Chart of The Day: China’s Fintech Players Await Their Fate

China’s big tech companies that made aggressive forays into financial services all have their eyes firmly fixed on the sector’s two dominant players — Ant Group Co. Ltd. and Tencent Holdings Ltd. — and how they are following regulators’ orders to overhaul their multibillion-dollar financial operations.

The cascade of new rules and regulatory action that have fallen on the country’s fintech industry since late last year mark a widening crackdown on the unbridled expansion by tech groups into financial services. They underscore growing concern among the authorities over potential systemic risks to financial stability and the outsized market power these companies have now built up.

|

|

|

Following a rectification plan imposed on Ant Group earlier this year, China’s top financial authorities summoned 13 tech companies, including Hong Kong-listed Tencent, to a meeting on April 29 and imposed a raft of stricter compliance requirements on their financial businesses. Regulators haven’t given a specific timetable for restructuring, rather they are waiting for the companies to submit their plans first, sources close to the matter told Caixin.

Most of the fintech groups involved are taking a wait-and-see approach. Rather than working out their own rectification plans, they are watching how Ant Group and Tencent structure their overhauls, according to multiple sources from some of the firms who met with regulators. The duo’s plans can then be taken as a template for others to follow, they said.

Read more

Exclusive: Tencent Ordered to Set Up Financial Holding Company

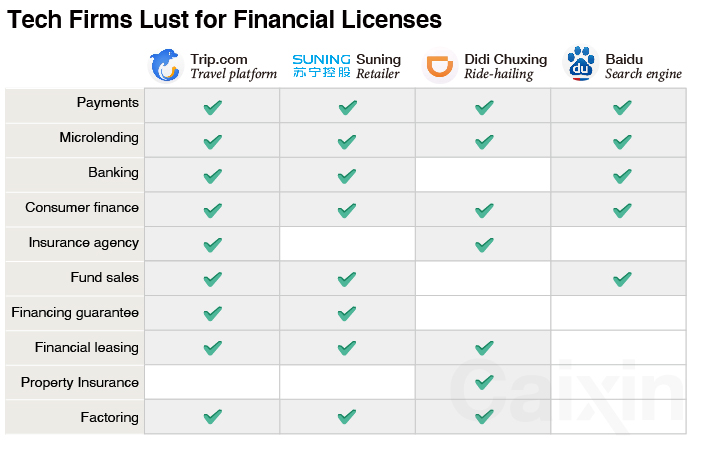

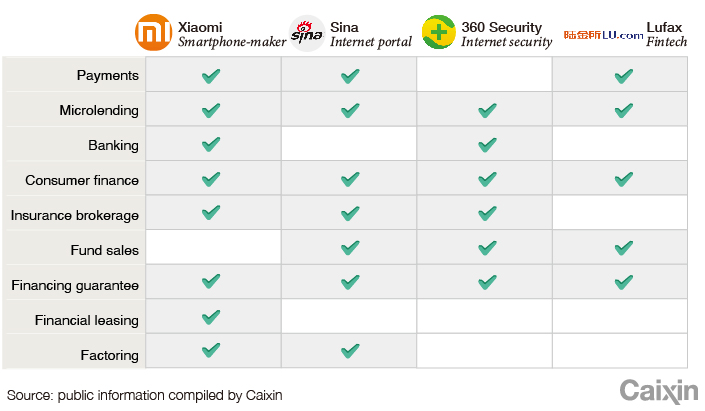

Tech groups called to the meeting include ByteDance Ltd., Lufax Holding Ltd., and the financial units of Baidu Inc., JD.com Inc., Meituan, Didi Chuxing, Xiaomi Corp., Sina Corp., Suning Holdings Group Co. Ltd., and Trip.com Group Ltd. Regulators made it clear that, just like Ant Group, they will need to obtain licenses to conduct financial services, delink other financial products from their payments services, apply for a license to conduct personal credit reporting business, and, for those who meet the criteria, set up a financial holding company to incorporate finance-related businesses.

Apart from 360 Security Technology Inc., all the companies have a third-party payments license. Some use the digital payment function on their platforms as a port of entry to attract users into more lucrative areas including consumer lending. JD.com for example links to its online consumer loan product JD Baitiao and online Chinese food-delivery giant Meituan also links to its microlending service.

“This kind of embedding can give users the wrong impression that consumer loan products are just another type of payment tools,” a source close to regulators said. “But the risk control mechanisms of credit and payment are different.”

Fintech companies involved in joint lending with banks and who take charge of promoting loans, carrying out risk management and assessing borrowers’ creditworthiness would be required to apply for a license under the proposed draft Measures for the Management of the Credit Reporting Business.

The new requirement to obtain this license means some tech companies may choose to cooperate with the major players in the personal credit reporting market that dominate the personal credit reporting market — Pudao Credit and central bank-backed Baihang Credit Scoring — and a new company being set up by Ant Group, some executives said.

The sweeping rectification now underway may mark the end of the existing fintech business model in which companies link lucrative financial products to their payments infrastructure, multiple insiders from tech companies said. In future, tech companies will focus more on offering micro- and small-business financial services.

The shakeup in the fintech sector is unlikely to unseat Ant Group and Tencent as the two dominant players, one source in the research department of a large fintech firm told Caixin. But other firms who emerge as winners in what is becoming an increasingly competitive market are likely to be those with a relatively full set of financial licenses who will focus more on microfinance, the source said.

Contact reporter Luo Meihan (meihanluo@caixin.com) and editor Nerys Avery (nerysavery@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR