China’s New Loans to Nonbanking Institutions Hit Nine-Year High

Listen to the full version

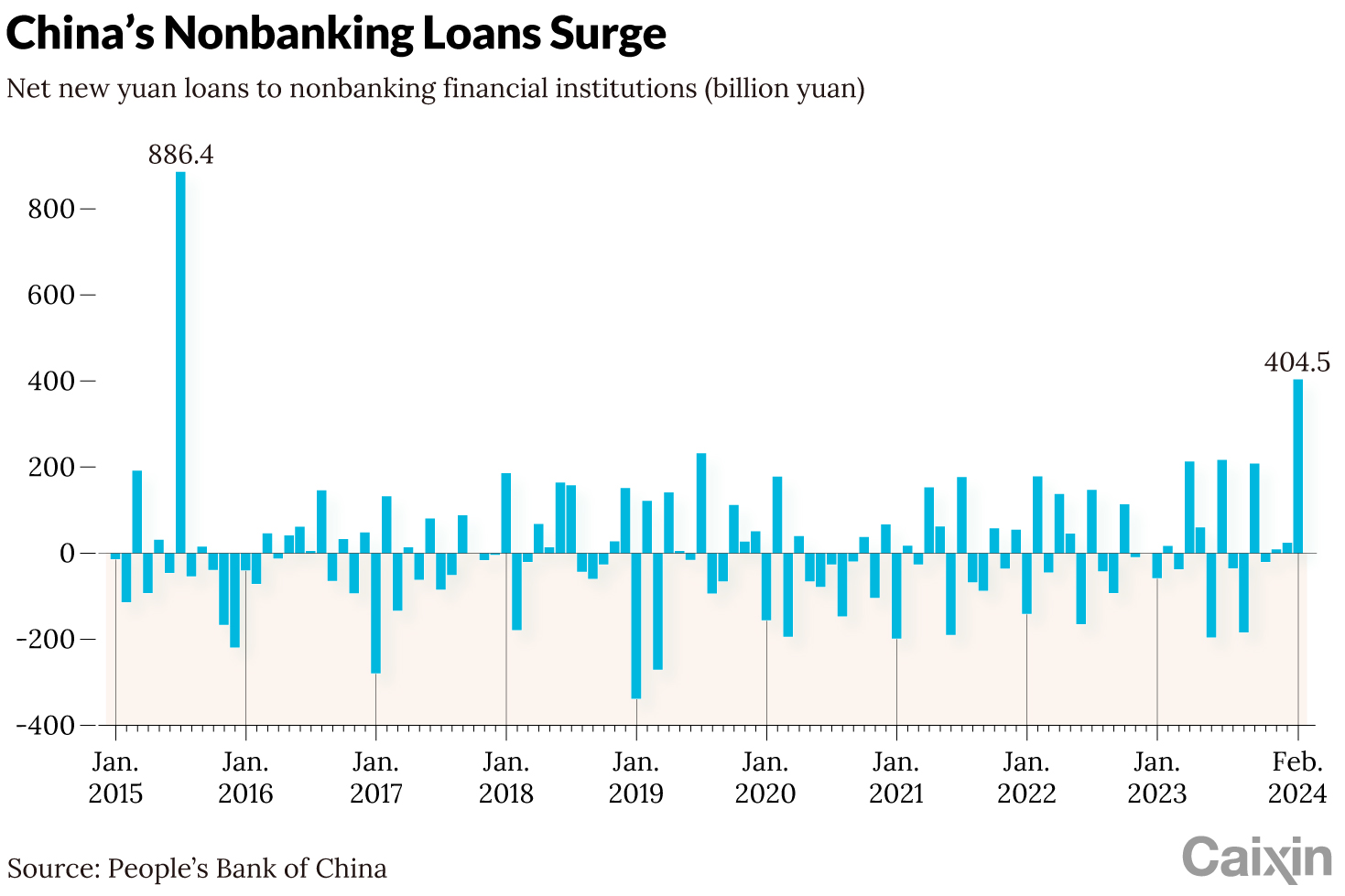

Net new yuan bank loans to China’s nonbanking financial institutions in February surged to the highest level since July 2015, a sign that some of the loans could have been used by state-backed investors to prop up the stock market, according to analysts.

The loans reached 404.5 billion yuan ($56.9 billion) last month, more than 23 times the amount in February 2023 and the highest since July 2015, when the reading was 886.4 billion yuan, central bank data show. In contrast, net new yuan loans in total in February dropped almost 20% year-on-year.

|

In both February 2024 and July 2015, government-backed companies increased their holdings of stocks and equity-focused mutual funds in a bid to lift the stock market out of a slump, suggesting that state-buying could explain the spikes in new nonbanking loans, analysts said.

Unlock exclusive discounts with a Caixin group subscription — ideal for teams and organizations.

Subscribe to both Caixin Global and The Wall Street Journal — for the price of one.

- MOST POPULAR