China Carbon Watch: Trading Volume Bounces Back

Week at a glance (Sept. 6-10)

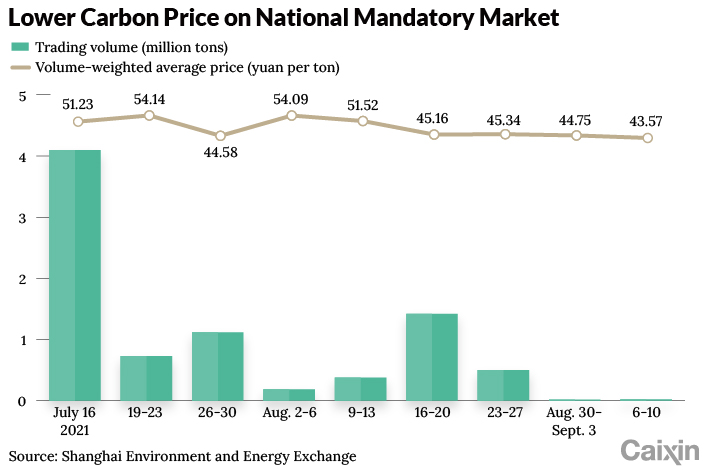

• China’s national carbon emission allowance (CEA) market saw some recovery in trading volume after the previous week’s decline. Total volume increased almost tenfold to 6,312 tons, with no block trades. The closing price decreased 1.5% to 44 yuan ($6.83) per ton. The downward trend in prices continued as traders held on to their credits, anticipating future rises once financial institutions are cleared to participate in trading.

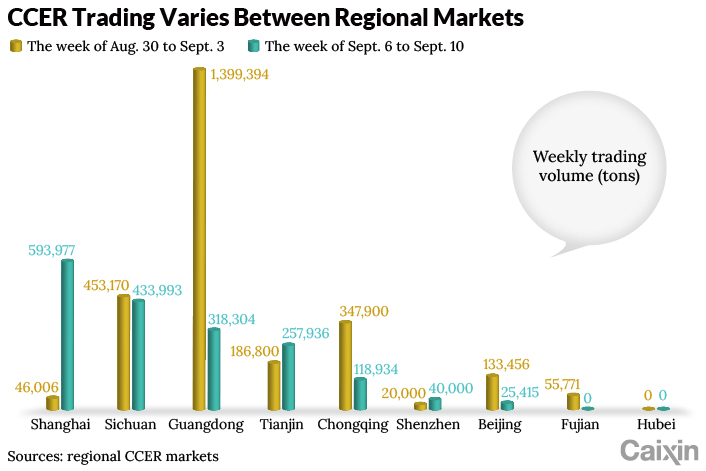

• The total volume of China certified emission reduction (CCER) credits decreased 32.3% to 1,788,559 tons, while individual markets remained volatile. Prices were mostly lower on the exchanges that make information available. Shanghai saw the most volume, likely due to the approaching Sept. 30 deadline for the 2020 compliance year.

• China launched a pilot green power trading scheme, with 259 entities trading over 7.9 billion kilowatt-hours (kWh) on the first day. A premium of 0.027 to 0.05 yuan per kWh was paid over local mid-to-long-term prices in the areas covered. It is not yet clear how this will impact the CCER market.

|

Carbon markets update

• Over the past trading week, the CEA market saw some recovery in activity from the previous week’s minuscule volume while prices continued to trend down

The national CEA market ended the week with the total volume up 859% to 6,312 tons, still near-zero compared to the volume experienced at launch. Block trades were absent for the second consecutive week. The volume-weighted average price for all trades was down 2.62% to 43.57 yuan per ton.

Emitters have not yet received all allowances to cover their 2019 and 2020 emissions, meaning there will be up to 5 billion more tons of CEAs to distribute before Dec. 31.

Non-covered entities, such as financial institutions and carbon asset managers, were initially expected to participate in trading from late September. This has been delayed to the end of the year to allow for all compliance companies to open accounts on the exchange.

• CCER markets’ total volume decreased 32.3%, while individual markets remained volatile

The total weekly volume across the nine regional pilot markets decreased to 1,788,559 tons. The Shanghai CCER trading increase was accompanied by a 150% increase in Shanghai emission allowance trading on the same market. This trend will likely continue as the compliance deadline approaches. The Sichuan exchange has been the most consistent, with weekly volume changes ranging from -20.0% to +5.5% in recent weeks. The Guangdong market accounts for 17.8% of the national volume, where compliance-ineligible CCER prices were down 42.2% to 7.04 yuan, and compliance-eligible prices remained steady. The Hubei market did not see any trading for the third consecutive week.

|

New CCERs have not been minted since 2017. Once the government restarts the issuance process, a flow of offsets is expected to be distributed to all the projects operating since then. As emissions trading scheme participants can use CCERs to count for up to 5% of their compliance obligations, demand is expected to be healthy.

Of the nine regional markets, only Shanghai, Beijing and Hubei display daily price information. Guangdong reports weekly averages each Monday. During the week, Beijing disclosed its offline trade prices for the first time. Shanghai discloses its cumulative total values, from which the offline trade price can be inferred. Guangdong separates the credits on its exchange based on compliance eligibility.

Read more

Caixin ESG Biweekly: No More ‘Campaign-Style’ Carbon Reduction Measures

Carbon market news

• Pilot green power trading market starts operations

State Grid and China Southern Power have started a market that connects energy buyers directly with renewable power projects. Initially just wind and solar energy producers, hydropower and other renewables will eventually be included. Immutable blockchain technology can trace the green energy units’ production, trading and consumption, with trading managed by the Beijing and Guangzhou power exchanges.

Global corporations such as Schneider, Tencent and BASF were active buyers on the first day of trading. It is not immediately clear how direct trading of renewable energy between producers and users will affect the trading of carbon credits on China’s markets.

Read more

Energy Insider: China Starts Trial of Clean Power Trading

Industry news

• China launches first offshore carbon capture and storage project

The project, launched last month by China’s National Offshore Oil Corp. in the Pearl River Delta, is designed to permanently capture and store 300,000 tons of carbon dioxide annually, removing an eventual total of 1.46 million tons. Government reports estimate that 1 billion to 1.8 billion tons of carbon dioxide equivalent need to be reduced through carbon capture, utilization and storage to meet their 2060 carbon neutrality goal.

• A global first: Carbon credit trade with emission reductions generated from Beijing’s mobility-as-a-service platform

The mobility-as-a-service platform managed by Gaode Maps (also known as AutoNavi) and Baidu provides carbon accounts for individual residents to earn credits through changes in their habits, like cycling to work instead of driving. Credits can be traded on an exchange for money or redeemed for material items such as cinema tickets or gift vouchers. Last week, a state-owned construction materials company purchased credits worth 15,000 tons from Gaode Maps. The value of carbon reductions from mobility alternatives is 0.06 yuan per kilogram of carbon dioxide, similar to the price of CEA traded on the Beijing Green Exchange.

Bai Bo is chairman and co-founder of the Cyberdyne Tech Exchange, a digital green exchange based in Singapore.

Contact editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

Get our free ESG newsletter.

- PODCAST

- MOST POPULAR