Lithium Stocks Sizzle as Electric Vehicle Sales Leap 200% in 2021

Chinese lithium stocks have surged over the past month as the country’s booming market for electric vehicles (EVs) drives sustained demand for the metals at the heart of the batteries that power them.

Shares in domestically listed lithium miners have risen by half on average since the start of July, with some individual equities increasing in value by over 200%, according to Caixin calculations based on stock market data.

Investor bullishness has also sucked in companies that research and develop technologies that use lithium, with some recording stock price rises of more than 150% over the same period.

Behind the boom lies a supply squeeze fueled by higher-than-expected demand from China’s flourishing new-energy sector for lithium salts and other raw materials, said Chen Guanghui, a lithium industry analyst at the Beijing-based research firm Antaike, adding that the shortfall could persist as late as the first half of next year.

A key source of demand is the Asian nation’s auto industry, where sales of new-energy vehicles — a category that includes electric cars — leapt by over 200% in the first half of the year to 1.2 million units, according to the China Association of Automobile Manufacturers.

That uptake, in turn, is driving demand further up the supply chain for producers of lithium iron phosphate batteries and the companies that supply the raw materials to make the cells, a trend that is likely to persist through the second half of the year, said Yang Pu, a battery metals analyst at CRU Group, a commodities research firm.

Ganfeng Lithium Co. Ltd. (002460.SZ), the world’s largest lithium firm by market capitalization and a supplier of battery-grade lithium to global EV leader Tesla Inc. and other clients, has seen the price of its Shenzhen-listed stocks jump by 52% since July 1.

Over the same period, Tianqi Lithium Corp. (002466.SZ) has risen by 79%, Youngy Co. Ltd. (002192.SZ) by 113%, Shenzhen Chengxin Lithium Group Co. Ltd. (002240.SZ) by 48%, Yongxing Special Materials Technology Co. Ltd. (002756.SZ) by 50% and Jiangxi Special Electric Motor Co. Ltd. (002176.SZ) by 217%. All five of the companies are listed in Shenzhen.

On the R&D side, Shanghai-listed Keda Industrial Group Co. Ltd. (600499.SH) has gained 45%, while Shenzhen-listed Tibet Mineral Development Co. Ltd. (000762.SZ) and Jiangsu Jiuwu Hitech Co. Ltd. (300631.SZ) are respectively up by 93% and 153%.

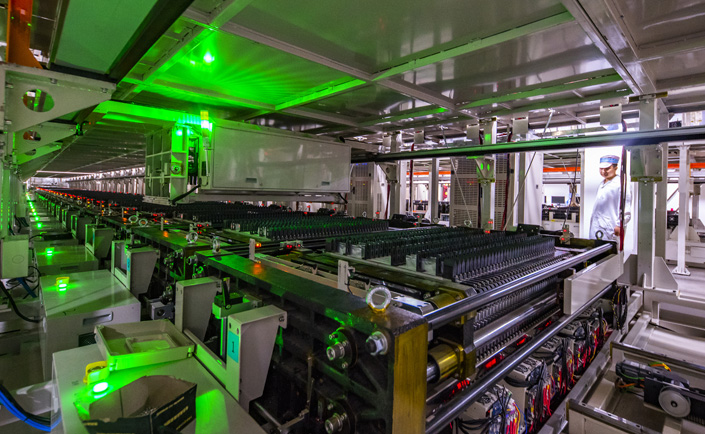

Ganfeng said in a stock exchange filing (link in Chinese) on Friday that it will spend a combined 8.4 billion yuan ($1.3 billion) on two projects that will make “new-type” lithium batteries, including new manufacturing hubs in the city of Chongqing and the eastern province of Jiangxi with a combined capacity of 15 gigawatt-hours.

The company did not specify what it meant by “new-type” cells, but said the Chongqing project would include a research institute providing technical support for “various solid-state batteries.”

The announcement underscored Ganfeng’s deepening push into the battery sector, after it obtained nearly 1 billion yuan in funding last week for its battery unit LiEnergy.

Contact reporter Matthew Walsh (matthewwalsh@caixin.com) and editor Heather Mowbray (heathermowbray@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Follow the Chinese markets in real time with Caixin Global’s new stock database.

Get our weekly free Must-Read newsletter.