Cover Story: Zhou Xiaochuan on the Challenges of Taxing the Digital Economy

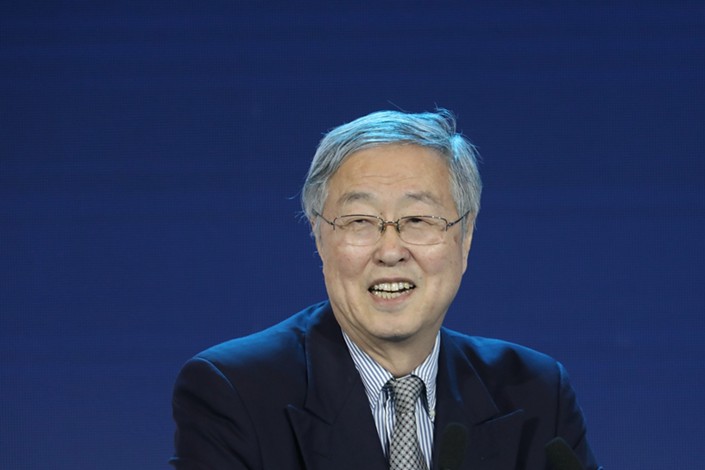

Along with many of the world’s nations, China faces difficult and delicate decisions around taxation of internet giants and fairness in an increasingly global digital economy, according to Zhou Xiaochuan, former governor of the People’s Bank of China (PBOC) and current president of the China Society for Finance and Banking, a PBOC-managed financial research institution.

On the one hand, advocates of a global digital services tax (DST) framework argue that multinational corporations shouldn’t be allowed to extract massive, tax-free profits from digital consuming countries. On the other hand, setting up a multilateral framework has repeatedly run into roadblocks amid rising protectionism and unilateralism.

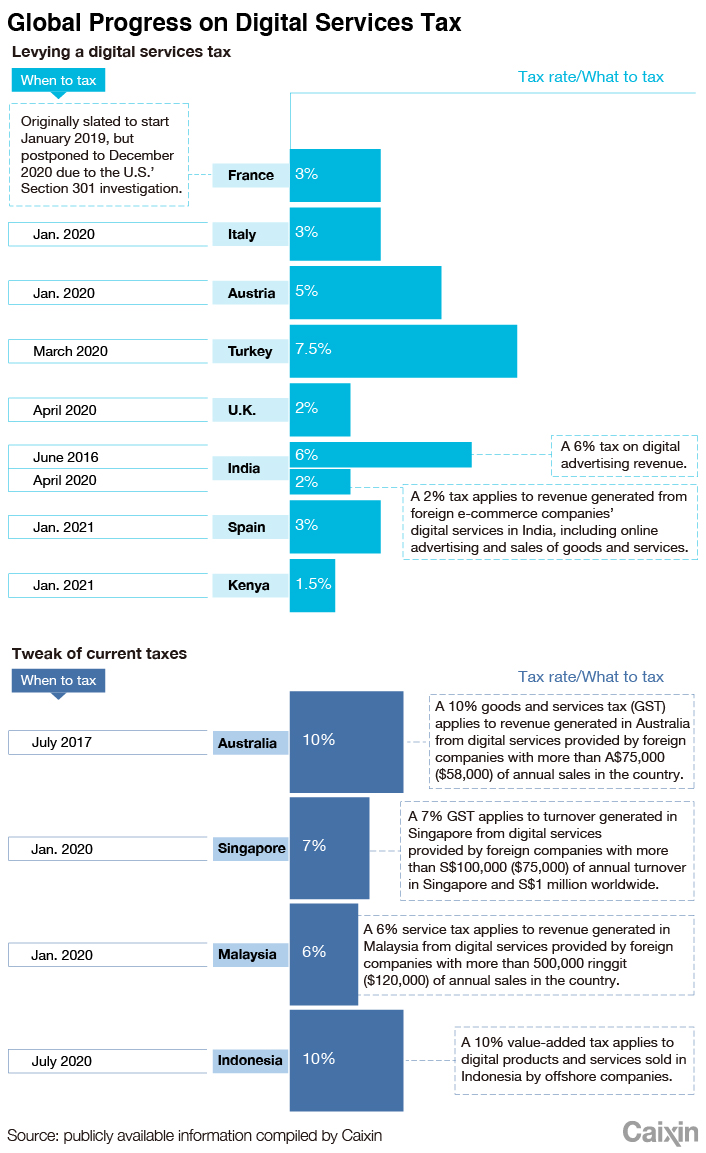

In the past three years, more than 20 countries have sought to go it alone with DSTs. That set off a backlash in tech giants’ home countries, particularly the U.S., where Google, Amazon and Facebook are based. The U.S. charged that France’s DST “discriminates” against American companies and in 2020 threatened additional tariffs on $1.3 billion of annual French imports, including cosmetics and handbags. Last month, the Office of the U.S. Trade Representative named six more countries — including Austria, India, and the U.K. — that may be subject to additional tariffs in response to their DSTs.

“A digital tax, if handled improperly, is prone to lead to trade wars and protectionist actions,” Zhou said in an interview with Caixin. As an important player in China’s efforts to improve and develop multilateral mechanisms, he has participated in discussions on the subject at the Group of 20 (G-20) leading rich and emerging nations. Since 2020, he has shared his thoughts and views on the issue with Caixin several times.

A timeline for reaching a global plan has been delayed again and again. The latest goal is mid-2021. At stake are billions of dollars of potential tax revenue as well as hundreds of billions of dollars of trade.

The Organisation for Economic Co-operation and Development (OECD) was among the first global organizations to study the digital tax issue to address the tax challenges of the burgeoning global digital economy. The subject has taken on greater urgency as national governments seek new revenue to offset increasing public spending in response to emergencies from the 2008 global financial crisis to the Covid-19 pandemic.

Based on the principle of building a global community with a shared future for humanity, as emphasized by Chinese President Xi Jinping, Zhou argued that China should adhere to a rules-based multilateral mechanism and avoid decisions that will intensify conflicts — such as trade and tariff wars — disrupt the process of globalization, or create new conflicts.

Since the end of 2020, there has been increasing discussion in China of levying a digital tax, including whether to simply strengthen tax collection and existing tax law, or to impose a new DST.

China should sort out what existing problems could be addressed through traditional methods and what new challenges have been raised by information technology giants and internet platform operators, Zhou said. For example, some of the controversies involving cross-border taxation, tax avoidance, tax systems and tax administration are not unique to digital services but also exist in traditional commerce, he said.

Digital services are not yet an element of production like capital, labor and land, so they can’t be taxed as a production factor or as a negative external effect, Zhou said. He argued that it is still feasible to tax the digital economy in terms of income.

The main difficulty in levying digital taxes is how to address challenges to the fairness of the traditional tax system posed by the new business models of internet platforms, he said. Designing a digital tax requires an innovative solution that doesn’t lose the basic legal basis, Zhou said. He suggested that China can tap its 40 years of experience in tax reform.

As to how to distribute digital tax revenue among countries, Zhou suggested that a digital tax could be designed as a global centralized tax to be used for global public expenditures to avoid trade conflicts caused by distribution of such tax income.

Caixin: A DST has been under discussion by the G-20. China is off to a later start, but also researching and discussing a DST. How do you approach DST? What are some points that stand out?

Zhou Xiaochuan: First of all, the majority of topics discussed by the G-20 are major and somewhat convoluted international issues that demand international efforts to coordinate. China needs to conduct its own research and present its own ideas and proposals, making its voice heard on these international issues. DST is one of the recent hot topics. Digital services have a broad scope of business. It may be easy to reach a consensus that DST should be collected, but as for who should collect it, that is much more difficult to agree upon. In the past, taxation was considered a sovereign policy, such that tax policies were made at the sole discretion of each sovereign state. But in the context of globalization, one country’s improper tax policy is likely to cause wide-ranging friction and conflict. In terms of a solution, first, we should rely on international organizations as well as their rules and coordination. There should be a system of checks and balances allowing for mutual retaliation, sanctions and even forced withdrawals in the event of any problems. We can no longer simply approach taxation as a sovereign policy for individual states to enforce as they will.

Second, China has consistently and vigorously supported globalization, multilateralism, a rule-based international order and trade and investment liberalization and facilitation, standing firm against unilateralism and protectionism. Yet if DST is not handled well, it can easily lead to trade wars and protectionism. The Trump administration embraced the concept of “America First.” The slogan spread virally, thwarting attempts at consensuses and problem-solving on a number of international issues. Countries around the world have to learn this lesson. Therefore, China’s role is significant.

And third, DST has to do with how we view new modes of business and the new networked economy. I hope that by studying this topic, we can sort out new issues and challenges raised by information technology giants and internet platforms. What kinds of policies and coordination are required? First of all it depends on the specific case. Some disputes — over cross-border matters, tax avoidance, tax systems or collection and administration — are not unique to DST, but familiar in traditional taxation theory and practice as well. To avoid getting off track or losing focus, the best bet is to discuss such problems separately from DST. The major difficulty when it comes to DST is dealing with the new internet-platform model.

Fourth, tech giants and internet platforms are obligated to pay taxes and to cover the government’s public expenditures. We need to use the existing tax systems and policies to the best of their abilities, including policies combating tax avoidance. It is unnecessary to start all over again. On that basis, additional institutional adjustments need to be made to address issues of fair competition and the equitable sharing of tax revenues; this in turn depends on clarifying the existing system’s formation, operating mechanisms and shortcomings, distinguishing old and pseudo-problems from new and real problems, and then discovering solutions in a targeted way.

The OECD has a head start studying DST and has proposed some guiding opinions, but when it comes to applying DST, each developed country is insisting on its own way. How do you see this problem?

The OECD had an early start in this field and has produced many reports. For example, since the global financial crisis, the OECD has submitted the tax haven issue to the G-20, followed by rules for base erosion and profit shifting (BEPS) and then rules for the Automatic Exchange of Information on tax matters through foreign bank accounts. Now they are also presenting reports on DST analysis and research.

On the whole, the OECD has put forward two important principles. First, taxes should be levied in the place where value is generated or created. Second, customers are the basis of consumption, so the customer base is also a critical source of value generation and growth. Without customers, there is no consumption and value cannot be realized; thus the place of consumption (or market country) should collect the tax revenue. I agree with the two principles, but there are many operational problems that cannot be so easily solved.

I have simplified the OECD’s specific DST recommendations into three points according to my own understanding. First, according to the BEPS rules, entities should be established in the market country and tax avoidance through internal pricing should be prevented; second, a new digital business tax can be introduced to enable the market country to collect profit tax from some service providers (even if there are no entities established in the country); third, parties must be kept from engaging in improper competition by setting excessively low corporate income tax (CIT) rates. If either the market or home country introduces an excessively low rate, the other side can levy supplementary taxes. The first point is hardly up for debate; it has a broad range and little specifically to do with internet services. The second point is vague in terms of principles, the tax base and tax rate, with strong flexibility and poor operability. The third point is also broad-based and not targeted, which may drive the game to evolve and generate new situations. In short, none of these are ideal. They have just arisen from initial discussions. We should use them as points of reference, but then move beyond them.

France is the first country to make a decision to enforce a DST. Considering that this may result in conflicts and even retaliation, what are its prospects?

France is currently imposing a 3% DST. It may resemble a business tax (BT), but it has some fundamental problems. It also lacks a credible basis for identifying the tax base and tax rate. Its DST is neither levied on the supply chain nor on sales volume and prices. It is somewhat similar to arbitrary tariffs, which can easily trigger tariff wars — for example, trade and tariff retaliation from the U.S. — and escalate existing conflicts. The OECD does not quite agree with France’s DST.

In fact, France knows what it is doing: making the opening move in order to gain the upper hand in a later game. France does not necessarily believe that DST is an ideal solution. This tax may have a hard time existing in the future.

|

The DST issue is wide-ranging, involving new business models, new tax categories and revenue ownership, so there are likely to be divergent views. In your opinion, how can we get to the key points of research and discussion?

First, as I mentioned earlier, digital services ought to be taxed. This point is not controversial, because the digital economy — just like other economies — should be taxed so long as there is activity and revenue there. Public finance is supported by everyone, so everyone is obligated to share the burden, and it should be shared in a way that is fair.

Second, taxing digital businesses has to do with fair competition. Designing a tax system conducive to fair competition is a complex process. Taxing economic activity requires the real cost and profit calculation, and reliable accounting. There are different types of tech giants — online e-commerce, search engines and social networks, as well as targeted advertising, data sales and intermediaries — and each presents different problems for taxation. The main issues should be drawn out precisely for discussion.

I think there are two real difficulties with DSTs. First is that because internet platforms exceed geographical boundaries and give rise to new business models and pricing methods, it is harder to identify added value, determine the locations of producers and consumers and quantify consumption value. For example, some digital platforms primarily or largely rely on advertising revenue, which is not produced in the location of the consumer market. As another example, the way platforms acquire customers is through free services, but they may gain indirect revenue and profits in a third business or through the rise in their share prices, which cannot be easily calculated according to the location of value creation.

Second, the existing tax system ensures that CIT can be collected from the digital economy, but the problem is determining tax ownership. In the current global fiscal and tax systems, tax avoidance and anti-tax avoidance are old problems. To a large extent, they are not unique to digital services. The G-20 is currently working on improving corresponding rules. Prior to the intensification of globalization, cross-border tax ownership was not that prominent and there was little practical experience. But among major world economies, there is a wealth of practical experience and analysis for reference when it comes to distributing taxes between the central and local governments, between states and between provinces.

In addition, stances should be improved to encourage rather than inhibit multilateralism and globalization. The application of DST must avoid aggravating friction and conflicts.

Does the rise of internet platforms mean that existing financial accounting and tax systems are out of date and need to be eliminated? Or can we simply correct partial failures to adapt?

Public finance and tax theory has been developed over a period of many years, equipping the economy with a solid foundation for handling taxation and fair competition. Beyond that, it has been closely linked with the financial accounting system. First, all taxes are based on real economic activities and their accounting. In the case of traditional CIT, a company gains income by selling its products or services (a value-added tax (VAT) is paid during sales). After deducting costs and paying factor fees (for labor and capital), the company gains profits; last, it needs to pay profit tax (CIT). After profit tax payment, the company distributes dividends to shareholders. Regarded as personal income, shareholders need to pay a personal income tax (PIT) on these earnings. A capital gains tax (CGT) should be paid for cashing out if equities appreciate. The whole process is based on accounting. That is, the old corporate tax model is designed to deal with taxation and fair competition in the traditional economy. Some tech giants and internet companies do in fact pay formal taxes through this channel. However, the traditional model is out of step with new business types and needs to be upgraded. People believe that insufficient tax payments or unfairness regarding the place of taxation should be handled in different categories, and that there should be differential treatment for the business and financial affairs of social platforms, search engines, e-commerce, targeted advertising, data sales and business intermediaries.

What challenges do the new tech giant and internet company models pose to taxation?

The new models of some internet platforms, especially when it comes to pricing, are very different from that of the traditional economy. In terms of taxation, there are three business situations causing problems for tax collection and tax revenue attribution.

The first situation is expansion of the customer base through advertising. Advertising is internet platforms’ main source of revenue, and customers are the source of the advertisements’ value. The problem is how to accurately determine the location of customers. Some suggest using the number of active customers, but even among this group, what activity and the degree of activity vary widely; others suggest using the click-through rate, but many advertisements can be seen without clicking. In the past, print media and television also relied on advertising, but the method, quantity, value and especially the orientation of that advertising are incomparable to that on internet platforms. The main channel for cross-border advertising was advertising on local media and in the local language within the country where a customer was located, and the advertising fee was basically paid to that country. But nowadays, internet platforms have greatly facilitated cross-border advertising. Advertisements can be easily made in different languages without needing to pay advertising fees to the target market country.

The second situation is the expansion of the customer base by massive financing or subsidizing products to give away or sell at low prices. In these cases, profitability is mainly realized from the future value of customers and data accumulation. In the past, indirect taxes on the sale of a product or service were paid according to the sales amount (sales price multiplied by sales volume). Nowadays, because products are being subsidized, sold at low prices or given away, very few indirect taxes can be collected. It should be noted that sales amount is not only the basis for indirect taxes; it is also the basis for location data on where consumption occurs. It is no wonder we have trouble determining where value is created. There are two ways to make profits in the future. First is if a winner-takes-all market develops, prices can be raised by virtue of the scale effect. Second is if the customer base is expanded, profits can be gained by leveraging a third business, selling customer resources and data or even selling the whole company to a third party. The practice of dumping first and then profiting by way of the scale effect has been used in certain industries (such as integrated circuits) in the past, but with the emergence of internet platforms — especially social network and search engine platforms — it has become commonplace. Subsidies are included in the business operation model (after all, these services have a cost), including the burning of investors’ cash. For the sake of fair competition, dumping and subsidies are severely restricted in international trade. World Trade Organization (WTO) rules promise counteractions against dumping and subsidies (including direct subsidies and cross-subsidization). China’s systems for ensuring fair trade operate according to the same principle. However, the development of digital business and popularization of the subsidy model will have a huge impact on fair competition and taxation.

The third situation is to gain profits through publicity, creating concepts and generating prestige. This works on capital market operations and the appreciation of assets. In the traditional economy, equity investors or insider shareholders mainly rely on increasing net sales revenue to increase their price-to-earnings ratio (P/E). According to past theories, changes in a company’s equity value or stock price are forecasted according to its P/E. In other words, the share price is roughly proportional to earnings per share. In other words, if there is growth in a company’s earnings per share, its share price will also go up, thus allowing equity investors or insider shareholders to benefit from dividends and stock prices. The new model, however, disconnects the share price from earnings. A company can increase its share price by other means, such as increasing its market share. After the market value goes up, a company can profit by selling equity. This is the only link where taxation may occur and, at present, the only relevant tax is the CGT, which is immature and conducted differently by country. This kind of tax should be studied further.

Overall, the new model adopted by internet platforms constitutes a partial rewrite of the traditional tax model. The traditional economy adheres to the standards of accounting: supply and demand relations are reflected through sales and in turn help determine pricing; added value is calculated according to input-output and cost accounting, with rewards given to factors, and the factors are then taxed. But under the new model, pricing is no longer a reflection of fair competition, the balance between supply and demand, or fair value, and with the loss of essential information on the location of value creation, difficulties emerge.

Recently, data has been suggested as a new production factor. Do you think we should design a factor income tax for data, like other factors of production?

Taking big data and digital processing resources as factors of production seems like a fresh idea, but it’s actually quite problematic. As of now, data cannot be treated the same as factors of production like capital, labor and land, nor considered a negative externality as pollution and carbon emissions; thus it is impossible to apply either kind of tax — for factor income or a negative externality — to data.

To a certain extent, big data and big data-based processing behave more like inputs; although somewhat different from raw materials and parts, they play a more critical role by amplifying effects in combination with other factors. Metaphorically speaking, in the chemical and biological industries, once catalysts and enzymes are put into other materials, they can bring about a sharp reaction, but they are not factors of production. Therefore, data should be treated as an input, and this is in line with existing accounting.

Zhou Xiaochuan

In the past, indirect taxes, such as VAT and sales tax, could be levied either at the production or consumption link. This is no longer the case under the new internet platform model, resulting in unfair competition and distribution. In this case, should we consider DST in terms of designing a new BT?

The basic principle of taxation is to levy taxes based primarily on income with normal costs deducted — in other words, to levy a tax on net income. In some countries, CIT, PIT and CGT are all taxed on the basis of net income, but as a direct tax, income tax is quite complex and there are many ways to evade it. In contrast, indirect tax is collected in production and sales links. Ultimately, the economic burden of the tax still lies with the consumer’s personal income, but collection has moved higher in the chain (which is why it is called an “indirect” tax), and tax revenue belongs to the place where consumption occurs.

Traditionally, cross-border business mainly involves indirect taxes, so there is no problem of tax attribution. VAT is levied on the price of a product or service at each stage of production, distribution or sale. There are VAT rebates in the exporting country, and the product or service competes internationally with zero indirect tax; for the importing country, VAT is levied by customs. Some countries implement a sales tax, from which exports are exempt, but imports are taxed accordingly at their sites of consumption. This is also fair in international competition. Theoretically, sales tax is not as advanced as VAT. But neither of them runs into problems in cross-border trade. They coexist internationally without substantive dispute. This solves most of the problems in traditional trade and reflects a logic where consumers as the ultimate bearers of indirect taxes’ economic burden and tax income belongs to the place of consumption.

In addition, tariffs and consumption taxes are also kinds of indirect tax. The latter are levied on negative externalities (like the oil and gas industries) or products whose consumption is discouraged (like tobacco and alcohol). There are also tariffs and consumption taxes on luxury goods, which nominally help regulate income distribution. There are some disputes over these two kinds of tax, but generally speaking, they have little to do with the digital economy and DST. So far, tariffs and consumption taxes have not been applied to digital platform companies or their products.

This explains why there have been few disputes over the fairness of taxation in cross-border transactions: under the indirect tax system, taxes are refunded in export and collected upon import, and the competition in the international market is zero-rated. However, if following this system, it would be difficult to design a new indirect tax for digital platforms. Because some digital services are free of charge, and sales revenue and value added are unknowable quantities; even if there is an actual value added, it would be very difficult to confirm where it occurs quantitatively. If using BT rather than VAT, a zero sales price would also mean unknowable turnover, making it difficult to determine the tax base and tax rate.

DST is designed according to a principle of fairness. How should we approach fair trade, fair competition, fair distribution and other issues from the earlier period of globalization? Can we apply the old thinking to the globalized digital economy?

First of all, according to the theory of public finance and taxation, the purpose of taxation is public expenditure, and tax revenue should be used for public expenditure. Second, taxation should reflect a kind of fairness, but taxes should not be the only measure responsible for upholding fairness. By this logic, the burden of public expenditure should be borne by everyone fairly (though the meaning of “fairly” requires interpretation). In addition, certain taxes — particularly the progressive individual income tax — can play a role in the redistribution of income. Rather than relying on taxes alone, various systems and policies are needed to realize fair trade, fair competition and fair distribution and to regulate redistribution.

To ensure fair competition in goods and services in a comprehensive sense, business competition itself also needs to be regulated. For cross-border competition, this involves relevant rules of the General Agreement on Tariffs and Trade, the General Agreement on Trade in Services and the WTO. All parties compete in the international market with zero indirect tax and restricted subsidies (as explicitly stated in the rules of competition) as well as countervailing and antidumping measures. This means that no economies can use subsidies as they please or seize market share by dumping; if they do, all other economies may respond with trade remedy measures. The WTO has also established a mechanism for settling trade disputes. However, many countries lack clear countervailing and antidumping systems to safeguard fair competition in their domestic economies.

As mentioned earlier, a significant portion of internet platforms’ digital services involve subsidies. This problem should be solved by business policies, not by DST or other taxes. The subsidy problem also hinges on the accuracy, openness, transparency and supervision of the financial and accounting system of a company and its whole supply chain.

Some inequities are the result of human factors or inadequate law enforcement. Will this problem become more prominent in the digital economy?

Indeed, some discussions have indicated the adverse impact of human factors in the process of formulating and implementing certain policies on fair competition, especially within the online e-commerce industry. Objectively speaking, China has established a relatively fair VAT system over years of practice and optimization. But in the formulation and implementation of specific policies, China has reduced or exempted VAT for online e-commerce in the past. Some have complained that it was unfair to levy VAT on the offline retail industry while exempting it for e-commerce. Although VAT was later imposed on e-commerce, different levels of collection still form a gap between offline retail and e-commerce. The different tax exemption thresholds for offline retail and e-commerce also cause unfair competition. Merchants tend to fit their scale to exploit policy loopholes and avoid government taxes. Duty-free stores, special tax rates and other differential policies also result in inequities across industries and regions. All these factors should be carefully taken into account. Of course, unfairness also exists where fair rules are poorly implemented. These issues are neither new in nature nor specific to the digital services industry, so they should not be tied to the DST issue too closely.

How should the widespread problem of tax avoidance be addressed? Is this also a concern with the digital economy?

Cross-border tax avoidance is actually a longstanding problem; there is an ongoing contest between tax avoidance and anti-tax avoidance. Many consultation companies and law firms even provide tax avoidance services. In general, there are two types of cross-border tax avoidance. One is where multinational corporations (MNCs) falsify reports of internal prices and costs, mainly to evade CIT and partially PIT. This problem is not unique to digital business. The other type has to do with atypical MNCs. Currently, the major online platforms in the U.S. are not traditional MNCs, but actually engage in a number of multinational operations. Although they exhibit tax avoidance behaviors, the contradiction is not so salient. However, digital platforms’ introduction of a new model has made for new challenges, making the contradiction more obvious. Nevertheless, the problems under discussion here may not be entirely new, nor are their solutions.

Since the global financial crisis, countries around the world have been facing a certain level of difficulty in finance, making cross-border tax avoidance all the more important. The G-20 and the OECD made great efforts and successively formulated three rules: The first targets tax havens (THs), opposing excessively low or zero income tax as a way to attract companies and individuals; the second is to cope with BEPS issues; the third proposes automatic exchange of information (AEI) and common reporting standards for individual accounts opened and deposits in overseas banks, requiring information for exchange generated by banks’ computers to conform to unified standards and be shared automatically.

When studying DST issues, we must distinguish the TH, BEPS and AEI issues that have already been addressed from those exclusive to the transnational business of digital platforms. If it is an old issue (that may, of course, present itself in new forms), then there’s no need to set up a new tax category for it or treat it separately from the existing economic problem. At the very least, there is no need to discuss it in depth in relation to DST, as it would spread the topic too wide.

Can the design concept of DST be separated from revenue and profit? What lessons and experiences can we take away from tax theory and practice?

From the perspective of national sovereignty, every country has the right to determine its own laws, categories, bases and rates for taxes. Thus tax systems vary by state. In the process of globalization, different countries’ tax systems gradually develop toward convergence; inappropriate tax categories are gradually switched out for ones that are more popular worldwide.

As mentioned earlier, income tax and VAT are ultimately taxes on net income. In the past, some taxes were not derived from net income, leading to price distortion or taxation even in cases of deficit. Sooner or later, such unreasonable taxes will be eliminated. In the 1980s, for example, China implemented a product tax, which was unreasonable as it was the result of China’s transition from the planned economy period. After the VAT reform in the 1990s, China still relied on BT for about 20 years, levying on the service industry according to gross income. Causing problems like repeated taxation, unreasonable tax burdens and price distortion, the product tax and BT were gradually weakened and finally eliminated. Transforming BT into VAT for the service industry was actually proposed when China conducted VAT reform in 1994. This concept would later be known as “replacing BT with VAT” and comprehensively implemented nationwide in 2016. DST should not be designed on the basis of backward tax categories.

Some people think that China should establish DST to make up for unsatisfying VAT. Is this tenable?

Most countries in the world have adopted a VAT, but results have differed. Some countries have introduced a variety of subjective tax reductions and exemptions, or complicated multilayered taxes, or have implemented VAT poorly, which hurts the impact even of a good tax. China has been transforming from a planned economy into a market economy. In the early stages of this process, it was said that the focus of economic control and regulation should shift from mandatory planning to the use of economic leverage — in other words, the use of price formation, tax categories and rates, interest rates and exchange rates. At the time, this was a progressive and understandable concept, but many years later, many officials were still using preferential policies for tax reductions and exemptions to attract investment and encourage or restrict certain industries’ development. At this point, “preferential policies” are actually harming the principles and operability of the tax system, producing loopholes, encouraging tax avoidance and generating inequities. There is no way DST can completely make up for these shortcomings. Research and evaluation are needed to correct improper tax reductions and exemptions. More focus should go toward maintaining a market that is conducive to fair competition.

In addition, China has been implementing the existing domestic tax distribution system — which deals with tax revenue distribution between the central and local governments — for more than 20 years, so there have been some changes. When the tax distribution system was introduced in 1994, it included a policy incentive to moderately increase the centralization of the central government’s finance, which has since been achieved. Later, China found out local governments’ fiscal revenue was relatively low and there was a lack of self-discipline. One of the approaches to increase local fiscal revenue is to distribute VAT while allowing local governments to collect sales tax. This approach can be considered for DST, but I think it needs to be implemented with caution. A consumption or sales tax can be used as a small-scale supplement, for example, in the case of some negative externalities, health hazards and so on. Any large-scale application would likely threaten the credibility, effectiveness and fairness of VAT as the core indirect tax. It may do more harm than good. Defects in the proportion of tax distribution between the central and local governments should be improved by focusing on the tax distribution system itself. DST is not necessarily a solution for these defects.

As mentioned earlier, advertising is a new model for internet platforms’ revenue. How should cross-border advertising revenue and ownership of relevant tax revenue be managed?

In fact, it is relatively easy to deal with tax from advertising revenue. The first is to calculate the net advertising revenue and clarify the geographical distribution of advertisements that can influence consumers. For companies that rely almost exclusively on advertising revenue, applying the income tax is sufficient; for companies with diverse sources of revenue, a special tax can be established for their net advertising revenue. It should be noted that, except for those appearing in formal advertising spaces, search engines’ ranked results (if they are paid) and informal pop-ups in certain applications should all be regarded as targeted advertising. Some have proposed using the active user volume or click-through rate as tools to map the geographical distribution of advertising. If this fails to produce satisfying results, there is another approach — suppliers can disclose the geographical distribution of sales in terms of the advertised commodity and service; after a summary of the advertising market’s geographical distribution, advertising-related tax revenue can be distributed accordingly by country and region.

In China, some have argued that tax revenue in the digital economy has caused inequality between regions. How can we respond to this problem?

I am also aware of this argument. As of now, the majority of China’s tech and internet giants are headquartered in just a few regions such as Zhejiang, Shenzhen, Shanghai and Beijing. However, their digital products and services are sold nationwide; consumption is not limited to the headquarters’ respective regions. That is exactly where regional inequality arises — the companies’ tax revenue, including the CIT, is only collected by their headquarters’ regions. There have been similar cases in other industries. In a large country like China, mega corporations engaged in transprovincial operations are listed as central government-managed state-owned enterprises (SOEs), and their income tax is classified as central government tax. For example, the three major telecom operators (China Mobile, China Telecom and China Unicom), three largest petroleum companies (PetroChina, Sinopec and CNOOC) and four major state-owned banks (ICBC, ABC, BOC and CCB) are all central SOEs, meaning they are responsible for paying VAT to whatever region in which they operate. It is worth noting that VAT goes to both central and local governments. Local employees pay individual income tax to their local government. Central SOEs pay CIT to the central government. In this way, local governments may be less discontented, although it is hard to say they are totally satisfied. The part of taxes that go to the central government will be used for central government expenditures on national defense, diplomacy and so on. If there is a surplus, the remainder can be refunded to local governments through transfer payments or allocated to income redistribution. Domestic practices for handling the central-prefectural and prefectural-prefectural relations within large countries are also applicable at the international level.

It is only reasonable for taxes to be levied by local governments in the places where economic activities are conducted or value created. But, when it is difficult to identify where that is, a better approach would be to incorporate a relevant tax into the scope of central taxation. Without central government intervention, local governments will find it extremely difficult to resolve conflicts of interest amongst themselves.

Many countries are facing economic dilemmas and macroeconomic difficulties. How does this impact DST?

Economic crises — specifically, the 1997 Asian financial crisis, the global financial crisis (GFC) beginning in 2008, the subsequent European debt crisis and the ongoing Covid-19 pandemic — have worsened most countries’ financial situations, increasing deficits and sending ratios of public debt to GDP soaring, even above 100% in many countries.

Under such circumstances, countries are likely to approach tax revenue as a way to improve their financial situations. In the 1990s, developed Western countries implemented a number of plans, including the green development, poverty reduction and millennium development plans, which initially appeared quite generous. As time went by, however, the financial outlook became increasingly pessimistic and public funds began to run out, especially during the GFC. The U.S. was not the only country to spend vast sums on bailouts; the U.K., the Netherlands and Belgium were offering similar assistance.

Although finance still faces difficulties, there is the advantage of extremely loose monetary policy, with low and even zero or negative interest rates. Thus the cost of fiscal debt extension remains very low, and spending can still be relatively generous. However, low interest rates are unlikely to last forever. Once they increase, the cost of debt extension will be high. By that time, countries will have greater motivation to compete for tax revenue and DST ownership will be hotly contested. With this in mind, we should make full considerations and formulate a plan.

In the context of globalization, how can we deal with countries’ scramble for tax revenue such as DST?

As globalization continues to develop, global public expenditure and its sources can be compared to the relationship between the central and local economies in a major country.

At the global level, all countries have independence in terms of sovereignty and autonomy. But, as globalization advances, countries are increasingly aligned by common interests and challenges — whether in trade, investment, climate change, income distribution, poverty reduction, green development, joint response to the pandemic or, for some countries, high levels of debt. The impact of the pandemic has only accentuated some countries’ debt issues. Moreover, any time an international financial crisis breaks out, panic is likely to spread among countries. Under such circumstances, all countries should make concerted efforts to curb its spread. All such problems require joint international action, which should be organized by the international community with public resources. There has been evidence. Since the GFC, rounds of fundraising have been organized. In particular, the International Monetary Fund (IMF) has carried out rounds of negotiations through the G-20 to seek new resources and call for countries to make contributions. Therefore, although the global financial system is based on sovereign countries, the global expenditure (including the funds of international organizations) has been increasing due to the pattern of globalization and its deepening development. It is noteworthy that although the Trump administration has attempted to “withdraw” from the pattern, which has upset all other sides, the trend of globalization is unstoppable.

But, where do the funds for global expenditure come from? We cannot find out relevant regulations yet. As there is a lack of such an intervention instrument like the central tax in the world, disputes and evasiveness easily rise among countries when it is time to shoulder responsibilities. The GFC was induced by the U.S.’ subprime mortgage crisis, as we know. But, when the IMF mobilized all countries to make contributions, the U.S. escaped. Furthermore, in the face of high debt, countries are in dispute over who is responsible for paying. Supposing that all countries are required to pay the central tax or something alike, and the amount is small, some problems would be easily solved.

From the perspective of globalization, what other issues should be paid attention to in the design of DST?

It is widely believed that when designing the DST, the contributor and the beneficiary of value should be reflected on the world map. For cross-border economic activities, the tax revenue should be attributed to the region where value is created, even if it is not cross-border per se, such as in large countries’ domestic economies (like China and the U.S.). Although the producer and demander are within a national territory, disputes remain over who is entitled to collect tax revenue because of the tax distribution system or fiscal federalism. There needs to be a way to resolve these disputes. In designing DST, we should consider the following questions:

First of all, should DST fall within the scope of indirect tax or direct tax? In view of the digital services market’s current absence of measures to limit subsidies and dumping, indirect taxes are less likely to work. On the supplier side, it is nearly impossible to find a good method for measuring the tax base; on the consumer side, the initial purpose of some European BT proposals is not to make local digital consumers bear some of the tax burdens, and again, there is no workable method of measurement. Therefore, targeting net income and income tax should be a more feasible approach with feasible measuring methods. For tech giants and internet platforms, input costs and gross income — which includes income from advertising, customer acquisition and data transfer — are computable; their local employees are required to pay individual income tax to the local government, and there is also a set of regulations to calculate the capital expenditure. This means that the calculation of income tax is relatively reliable, as the current accounting regulations cover major aspects like revenue, costs and profit. Of course, it is likely that these companies are barely profitable considering the high cost of operations, subsidies handed out and acquisitions involved. A tax on corporate profits may therefore fail to match the company’s actual status.

Next, who is entitled to collect the income tax, and should it be shared? When it is difficult to accurately determine ownership of the income tax, in order to avoid friction, confusion, wrong taxation, duplicated taxation and other problems, we can refer to major countries’ tax sharing and finance systems and approach DST as a global central tax in terms of design. An international organization can be temporarily designated to take charge of the tax in its initial stages. As globalization develops and global issues proliferate, there is an inescapable need for global expenditure. Major countries in the global financial supply — most of which are also large and powerful countries — have already assumed a greater share of international obligations. Many international organizations also rely on contributions or donations from major countries. If, in the future, global public expenditure can be partially disbursed by global public taxation, it would also lessen the burden on major donor and contributor countries’ financial channels, helping maintain the liberalization and facilitation of trade and investment, demonstrating multilateralism and the gradual development of multilateral institutions. There needs to be a consensus that companies with a high volume of international operations should be, at some point, defined as global companies, such that their CIT is independent of the country in which they are incorporated. DST can also refer to the tax sharing system and be designed as a shared tax according to the approximate proportion of international business volume. Of course, this kind of “central tax” must be based on international accounting standards and international auditing. It should also be targeted at CIT, and not turned into defective taxes such as tariffs, product taxes or BT. In terms of its target industries, internet platforms should be the first to be taxed, because the threshold is the lowest for cross-border internet business. For MNCs in other fields, if the proportion of multinational business is large, taxation can also be implemented. For now, there are too few qualifying companies to meet the needs of global public spending. But addressing some of those needs is a start.

Finally, even if DST is introduced as a kind of global central tax, the question still remains of how to fully manage fair competition between the new digital platform economy and other industries. Therefore, we also need an approach for business policy, with rules on cash-burning, dumping and subsidies. For this, we can refer to the practices of the WTO on antidumping and countervailing, and normalize the order of competition with certain policy restrictions. This will also have a significant effect on reducing global or regional financial risks.

The ideas I’ve shared here, based on my personal observations of G-20 topic operations over many years, may be of some value to research.

Contact translator Denise Jia (huijuanjia@caixin.com) and editors Bob Simison (bobsimison@caixin.com) and Lin Jinbing (jinbinglin@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Follow the Chinese markets in real time with Caixin Global’s new stock database.

- PODCAST

- MOST POPULAR