CX Daily: Didi’s Rocky Road for Moving Its Stock to Hong Kong

Didi /

Cover Story: Didi’s rocky road for moving its stock to Hong Kong

Didi Global may have to take unprecedented steps to carry out its plan to shift trading in its shares to Hong Kong from New York with the challenges ahead mounting.

The Chinese ride-hailing giant disclosed its plan to withdraw from the New York Stock Exchange (NYSE) and pursue trading on the Hong Kong stock exchange in a briefly worded statement Dec. 3, barely five months after its $4.4 billion initial public offering (IPO) June 30.

The offering was the second-largest U.S. share sale by a Chinese company, trailing only Alibaba Group Holding Ltd.’s $25 billion IPO in 2014. But Didi’s rush to push it through ran afoul of Chinese regulators, who launched a national security investigation of the company only two days later.

FINANCE & ECONOMY

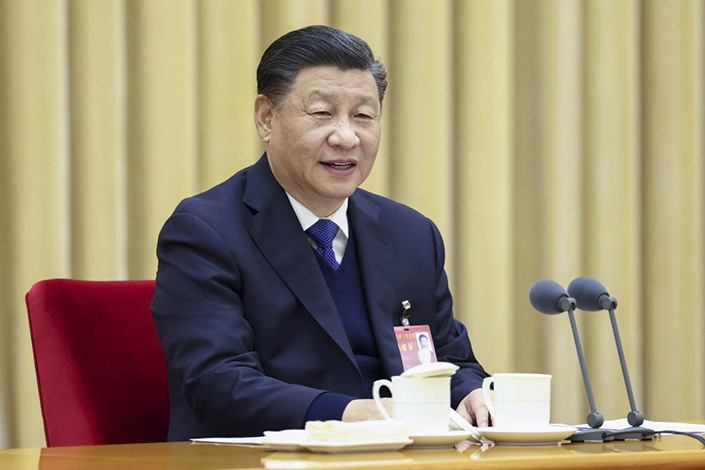

Chinese President Xi Jinping delivers speech at the annual central economic work conference.

Economy /

China sets stability as top priority for next year’s economic work

Chinese leaders stressed the importance of stable growth and stable macroeconomic policies at a key annual central economic work conference.

In a speech at the conference, Chinese President Xi Jinping reviewed the country’s economy in 2021, analyzed the current economic situation and arranged next year's economic priorities.

China’s economic development is facing “triple pressure” from demand contraction, supply shocks and weakening expectations, and the external environment is becoming increasingly complicated and uncertain, according to a statement released after the meeting.

Editorial: Stabilizing policies to stabilize growth

Ratings /

Credit ratings of over a dozen Chinese property firms withdrawn amid crisis

International credit rating agencies have withdrawn more than a dozen Chinese property developers’ ratings this year amid the liquidity crisis wracking the country’s real estate sector.

Moody’s retracted five such ratings, including for Tahoe Group; Standard & Poor’s retracted seven, including for Kaisa Group and China Aoyuan Ltd.; and Fitch withdrew six, including for Greenland Holding Group; according to Caixin calculations.

The withdrawals were either made due to the agencies’ decision that they didn’t have enough information to make a judgment or at the request of the property developer. This will weaken the developers’ ability to raise money on global bond markets, industry insiders and analysts told Caixin.

Stocks /

Shanghai and Shenzhen exchanges lay groundwork for registration-based IPOs

More than two years after China first introduced the rules for registration-based IPOs, the Shanghai and Shenzhen stock exchanges are laying the groundwork for a rollout across the A-shares market.

The two bourses recently proposed updated rules governing listed companies and new listings. The rules ask intermediaries to serve as “watchdogs,” update corporate governance requirements, and encourage companies to disclose information more effectively.

Mastercard /

Mastercard Asia-Pacific executive to take broader international portfolio

Ling Hai, a co-president of the Asia Pacific region of Mastercard Inc., will lead international markets for the American multinational financial services company as co-president next year. The move is part of a series of leadership changes to realign the firm’s international operations.

In this new role, Ling will “advance business strategy, sales, business development, product management and engagements with customers and regulators across Europe, the Middle East, Africa, Asia and Latin America” alongside Raghu Malhotra, now president of Mastercard Middle East and Africa, the company said in an announcement last week.

Quick hits /

China’s stats accentuate positive, play down negatives, former finance minister says

Binance Singapore drops application for local crypto exchange

BUSINESS & TECH

Unigroup had 296.6 billion yuan of assets and 202.9 billion yuan of liabilities as of the end of June 2020.

Restructuring /

State-backed investors beat out Alibaba for Unigroup

A consortium led by two Beijing tech-focused private equity funds beat out Alibaba Group Holding Co. Ltd. to become strategic investors in Chinese chip conglomerate Tsinghua Unigroup, the company said Friday.

The group led by Beijing Jianguang Asset Management Co. Ltd. and Wise Road Capital Ltd. will work with Unigroup to draft a restructuring plan to rescue the beleaguered group from a two-year debt crisis. The restructuring plan will need approval by creditors and the court.

Tutoring /

China’s capital offers free online tutoring to middle schoolers amid education crackdown

Beijing education authorities designed an online platform to provide free tutoring for the city’s roughly 330,000 middle school students as China’s capital tests government-funded supplemental education amid a sweeping national overhaul of the private tutoring industry.

The document, issued by the Beijing Municipal Commission of Education, notes that the platform would offer online tutoring in forms including one-on-one tutoring and livestreaming classrooms. All middle school students in the city would be able to access the services on nine school curriculum subjects from 6 p.m. to 9 p.m. daily except weekends and holidays.

Chips /

Auto chip developer SiEngine unveils its first smart cockpit chip

Wuhan-based car chip designer SiEngine Technology Co. Ltd. unveiled its first automotive-grade smart cockpit chip, which it says is scheduled to enter mass production and be installed in vehicles by the end of 2022.

The launch of the new system-on-a-chip (SoC) named DragonHawk 1, which will be made by Taiwan chipmaker TSMC using its advanced 7-nanometer (nm) manufacturing technology, comes as a global semiconductor crunch wreaks havoc on the automotive sector with many carmakers cutting their outlook for deliveries.

Quick hits /

Evergrande Chairman sells shares as Beijing controls narrative

Top equity funds in Asia are all buying China’s green stocks

GALLERY

China remembers Nanjing Massacre victims

Recommended newsletter for you /

China Green Bulletin Premium - Subscribe to join the Caixin green community and stay up to date with the most exclusive insights on ESG, energy and carbon. Sign up here.

Thanks for reading. If you haven’t already, click here to subscribe.

- PODCAST

- MOST POPULAR