Caixin ESG Biweekly: Energy Storage, Carbon Futures and Climate Change Risks

In Depth

China Plans to Double Energy Storage Capacity Within Five Years

China would rapidly expand its energy storage sector over the next five years under a new draft plan. The proposals aim to use emerging technologies to add 35 gigawatts to China’s energy storage capacity by 2025. Read more about the promising news for the country’s battery manufacturers here.

Top News Items

The central bank pledged to incorporate climate change risks into its macroprudential policy framework. A carbon futures market is being mulled over.

[Policies]

Ministry of Ecology and Environment (MEE)

On April 15, the MEE issued a new regulation tightening environmental impact assessments for high emissions and energy-consuming projects, which will have an impact on six industries. The new regulation —The Guiding Opinions on Strengthening Prevention and Control Over Ecological Environment Sources of High Energy-Consuming and High Emission Projects (Draft for Comments) (关于加强高耗能、高排放项目生态环境源头防控的指导意见(征求意见稿)) — imposes stricter controls on environmental access for the construction, reconstruction or expansion of high emissions and energy-consuming projects, requiring these projects’ environmental impact assessments to contain a pilot assessment of their carbon emissions impact. The draft also requires all regions to formulate corresponding pollutant reduction plans for petrochemical, coal chemical, coal-fired power (including thermoelectricity), steel, non-ferrous smelting and other projects to clarify regional reduction measures and identify liable parties. The new regulation focuses on six industries — thermal power, petrochemicals, chemical engineering, steel, building materials and non-ferrous smelting — and attempts to apply control requirements specifically per industry categories.

People’s Bank of China (PBOC)

On April 15, the PBOC and IMF co-hosted the High-Level Seminar on Green Finance and Climate Policy. PBOC Governor Yi Gang said that the central bank plans to launch tools supporting carbon emissions reduction and provide low-cost capital for carbon emissions reduction. The PBOC is exploring the systematic inclusion of climate change factors in its stress tests for financial institutions. It also plans to gradually incorporate climate change risks into its macroprudential policy framework. The PBOC has made quarterly assessments of financial institutions’ green credit and green bonds while encouraging them to self-evaluate and manage their environmental and climatic risks. It will also strengthen green finance support through commercial credit ratings, deposit insurance rates, collateral for open market operations and more.

By the end of 2020, China’s green loan balance had reached $1.8 trillion and its green bond stock $125 billion, making them the largest and second-largest in the world, respectively. More than 40 carbon-neutrality bonds have been recently issued, their total value exceeding $10 billion.

China Securities Regulatory Commission (CSRC)

On April 16, a CSRC spokesperson introduced the commission’s concrete measures for green finance development. First, it actively backs green and low-carbon financing. During the 13th Five-Year Plan (FYP) period, green and low-carbon enterprises raised a total of 1.9 trillion yuan ($290 billion) through IPOs, refinancing, listing and others. Second, it supports M&A and reorganization in green and low-carbon industry. During the 13th FYP period, emerging industries including new energy, new materials, energy conservation and environment protection generated a total of 2.9 trillion yuan from M&A and reorganization. Third, it strengthens listed companies’ environmental information disclosure. In the 2019 annual report season, 1,452 listed companies disclosed their environmental information. Fourth, it guides securities, funds and financial institutions to serve green financing. Between 2016 and late February 2021, 96 green-themed public-raising funds had been issued, with a duration scale of 221.9 billion yuan. Fifth, it explores the construction of the carbon futures market and guides the steady and smooth operation of the Guangzhou Futures Exchange. Sixth, it formulates and improves relevant international standards on green finance.

Shanghai Equity Exchange (SEE)

On April 14, the SEE officially launched its carbon neutrality index. The carbon neutrality index was designed with reference to mainstream carbon neutrality indexes and relevant concepts in the current market. The index sample includes a total of 190 listed enterprises engaged in energy conservation and environmental protection, new energy and other areas in the Share Transfer System (Exchange Board) and Science and Technology Innovation Board (New Four Board).

[Enterprises]

AXA SPDB Investment Managers, Penghua Fund, Fullgoal Fund

By April 14, the first batch of ESG ETFs had all received approval, including four products from AXA SPDB Investment Managers, Penghua Fund and Fullgoal Fund. As one of the strongest through lines in 2021, carbon neutrality has become a competitive factor in the A-share market. The first four ESG ETFs respectively track core indexes along this line — the CSI ESG 120 Strategy Index, CSI 300 ESG Benchmark Index and CNI ESG 300 Index. As of April 14, the market had a total of 135 ESG concept funds, more than 30% of which were issued after 2018. The average rate of return for ESG concept funds in the market over the past year reached 50.13%, 66.96% over the past two years and 69.63% over the past five years.

Bank of China (BOC) Wealth Management

BOC Wealth Management raised funds to issue the first “peak carbon dioxide emissions” wealth management product on April 8 of this year. Taking equity assets as the main line of allocation, it will focus on exploring investment opportunities in leading industry segments such as energy conservation and emissions reduction, new energy, environmental protection and green consumption. According to Chinawealth, the product — named “(Peak Carbon Dioxide Emissions) BOC Wealth Management – Zhifu (Closed)” — has an annualized performance comparison benchmark of 4.75%; its risk level is 3; the product term is 760 days; the minimum purchase amount is 1,000 yuan. Fundraising was conducted from March 31 to April 7.

[Insights]

Xu Lin: Carbon neutrality has strategic significance for China’s energy security and compels enterprises to innovate

Chairman of the China-U.S. Green Fund Xu Lin believes that because China’s traditional fossil energy is heavily dependent on imports, the energy transformation toward carbon neutrality is of strategic significance to China. On April 11, the “Climate Economy and Future Investment Trends & Bill Gates’ New Book Sharing” was co-hosted by the Citic Press Group and other agencies. At the meeting, Xu reported that China is dependent on foreign countries for approximately 73% of its oil and more than 40% of its natural gas, and that both of these figures are rising. If China’s transportation industry can be fueled by green power or hydrogen instead, the reduction in carbon emissions would be immense, but beyond that, it would also reduce imports of oil and natural gas to significantly improve China’s energy security.

Highlight

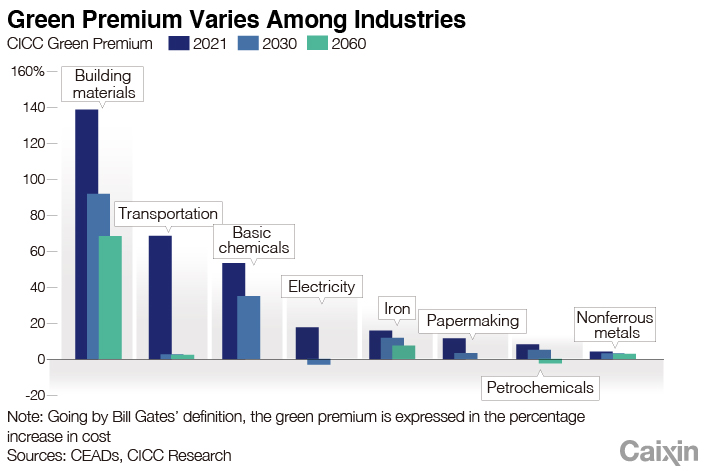

The green premium is the difference in cost between clean (zero carbon emission) energy and fossil energy for a certain economic activity. A negative green premium indicates that the cost of fossil energy is higher than that of clean energy (zero emission) — an incentive to switch to clean energy and reduce carbon emissions. Green premiums are highly structural and vary significantly across industries due to differences in technologies, business models and public policies. A study by CICC suggests that market prices are unable to provide sufficient incentives for a switch to clean energy in the eight industries, which collectively account for as much as 88% of total carbon emissions in China.

Contact editor Joshua Dummer (joshuadummer@caixin.com)

Read more Caixin ESG Biweekly here.

Get our ESG Biweekly newsletter and more delivered to your inbox.

Download our app to receive breaking news alerts and read the news on the go.

Caixin Insight, the research arm of Caixin Global, is a strategic advisory helping clients assess policy risk and macroeconomics in China.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas