Bank of China Profit Rebounds as Lending Margin Stabilizes

Listen to the full version

Bank of China Ltd. posted modest profit growth in the first three quarters of 2025, marking a turnaround driven by a stronger third quarter and a stabilizing net interest margin — an early sign that the worst may be over for the state-owned lender in a persistently low-rate environment.

The Beijing-based bank said Tuesday that net profit attributable to shareholders rose 1.1% year-over-year to 177.7 billion yuan ($24.9 billion) for the January-September period. That reversed declines recorded in the first half of the year and was largely supported by a 5.1% rise in third-quarter net income to 60.1 billion yuan.

Operating revenue for the period climbed 2.7% to 491.2 billion yuan.

Unlock exclusive discounts with a Caixin group subscription — ideal for teams and organizations.

Subscribe to both Caixin Global and The Wall Street Journal — for the price of one.

- DIGEST HUB

- Bank of China posted a 1.1% year-over-year net profit increase to 177.7 billion yuan ($24.9 billion) for Jan–Sept 2025, reversing earlier declines.

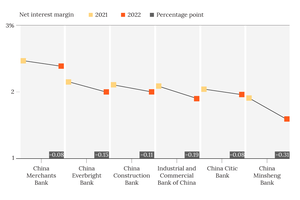

- Net interest margin stabilized at 1.3%; noninterest income surged 16.2% to 165.4 billion yuan, offsetting weaker net interest income.

- New domestic loans rose 9.2% (1.7 trillion yuan), NPL ratio dipped to 1.2%, but property sector loan NPLs rose to 5.4%.

- Bank of China Ltd.

- Bank of China Ltd. saw modest profit growth in the first three quarters of 2025, with net profit up 1.1% to 177.7 billion yuan. This turnaround was supported by a strong third quarter and a stabilizing net interest margin (NIM) at 1.3%. The bank's operating revenue climbed 2.7%, and its nonperforming loan ratio slightly dipped to 1.2%.

- MOST POPULAR