China Names and Shames 353 Private Firms Pretending to Be State-Owned

China’s top state-owned asset watchdog has announced a list of hundreds of private-sector companies masquerading as state-owned enterprises (SOEs), in a bid to help investors avoid being scammed.

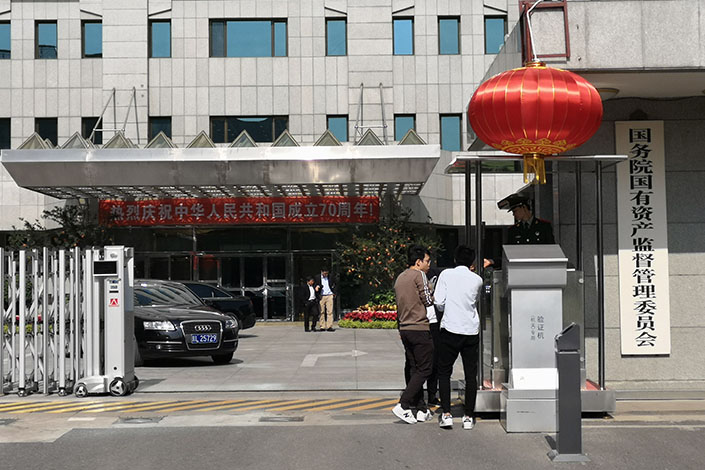

“Those companies and their subsidiaries are fake SOEs and have no affiliation or equity relationship with central government-supervised SOEs, nor any investment, cooperation or business relationship,” according to a recent statement (link in Chinese) released by the State Council’s State-owned Assets Supervision and Administration Commission (SASAC). “All their behaviors are irrelevant to the central SOEs.”

- MOST POPULAR