around two months after the company, as well as its two main rivals, saw trading in their ADRs abruptly suspended by the New York Stock Exchange after Trump signed an order last November banning Americans from investing in all three companies due to alleged affiliation with China’s military.

The New York Stock Exchange went on to announce it would delist the three. That led to a selloff of their shares both in New York and Hong Kong as the stocks became off limits to U.S. investors. But they later rebounded as Chinese investors stepped in to pick up the shares for relatively bargain prices, an analyst at a joint venture brokerage said.

“The U.S. sanctions were just a bit of background behind China Telecom’s A-share listing decision, and thus it was more just another good reason to proceed with the plan,” a telecoms investor with a long-term view on the sector said. He added the bigger reason for the decision was the benefits such an A-share listing might bring, including not only raising new cash but other considerations like making the company’s shares more available to future strategic partners on the mainland for new initiatives.

Some of those initiatives could be aimed at jumpstarting the company’s growth to make it more attractive to investors. Unicom took its own big step in that direction in 2017 when it sold a major portion of itself to a group of private investors, including many of China’s top high-tech names, to breathe new life into the company. But China Telecom and China Mobile have been slower to follow that example.

In a bid to jumpstart its growth, China Telecom last year started promoting a strategy of moving into less developed areas with bigger potential like cloud- and digital-based services, with a special focus on such services for business customers rather than general consumers.

“China Telecom’s market share is too low right now, and there’s very little room for growth. So it must transform,” a source close to the company told Caixin. The company currently has 351 million mobile users, or 22% market share, which is far less than China Mobile’s dominant 942 million subscribers.

Pressure to maintain its existing market share has forced the company to lower prices for mobile service, leading to broader weakness in its financial results. Since 2014, the company’s revenue growth has dropped steadily from double-digits to low single-digits, and finally to a first-ever decline in 2019. The company’s profits have also been steadily declining.

China Telecom has also been looking for new growth engines through acquisitions, including its purchase of 18.7% of information safety specialist Beijing Global Safety Technology Co. Ltd. last year for 1.77 billion yuan ($272 million).

Contact reporter Yang Ge (geyang@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Follow the Chinese markets in real time with Caixin Global’s new stock database.