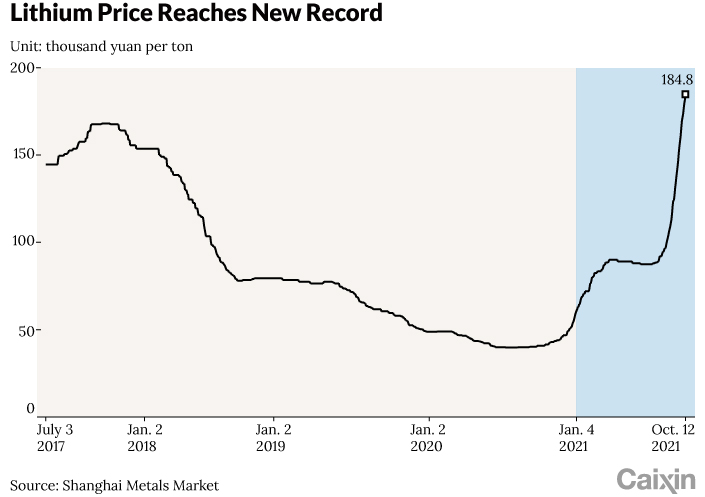

Battery-Grade Lithium Price Jumps More Than Fourfold to Hit New Record

The price of lithium for use in electric-car batteries has more than quadrupled in China over the past 12 months, touching a record high after bouncing back from last year’s near-historic low.

Prices for battery-grade lithium carbonate jumped 360% yearly to 184,800 yuan ($28,690) per ton on Tuesday, surpassing the record of 170,000 yuan per ton set in late September. Previously, the highest price for the metal was 168,000 yuan per ton, set back in 2017, metal research institute Shanghai Metals Market data shows.

Lithium carbonate is a key material used in batteries for new-energy vehicles (NEVs). Sales of NEVs also set a new record in September with more than 357,000 vehicles being shipped even as overall auto sales declined, according to China Association of Automobile Manufacturers data. China’s NEV sales surged 190% year-on-year in the first nine months.

However, as the lithium supply isn’t expected to expand in the near future, prices will remain elevated at around 180,000 yuan per ton until at least 2023, according to a Guotai Junan Securities analysis.

Soaring prices are burdening some smaller players in the battery-making industry that struggle to pass on their higher costs to carmakers. This has led some manufacturers to either cut output or stop taking new orders, a source inside the lithium industry told Caixin.

|

Meanwhile, some major firms are stepping up their efforts to secure their own supplies of lithium. In May, Shenzhen-listed Ganfeng Lithium Co. Ltd. (002460.SZ) bought out London-listed Mexican miner Bacanora Lithium PLC in a deal valued at up to 190 million pounds ($264 million) to get access to its Sonora project, which is among the world’s largest lithium clay sites. A Hong Kong subsidiary of Ganfeng spent another $130 million a month later to invest in a lithium mine in the western African country of Mali.

Contemporary Amperex Technology Co. Ltd. (300750.SZ) also made two deals in September. One of its subsidiaries paid $240 million for a 24% stake in the Manono project in the Democratic Republic of the Congo. A few days later, the battery-maker announced it would acquire Canada’s Millennial Lithium Corp. for C$376.8 million ($297.3 million) in cash, granting it access to lithium mining sites in Argentina.

On Monday, Zijin Mining Group Co. Ltd. (601899.SH) declared it will acquire Canada-based lithium company Neo Lithium for C$960 million in an all-cash deal.

Contact reporter Manyun Zou (manyunzou@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.